Blockchain in insurance market is expected to grow at a CAGR of 65.9% over the forecast years (2019 – 2027), as Insurance Behemoths and InsurTech Companies are Venturing to Leverage Blockchain Technology to Prevent Insurance Fraud, Says Absolute Markets Insights.

Industry-wide collaborations on blockchain are formulating to make insurance use cases a reality. Insurtech startups are developing solutions for insurance companies that reduce fraudulent activities with improved traceability and accountability. For instance, Everledger Ltd is a London-based blockchain solutions provider that offers an immutable ledger for the diamond insurance sector. It identifies and verifies transactions for various stakeholders, including insurance companies, claimants and law enforcement agencies. Once the fraudulent claims are recognized, the sale of stolen valuables can be uncovered and recovered. The company works with crime agencies to assist in the identification of cross border transactions, counterfeit goods and money laundering. Similarly, KSI (Keyless Signature Infrastructure) is a blockchain technology designed by Estonia-based Guardtime. It aids in fraud elimination by providing a means for independent verification of a large number of policies and claims. This provides a high-efficient alternative to the task of a trusted third party for providing verifiable public records of all transactions and subsequently preventing duplicate transactions.

To explore the opportunities of blockchain insurance, insurance companies across the world are forming collaborative alliances namely RiskBlock alliance and B3i. With the help of technology vendors, these kinds of alliances aim at establishing a highly efficient global insurance ecosystem.

“The blockchain-based transaction information is visible to insurers, brokers, third-party administrators and service providers shared at multiple locations. As blockchain creates a permanent audit trail, this information is impossible to alter or delete. Mutual consensus verification protocols allow a network to agree on updates to the database collectively. This ensures that even without a central governing authority the overall data set remains correct at all times. As this capability has immense potential, blockchain-specialized startups as well as established technology companies with vast resources such as IBM Corporation have entered the Blockchain in insurance market.”

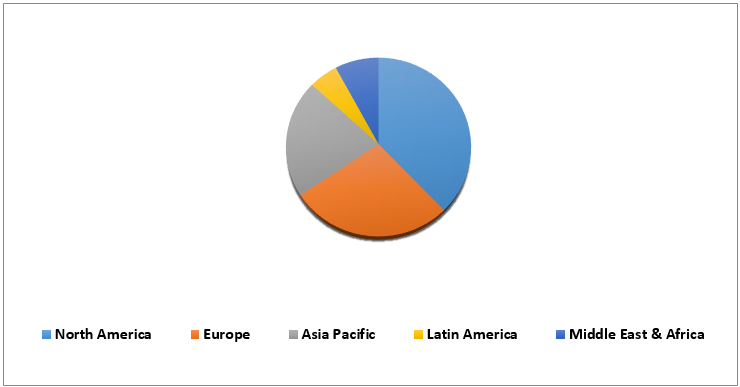

The detailed research study provides qualitative and quantitative analysis of blockchain in insurance market. The report is bifurcated into segments based on offerings, application, organization size, insurance type and region in the global Blockchain in insurance market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. Apart from the above-mentioned analysis, the report also includes historical and future trends of the market to validate on approaching attractive markets. The report covers in depth analysis of the segments mentioned in the report based on geography into North America, Europe, Asia Pacific and Middle East and Africa and Latin America.

Global Blockchain in Insurance Market (US$ Million) 2018, By Region

Some of the players operating in the Blockchain in Insurance market are Amazon Web Services, Inc., AUXESIS GROUP, Bitfury Group Limited, Boston Consulting Group, BTL Group Ltd, ChainThat, Circle Internet Financial Limited, CONSENSUS SYSTEMS (Consensys), Deloitte Touche Tohmatsu Limited, Digital Asset Holdings, LLC, Everledger Ltd, Etherparty Inc, Factom, Guardtime, IBM Corporation, iXLedger, KPMG International Cooperative, Microsoft, Oracle, SafeShare, Symbiont.io and Willis Towers Watson amongst others.

Blockchain in Insurance Market:

By Offerings

- Solutions

- Applications and Platforms

- Middleware

- Infrastructure and Protocols

- Services

- Professional

- Managed

By Application

- Identity Management and Fraud Detection

- Claims Management

- Distribution and Payment Models

- Others (GRC Management etc.)

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Insurance Type

- Life Insurance

- Health Insurance

- Property and Casualty Insurance

- Reinsurance

- Others (Travel Insurance, Vehicle Insurance etc.)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic

- Denmark

- Finland

- Iceland

- Norway

- Sweden

- Rest of Nordic

- The Benelux Union

- Belgium

- the Netherlands

- Luxemburg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- New Zealand

- Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- GCC Countries

- Southern Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America