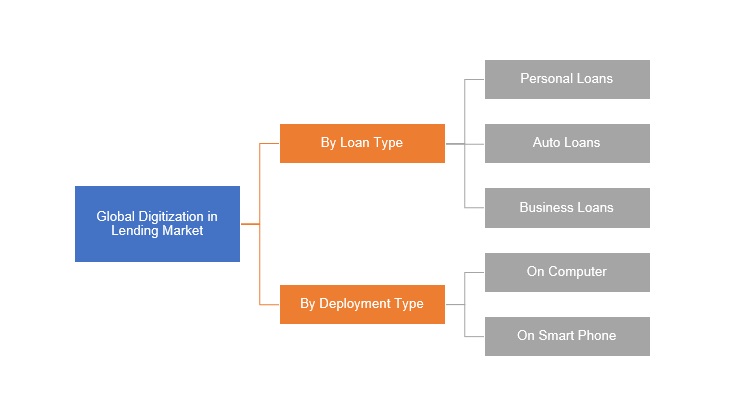

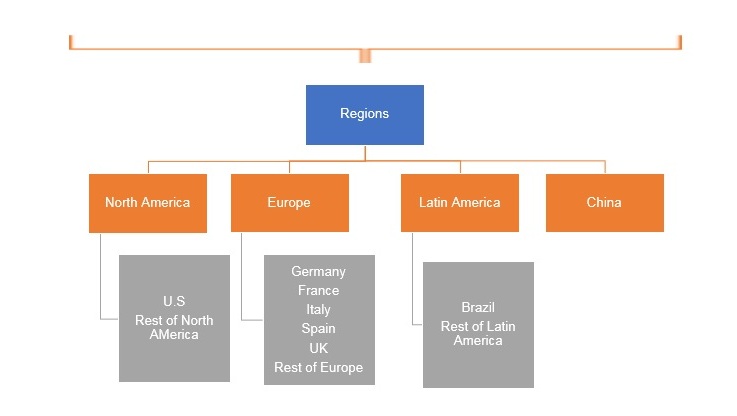

Digitization in Lending Market by Loan Type (Personal Loans, Auto Loans, Business Loans); by Deployment (On Computer, On Smart Phone); by Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Brazil, Rest of Latin America) – Global Insights, Industry Trends, Price Trends, Growth, Size, Supply, Demand, Comparative Analysis, Competitive Market Share and Forecast, 2018-2026

Industry Trends

Digital lending is a borrowing process, which is carried out on the online or digital platform without making use of paperwork. This platform makes use of automated processes such as document and electronic data capture, e-signatures, and automated underwriting. Through digital lending automation complex processes becomes easy to operate and helps in decreasing manual interferences, owing to which the demand of digital lending is increasing. Thus, in coming years there will be an increasing adoption of digital lending. The Global Digitization in Lending Market was valued at US$ 2693460 Mn in 2017 and is expected to reach US$ 22514830 Mn by 2022.

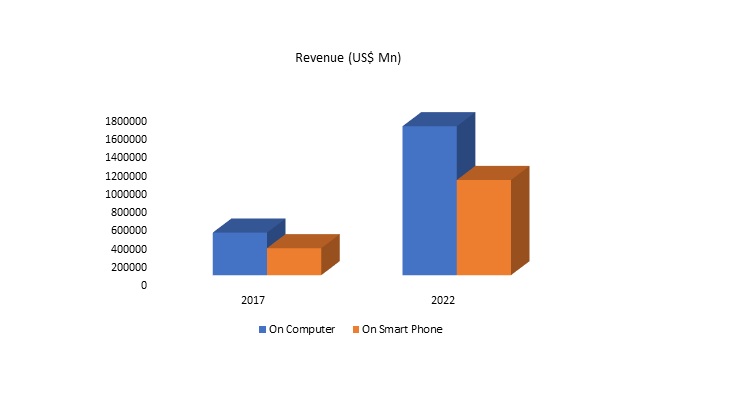

North America Digitization in Lending Market Size, by Deployment, 2017 & 2022, (US$ Million)

Digital lending is operated through electronic manner only. For instance, banks sell home loans, auto loans, personal loans or credit cards through digital channels such as email, Facebook, Google, etc. Digital lending is a time saving process and has increased data security, thereby more people are incorporating the usage of digital lending.

