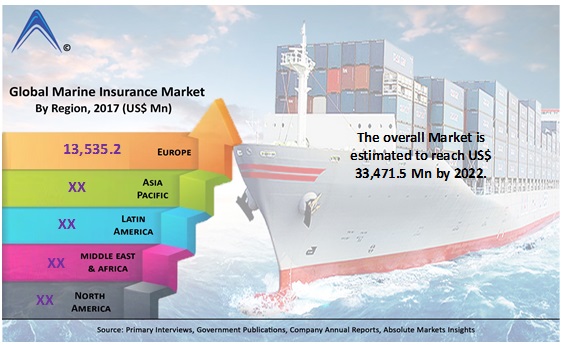

The Marine Insurance Market is Predicted to Reach US$ 33,471.5 Mn by 2022, Due to Rise in International Trade Volume

Absolute Markets Insights offers its latest published report Marine Insurance Market by Type (Transport/Cargo, Hull, Offshore/Energy, Marine Liability); by Insurance Coverage (Loss/Damage, Fire/Explosion, Natural Calamity, Others); by Region outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, Rest of World) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 – 2026.

The author of the report analyzed that the global marine insurance market accounted for US$ 28,483.6 Mn in 2017. With increase in globalization there is high demand for import and export of goods, which is mainly done by marine transport. This makes marine insurance one of the most important field in today’s commercial age.

“Marine Insurance market has been witnessing rapid growth in the last decade. With the market being highly fragmented, it is important for market players to leverage their strengths and appropriately capture the opportunities to sustain themselves in the growing market. ’’

Purchase the complete report titled “Marine Insurance Market - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026” at (https://www.absolutemarketsinsights.com/reports/Marine-Insurance-Market-2018-2026-142)

As countries import & export of good is interlinked with economic growth, marine insurance plays a very crucial role in industrial growth. Thus any transport of cargo or freight is always insured which will drive the market growth in the forecast period. One of the main concern for this market is the new technological advances that are used to moves goods via marine transport. Insurers are facing a challenge in providing policies which can cover the various technological devices used in freight logistics. This may refrain the insurers from providing better policies for freights, which may create an adverse impact on market growth. However, many technological tools are also providing opportunities to enhance logistics process of marine transport. In various industry, there is sudden boom in the usage technology namely internet of things (IoT) which is making it easier for business to process. The marine insurance industry has also has huge opportunity to grow with the integration of such technology which can streamline the insurance/claim process and make it more robust. Use of such analytical tools will also allow risk mitigation more efficiently.

Loss/Damage Insurance Coverage is estimated to be the Fastest Growing Segment during the Forecast Period

Loss or damage of cargo and product in transit is the major reason ship owners incur monetary loss. Thus it is the most frequent category for which the insurance coverage is opted by the transporters. Insurance providers have come up with various policies to cover cost against loss or damage to cargo or freight in transit from one place to another.

North America Region is estimated to be the Fastest Growing Segment in the Forecast Period.

Marine Insurance in North America is likely to show highest growth due to increase insurance policies that are provided by insurers to mitigate risk and loss that can be incurred in marine transit. North American countries face high risk of natural calamities such as hurricanes and tornadoes which can cause huge monetary loss. This will play a huge role in impacting the growth of marine insurance market in North America region.

Marine Insurance Market is Highly Fragmented and Diversified in Nature with Presence of Small and New Entrants Globally.

Some of the significant players functioning in the marine insurance market are Lockton Companies, Jardine Lloyd Thompson Group plc, HDFC ERGO General Insurance Company Limited, Gallagher, Marsh LLC, Lampe & Schwartze KG, Hannover Re, American International Group, Inc., Anderson Insurance Agency, ARIES MARINE INSURANCE BROKERS LTD, Atrium, Ascot, AXA Insurance Company, MS&AD Insurance Group Holdings, Inc., Tokio Marine Holdings, Inc., United India Insurance Co. Ltd., Gard, Allianz Global Corporate & Specialty SE, Eidgenössische Technische Hochschule Zürich, Berkshire Hathaway Inc. (Berkshire Hathaway Specialty Insurance), Swiss Re, SOMPO Taiwan Brokers Co., Ltd, Beazley, Willis Towers Watson, AXA XL, Thomas Miller, Sirius International Insurance Corporation, Munich Re Group, Brown & Brown Insurance, Aon plc, The Chubb Corporation.

On 25th May, 2018, World’s first Blockchain platform was launched for marine insurance, which was backed by Maersk Group to support marine hull insurance. This platform is named Insurwave, built by a joint venture between EY and Gaurdtime. The platform will support more than half a million automated ledger transaction and help in managing risk for more than thousand commercial vessels in the first year.

- Marine Insurance Market – By Type

- Transport/Cargo

- Hull

- Offshore/Energy

- Marine Liability

- Marine Insurance Market – By Insurance Coverage

- Loss/Damage

- Fire/Explosion

- Natural Calamity

- Others

- Marine Insurance Market – By Region

- North America

- U.S.

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- GCC Countries

- Southern Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Rest of Latin America