The Anti-Money Laundering Software Market is Predicted to Reach US$ 2,186.21 Mn in 2022, Owing to Technological Breakthrough

Absolute Markets Insights offers its latest published report ‘Anti-Money Laundering Software Market by Component (Software, Services); by Product Type (Transaction Monitoring Systems, Customer Identity Management Systems, Currency Transaction Reporting Systems, Compliance Management Software); by Deployment (On-Premise, Cloud); by End User (Retail Banking, Corporate Banking, Private Banking, Investment Banking, Asset Management, Insurance, Multiple Banking Services, Legal Service Providers, Others (Credit Unions, Etc.)); by Solution Type ( Transactional Monitoring, KYC, Fraud, Risk and Compliance Management, Watch-list Screening, Data Warehouse Management, Analytics and Visualization, Alert Management and Reporting, Case Management); Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026’.

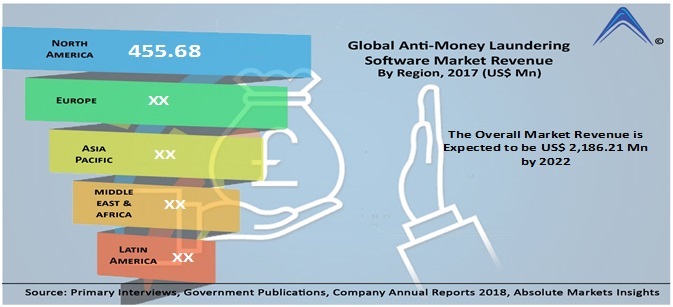

The author of the report analyzed that the global anti-money laundering software market accounted for US$ 1,195.08 million in 2017. Transformational regulatory changes, technology improvements, and evolving legal precedents in the banking and financial sector along with the convergence of Financial Crimes Compliance (FCC) are some of the factors which have led to the increased adoption of anti-money laundering software market.

Purchase the complete report titled “Anti-Money Laundering Software Market - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026” at (https://www.absolutemarketsinsights.com/reports/Anti-Money-Laundering-Software-Market-137)

The recent regulatory focus is largely centered on money laundering risks which are associated with digital payment methods such as e-payments and mobile wallets. The process of curbing cybercrime and combating money laundering risks involving virtual currencies is currently being given high priority. Financial institutions are increasingly adopting transaction monitoring and leveraging browser-based delivery of commercial watch lists. This process assists in instantly spotting new methods of policy violation. The banking and financial industry is rapidly adopting enterprise-wide case management system and centralized control.

On-Premise is Estimated to be the Fastest Growing Deployment Type during the Forecast Period.

On-premise deployment of anti-money laundering software is the most widely implemented type as compared to cloud-based deployment. Due to the high volume of monetary transactions that are carried out in the operations of banking, insurance and other financial services, on-premise deployment makes for a safer option as sensitive information regarding transactions which are generated are lesser prone to hacks and data leaks. The security offered by on-premise deployment is the main reason for its wide adoption.

North America is Anticipated to Hold a Significant Share in the Global Market.

The presence of a number of banks and large financial institutions in this region has made North America the largest market share holder for anti-money laundering software market. The new emergence of crypto currency and robotic process automation is so far most prevalent in the United States. These revolutionary technologies play a large factor in the wide adoption of anti-money laundering software across financial institutions in the North American continent.

Anti-money Laundering Software Market is Fragmented in Nature with the Presence of Global and Regional Players

Some of the significant players functioning in the global anti-money laundering software market include Nelito Systems Limited, Tipalti, Open Text Corporation, Trulioo, 3i Infotech, EastNets, Verafin Inc., Tata Consultancy Services Limited, RiskMS (AMLcheck), Accenture, Fiserv Inc. and Cognizant amongst others.

Open Text Corporation has strategic partnerships with companies like SAP SE, Microsoft Corporation and Accenture. It is a Canadian organization and is engaged in providing automated cyber risk management software services, forensic security and analytics solutions. The Company also provides cloud services.

- Anti-money Laundering Software Market - By Component

- Service

- Software

- Anti-money Laundering Software Market - By End User

- Retail Banking

- Corporate Banking

- Private Banking

- Investment Banking

- Asset Management

- Insurance

- Multiple Banking Services

- Legal Service Providers

- Others (Credit Unions etc.)

- Anti-money Laundering Software Market - By Deployment Type

- Cloud-based

- On-premise

- Anti-money Laundering Software Market - By Product Type

- Compliance Management Software

- Currency Transaction Reporting (CTR) Systems

- Customer Identity Management Systems

- Transaction Monitoring Systems

- Anti-money Laundering Software Market - By Solution Type

- Transaction Monitoring

- KYC (Know Your Customer)

- Fraud, Risk and Compliance Management

- Watch-list Screening

- Data Warehouse Management

- Analytics and Visualization

- Alert Management and Reporting

- Case Management

- Anti-money Laundering Software Market - By Region

- North America

- U.S.

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- GCC Countries

- Southern Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Rest of Latin America

- North America