Digitization in Lending Market, By Loan Type

Business loan segment leads the global market; it contributed a major market share of more than half percent in 2017. It is projected that this segment will retain its dominance in the forecast period. The major factor that is driving this segment is the rising number of small-scale businesses across the world. For instance, India’s focus on digital transformation in the last few years coupled with other efforts such as the Jan Dhan Yojana and the direct benefit transfer scheme by the government has opened up vast space in the business of lending more specifically in the business lending space. The digital initiative adopted by the government and corporate India have made sourcing of funds relatively easy today.

Digitization in Lending Market, By Region

Europe accounted for the largest revenue of around US$ 1070650 Mn in the digitization in lending market in 2017. In Europe, the U.K. and France contributed the largest share in the market in the region. However, with the presence of major banking sectors in countries in U.K. and France have positively contributed to the growth of the market. In Europe, HSBC bank is one of the leading banks with total assets. With the continuous growth in finance sector in this region is boosting the growth opportunities for the market.

Competitive Landscape

The report provides both, qualitative and quantitative research of the market, as well as strategic insights along with developments that are being adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as mergers and acquisition (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their competitors, service type, application and specification, pricing, and gross margin.

Market Participants include Rise Credit, FirstCash, Inc., Speedy Cash, LendUp, Elevate, NetCredit, Avant, Inc., Opportunity Financial, LLC., Prosper Marketplace, Inc., The Business Backer LLC., Headway Capital Partners LLP, Blue Vine, Lendio, RapidAdvance, AmigoLoans Ltd, Lendico, Trigg, Lending Stream, 118118Money, Simplic, Wonga Group, OnDeck, Kabbage, Inc., Fundation Group LLC, among others.

Global Digitization in Lending Market Industry Background

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Digitization in Lending Market Snapshot

