Fraud Detection and Prevention Market is Projected to Grow at a CAGR of 25.6% over the forecast period (2019 – 2027), owing to Increasing Diversity of Fraud Occurrences across Different Industries, says Absolute Markets Insights

With rising incidences of fraud across a variety of industries, enterprises and government bodies are losing large amounts of capital every year. Among different industries, the highly regulated sectors like financial, healthcare, insurance, retail, and social security are the frequent targets. For these industries, combating fraud is essential as there is a multitude of compliance, regulations, risk management measures, and monetary consequences. Furthermore, increased use of digital data mode, high usage of internet enabled devices, and cloud services has rapidly increased the vulnerability of enterprises towards fraud, further fueling the fraud detection and prevention market.

With growing digitization, fraud detection and prevention market has witnessed the replacement of traditional methods of fraud detection by advanced techniques. The introduction of key technologies namely big data analytics, cloud computing services, AI and machine learning are driving the growth of fraud detection and prevention market. For instance, LexisNexis offers fraud detection solutions leveraging advanced analytics and robust data to combat insurance fraud. This solution helps insurance carriers identify and investigate potentially fraudulent claims and questionable provider behavior more efficiently. On the other hand, deepsense.ai builds machine learning algorithms that are more efficient than rules-based systems for fraud detection. These algorithms decrease the number of false alarms and aid companies to maintain a good relationship with their customers.

Increase in complex enterprise data generation, high industry-specific requirements, and rising incidences of fraud are supplementing the fraud detection and prevention market growth. Technological advancements in the field have enabled vendors to offer industry-specific solutions that are helping in mitigating risks associated with frauds in addition to saving money and reputation. Organizations across the world are investing in these solutions to save money and reputation. In the coming years, vendors are expected to develop more sophisticated solutions to prevent fraud by leveraging innovative technologies.

The detailed research study provides qualitative and quantitative analysis of fraud detection and prevention market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East, Africa and Latin America.

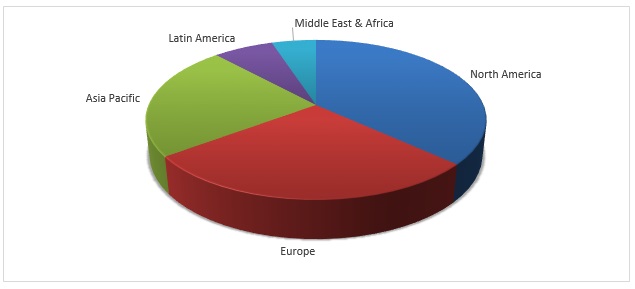

Global Fraud Detection and Prevention Market (US$ Billion) 2018, By Region

Key Findings of the Report:

- In terms of revenue, the North American region accounted for the highest market share in 2018 and is anticipated to witness a sustainable CAGR over the forecast period.

- Among the solutions, Fraud analytics segments accounted for a significant market share in 2018, growing at a CAGR of 26.0% over the forecast years (2019 – 2027).

- Cloud based deployment is expected to grow at an increasing rate as compared to on-premise, owing to the ease of installation & updation, high scalability, total low cost of ownership and other benefits offered by cloud-based deployment.

- Key players operating in the fraud detection and prevention market are IBM Corporation, SAP SE, Dell Inc., FRISS, BAE Systems and NICE amongst others. However, the new market entrants offering highly advanced solutions are also expected to propel the market in the near future.

- Increase in the frequency and sophistication of cyber frauds and attacks is prompting industry participants to collaborate with others in order to develop cutting edge solutions.

Fraud Detection and Prevention Market:

- By Deployment

- On Cloud

- On Premise

- By Organization Size

- SMEs

- Large Enterprise

- By Component

- Solutions

- Fraud Analytics

- Authentication

- Single-Factor Authentication

- Multifactor Authentication

- Others

- Services

- Professional Service

- Managed Service

- By Application

- Identity Theft

- Payment Frauds

- Electronic Payment Fraud

- Mobile Payment Fraud

- Credit and Debit Card Fraud

- Money Laundering

- Others (Banking Transactions, Fund Transfers etc.)

- By Industry Vertical:

- Banking, Financial Services and Insurance (BFSI)

- Energy and Power

- Government/Public Sector

- Healthcare

- Manufacturing

- Real Estate

- Retail

- Telecommunication

- Others (Travel and Transportation, Media and Entertainment, etc.)

- By Region:

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America