3. Executive Summary: Digitization in Lending Market

4. Qualitative Analysis: Digitization in Lending Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Trends in Market

5. Global Digitization in Lending Market Analysis and Forecasts,

2018 – 2026

5.1. Overview

5.1.1. Global Market Revenue (US$ Mn) and Forecasts

5.2. Global Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

5.2.1. Personal Loans

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Auto Loans

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.2.3. Business Loans

5.2.3.1. Definition

5.2.3.2. Market Penetration

5.2.3.3. Market Revenue Expected to Increase by 2026

5.2.3.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Loan Type

6. Global Digitization in Lending Market Analysis and Forecasts,

2018 – 2026

6.1. Overview

6.2. Global Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Deployment

6.2.1. On Computer

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. On Smart Phone

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By Deployment

7. North America Digitization in Lending Market Analysis and

Forecasts, 2018 – 2026

7.1. Overview

7.1.1. North America Market Revenue (US$ Mn)

7.2. North America Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Loan Type

7.2.1. Personal Loans

7.2.2. Auto Loans

7.2.3. Business Loans

7.3. North America Market Revenue (US$ Mn) and Forecasts, By

Deployment

7.3.1. On Computer

7.3.2. On Smart Phone

7.4. North America Market Revenue (US$ Mn) and Forecasts, By

Country

7.4.1. U.S.

7.4.1.1. U.S. Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

7.4.1.1.1. Personal Loans

7.4.1.1.2. Auto Loans

7.4.1.1.3. Business Loans

7.4.1.2. U.S. Market Revenue (US$ Mn) and Forecasts, By Deployment

7.4.1.2.1. On Computer

7.4.1.2.2. On Smart Phone

7.4.2. Rest of North America

7.4.2.1. Rest of North America Digitization in Lending Market Revenue

(US$ Mn) and Forecasts, By Loan Type

7.4.2.1.1. Personal Loans

7.4.2.1.2. Auto Loans

7.4.2.1.3. Business Loans

7.4.2.2. Rest of North America Market Revenue (US$ Mn) and Forecasts,

By Deployment

7.4.2.2.1. On Computer

7.4.2.2.2. On Smart Phone

7.5. Key Segment for Channeling Investments

7.5.1. By Country

7.5.2. By Loan Type

7.5.3. By Deployment

8. Europe Digitization in Lending Market Analysis and Forecasts,

2018 – 2026

8.1. Overview

8.1.1. Europe Market Revenue (US$ Mn)

8.2. Europe Market Revenue (US$ Mn) and Forecasts, By Loan Type

8.2.1. Personal Loans

8.2.2. Auto Loans

8.2.3. Business Loans

8.3. Europe Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Deployment

8.3.1. On Computer

8.3.2. On Smart Phone

8.4. Europe Market Revenue (US$ Mn) and Forecasts, By Country

8.4.1. France

8.4.1.1. France Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

8.4.1.1.1. Personal Loans

8.4.1.1.2. Auto Loans

8.4.1.1.3. Business Loans

8.4.1.2. France Market Revenue (US$ Mn) and Forecasts, By Deployment

8.4.1.2.1. On Computer

8.4.1.2.2. On Smart Phone

8.4.2. The UK

8.4.2.1. The UK Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

8.4.2.1.1. Personal Loans

8.4.2.1.2. Auto Loans

8.4.2.1.3. Business Loans

8.4.2.2. The UK Market Revenue (US$ Mn) and Forecasts, By Deployment

8.4.2.2.1. On Computer

8.4.2.2.2. On Smart Phone

8.4.3. Spain

8.4.3.1. Spain Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

8.4.3.1.1. Personal Loans

8.4.3.1.2. Auto Loans

8.4.3.1.3. Business Loans

8.4.3.2. Spain Market Revenue (US$ Mn) and Forecasts, By Deployment

8.4.3.2.1. On Computer

8.4.3.2.2. On Smart Phone

8.4.4. Germany

8.4.4.1. Germany Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

8.4.4.1.1. Personal Loans

8.4.4.1.2. Auto Loans

8.4.4.1.3. Business Loans

8.4.4.2. Germany Market Revenue (US$ Mn) and Forecasts, By Deployment

8.4.4.2.1. On Computer

8.4.4.2.2. On Smart Phone

8.4.5. Italy

8.4.5.1. Italy Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

8.4.5.1.1. Personal Loans

8.4.5.1.2. Auto Loans

8.4.5.1.3. Business Loans

8.4.5.2. Italy Market Revenue (US$ Mn) and Forecasts, By Deployment

8.4.5.2.1. On Computer

8.4.5.2.2. On Smart Phone

8.4.6. Rest of Europe

8.4.6.1. Rest of Europe Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Loan Type

8.4.6.1.1. Personal Loans

8.4.6.1.2. Auto Loans

8.4.6.1.3. Business Loans

8.4.6.2. Rest of Europe Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Deployment

8.4.6.2.1. On Computer

8.4.6.2.2. On Smart Phone

8.5. Key Segment for Channeling Investments

8.5.1. By Country

8.5.2. By Loan Type

8.5.3. By Deployment

9. Asia Pacific Digitization in Lending Market Analysis and

Forecasts, 2018 – 2026

9.1. Overview

9.1.1. Asia Pacific Market Revenue (US$ Mn)

9.2. Asia Pacific Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Loan Type

9.2.1. Personal Loans

9.2.2. Auto Loans

9.2.3. Business Loans

9.3. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By

Deployment

9.3.1. On Computer

9.3.2. On Smart Phone

9.4. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By Country

9.4.1. China

9.4.1.1. China Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

9.4.1.1.1. Personal Loans

9.4.1.1.2. Auto Loans

9.4.1.1.3. Business Loans

9.4.1.2. China Market Revenue (US$ Mn) and Forecasts, By Deployment

9.4.1.2.1. On Computer

9.4.1.2.2. On Smart Phone

9.4.2. Japan

9.4.2.1. Japan Digitization in Lending Market Revenue (US$ Mn) and Forecasts,

By Loan Type

9.4.2.1.1. Personal Loans

9.4.2.1.2. Auto Loans

9.4.2.1.3. Business Loans

9.4.2.2. Japan Market Revenue (US$ Mn) and Forecasts, By Deployment

9.4.2.2.1. On Computer

9.4.2.2.2. On Smart Phone

9.4.3. India

9.4.3.1. India Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

9.4.3.1.1. Personal Loans

9.4.3.1.2. Auto Loans

9.4.3.1.3. Business Loans

9.4.3.2. India Market Revenue (US$ Mn) and Forecasts, By Deployment

9.4.3.2.1. On Computer

9.4.3.2.2. On Smart Phone

9.4.4. Southeast Asia

9.4.4.1. Southeast Asia Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Loan Type

9.4.4.1.1. Personal Loans

9.4.4.1.2. Auto Loans

9.4.4.1.3. Business Loans

9.4.4.2. Southeast Asia Market Revenue (US$ Mn) and Forecasts, By

Deployment

9.4.4.2.1. On Computer

9.4.4.2.2. On Smart Phone

9.4.5. Rest of Asia Pacific

9.4.5.1. Rest of Asia Pacific Digitization in Lending Market Revenue

(US$ Mn) and Forecasts, By Loan Type

9.4.5.1.1. Personal Loans

9.4.5.1.2. Auto Loans

9.4.5.1.3. Business Loans

9.4.5.2. Rest of Asia Pacific Market Revenue (US$ Mn) and Forecasts, By

Deployment

9.4.5.2.1. On Computer

9.4.5.2.2. On Smart Phone

9.5. Key Segment for Channeling Investments

9.5.1. By Country

9.5.2. By Loan Type

9.5.3. By Deployment

10. Middle East and Africa Digitization in Lending Market

Analysis and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Market Revenue (US$ Mn)

10.2. Middle East and Africa Digitization in Lending Market Revenue

(US$ Mn) and Forecasts, By Loan Type

10.2.1. Personal Loans

10.2.2. Auto Loans

10.2.3. Business Loans

10.3. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By Deployment

10.3.1. On Computer

10.3.2. On Smart Phone

10.4. Middle East and Africa Digitization in Lending Market Revenue

(US$ Mn) and Forecasts, By Country

10.4.1. GCC Countries

10.4.1.1. GCC Countries Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Loan Type

10.4.1.1.1. Personal Loans

10.4.1.1.2. Auto Loans

10.4.1.1.3. Business Loans

10.4.1.2. GCC Countries Market Revenue (US$ Mn) and Forecasts, By

Deployment

10.4.1.2.1. On Computer

10.4.1.2.2. On Smart Phone

10.4.2. Southern Africa

10.4.2.1. Southern Africa Digitization in Lending Market Revenue (US$

Mn) and Forecasts, By Loan Type

10.4.2.1.1. Personal Loans

10.4.2.1.2. Auto Loans

10.4.2.1.3. Business Loans

10.4.2.2. Southern Africa Market Revenue (US$ Mn) and Forecasts, By

Deployment

10.4.2.2.1. On Computer

10.4.2.2.2. On Smart Phone

10.4.3. Rest of MEA

10.4.3.1. Rest of MEA Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Loan Type

10.4.3.1.1. Personal Loans

10.4.3.1.2. Auto Loans

10.4.3.1.3. Business Loans

10.4.3.2. Rest of MEA Market Revenue (US$ Mn) and Forecasts, By

Deployment

10.4.3.2.1. On Computer

10.4.3.2.2. On Smart Phone

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Loan Type

10.5.3. By Deployment

11. Latin America Digitization in Lending Market Analysis and

Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America Digitization in Lending Market Revenue (US$ Mn)

11.2. Latin America Market Revenue (US$ Mn) and Forecasts, By Loan

Type

11.2.1. Personal Loans

11.2.2. Auto Loans

11.2.3. Business Loans

11.3. Latin America Digitization in Lending Market Revenue (US$ Mn)

and Forecasts, By Deployment

11.3.1. On Computer

11.3.2. On Smart Phone

11.4. Latin America Market Revenue (US$ Mn) and Forecasts, By

Country

11.4.1. Brazil

11.4.1.1. Brazil Digitization in Lending Market Revenue (US$ Mn) and

Forecasts, By Loan Type

11.4.1.1.1. Personal Loans

11.4.1.1.2. Auto Loans

11.4.1.1.3. Business Loans

11.4.1.2. Brazil Market Revenue (US$ Mn) and Forecasts, By Deployment

11.4.1.2.1. On Computer

11.4.1.2.2. On Smart Phone

11.4.2. Rest of Latin America

11.4.2.1. Rest of Latin America Digitization in Lending Market Revenue

(US$ Mn) and Forecasts, By Loan Type

11.4.2.1.1. Personal Loans

11.4.2.1.2. Auto Loans

11.4.2.1.3. Business Loans

11.4.2.2. Rest of Latin America Market Revenue (US$ Mn) and Forecasts,

By Deployment

11.4.2.2.1. On Computer

11.4.2.2.2. On Smart Phone

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Loan Type

11.5.3. By Deployment

12. Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13. Player Profiles

13.1. 118118Money

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. AmigoLoans Ltd.

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Avant, Inc.

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. Blue Vine

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. Elevate

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. FirstCash, Inc.

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. Fundation Group LLC

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. Headway Capital Partners LLP

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. Kabbage, Inc.

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10. Lendico

13.10.1. Company Details

13.10.2. Company Overview

13.10.3. Product Offerings

13.10.4. Key Developments

13.10.5. Financial Analysis

13.10.6. SWOT Analysis

13.10.7. Business Strategies

13.11. Lending

Stream

13.11.1. Company Details

13.11.2. Company Overview

13.11.3. Product Offerings

13.11.4. Key Developments

13.11.5. Financial Analysis

13.11.6. SWOT Analysis

13.11.7. Business Strategies

13.12. Lendio

13.12.1. Company Details

13.12.2. Company Overview

13.12.3. Product Offerings

13.12.4. Key Developments

13.12.5. Financial Analysis

13.12.6. SWOT Analysis

13.12.7. Business Strategies

13.13. LendUp

13.13.1. Company Details

13.13.2. Company Overview

13.13.3. Product Offerings

13.13.4. Key Developments

13.13.5. Financial Analysis

13.13.6. SWOT Analysis

13.13.7. Business Strategies

13.14. NetCredit

13.14.1. Company Details

13.14.2. Company Overview

13.14.3. Product Offerings

13.14.4. Key Developments

13.14.5. Financial Analysis

13.14.6. SWOT Analysis

13.14.7. Business Strategies

13.15. OnDeck

13.15.1. Company Details

13.15.2. Company Overview

13.15.3. Product Offerings

13.15.4. Key Developments

13.15.5. Financial Analysis

13.15.6. SWOT Analysis

13.15.7. Business Strategies

13.16. Opportunity

Financial, LLC.

13.16.1. Company Details

13.16.2. Company Overview

13.16.3. Product Offerings

13.16.4. Key Developments

13.16.5. Financial Analysis

13.16.6. SWOT Analysis

13.16.7. Business Strategies

13.17. Prosper

Marketplace, Inc.

13.17.1. Company Details

13.17.2. Company Overview

13.17.3. Product Offerings

13.17.4. Key Developments

13.17.5. Financial Analysis

13.17.6. SWOT Analysis

13.17.7. Business Strategies

13.18. RapidAdvance

13.18.1. Company Details

13.18.2. Company Overview

13.18.3. Product Offerings

13.18.4. Key Developments

13.18.5. Financial Analysis

13.18.6. SWOT Analysis

13.18.7. Business Strategies

13.19. Rise

Credit

13.19.1. Company Details

13.19.2. Company Overview

13.19.3. Product Offerings

13.19.4. Key Developments

13.19.5. Financial Analysis

13.19.6. SWOT Analysis

13.19.7. Business Strategies

13.20. Simplic

13.20.1. Company Details

13.20.2. Company Overview

13.20.3. Product Offerings

13.20.4. Key Developments

13.20.5. Financial Analysis

13.20.6. SWOT Analysis

13.20.7. Business Strategies

13.21. Speedy

Cash

13.21.1. Company Details

13.21.2. Company Overview

13.21.3. Product Offerings

13.21.4. Key Developments

13.21.5. Financial Analysis

13.21.6. SWOT Analysis

13.21.7. Business Strategies

13.22. The

Business Backer LLC.

13.22.1. Company Details

13.22.2. Company Overview

13.22.3. Product Offerings

13.22.4. Key Developments

13.22.5. Financial Analysis

13.22.6. SWOT Analysis

13.22.7. Business Strategies

13.23. Trigg

13.23.1. Company Details

13.23.2. Company Overview

13.23.3. Product Offerings

13.23.4. Key Developments

13.23.5. Financial Analysis

13.23.6. SWOT Analysis

13.23.7. Business Strategies

13.24. Wonga

Group

13.24.1. Company

Details

13.24.2. Company

Overview

13.24.3. Product

Offerings

13.24.4. Key

Developments

13.24.5. Financial

Analysis

13.24.6. SWOT

Analysis

13.24.7. Business

Strategies

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Reach to us

Call us on

+91-74002-42424

Drop us an email at

sales@absolutemarketsinsights.com

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.