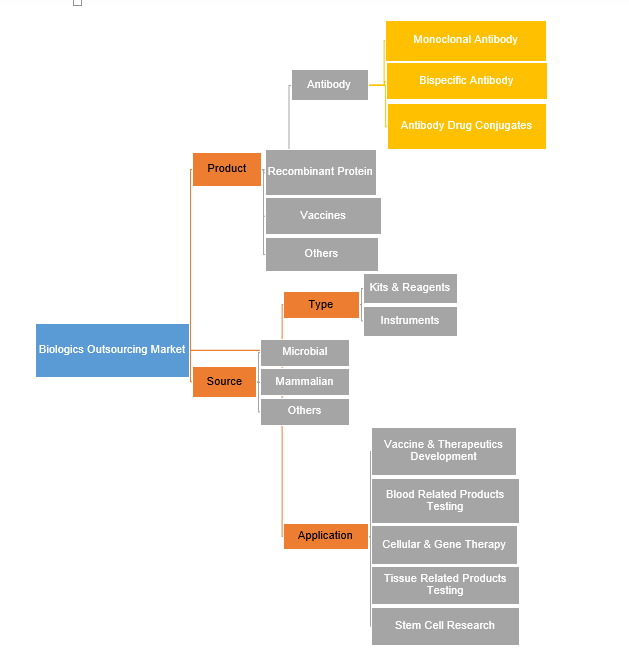

Biologics Outsourcing Market by Product (Antibody {Monoclonal Antibody, Bispecific Antibody, Antibody Drug Conjugates}, Recombinant Protein, Vaccines, Others (Gene Therapy, Cell Therapy)); by Type (Kits & Reagents, Instruments); by Source (Microbial, Mammalian, Others (Transgenic Sources, Avian, Insect)); by Application (Vaccine & Therapeutics Development, Blood & Blood Related Products Testing, Cellular and Gene Therapy, Tissue and Tissue Related Products Testing, Stem Cell Research); by Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026

Industry Trends

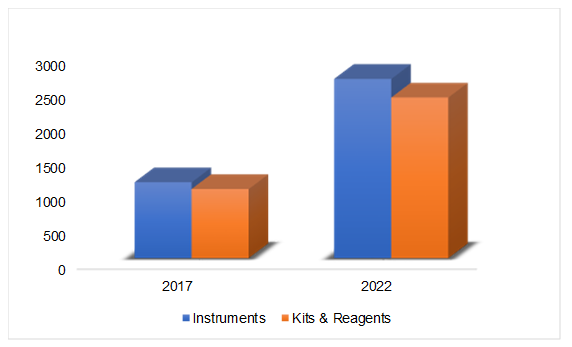

Biologics are entities derived from natural sources such as humans, animals or microorganisms. These are different from the chemically synthesized and structured drugs. Biologics may comprise of live attenuated microorganisms (vaccines), human cells and tissues (transplantation), cell therapies and gene therapies, allergenic extracts (allergy shots). Similar to any small molecule drug, Biologics is used for treating diseases and overcoming medical conditions. However, Biologics highlights higher range of drugs for treating specific diseases. For instance, entities like monoclonal antibodies and recombinant proteins target a specific disease such as cancer. In terms of revenue, the Global Biologics Outsourcing Market was valued at US$ 9,905.0 Mn in 2017 and is expected to reach US$ 22,810.3 Mn by 2022.

Global Biologics Outsourcing Market (USD Million), By Type, 2017-2022

Increasing investments in the research & development of biologics are significantly propelling the outsourcing market among the big as well as small pharmaceutical and biotechnological industries. Additionally, the robust inventory network guaranteed by the secondary manufacturer attracts the organizations for outsourcing of biologics. This is expected to eventually drive the biologics outsourcing market during the forecast period.

Although biologics are significantly costlier than small molecule drugs, these classes of medications prove to be exceedingly beneficial for the patient. Moreover, Biologics bring about 40% higher profit to the manufacturers when compared with small molecule drug treatments. Since the demand for biologics drugs and regulatory approvals have increased for these medications, there is an immense demand for biologics manufacture and testing at different levels of clinical examinations.

Biologics Outsourcing Market, By Product

On the basis of product, the antibody segment is projected to hold the largest and fastest growing segment over the research period. High use of antibodies for treating various chronic diseases, such as, asthma and diabetes, is projected to dominate the biologics outsourcing market during the forecast period. Globalization of the pharmaceutical industry has resulted in outsourcing options becoming more universal in nature. The monoclonal antibodies sub-segment of antibodies account for the major share of the market inferable from increased applications in the Pharma and biotechnology enterprises. The ongoing breadth and depth of research and innovation within the antibody engineering field guarantees that monoclonal antibodies-based products will boost the market.

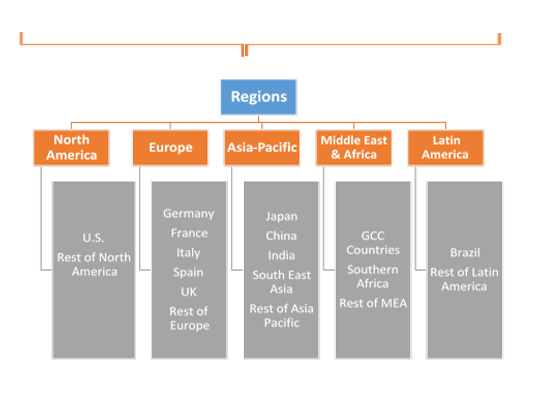

Biologics Outsourcing Market, By Region

North America is the largest market for pharmaceutical/biopharmaceutical research, conducting more than three-quarters of the global R&D. It holds the IP rights for most of the world’s new drug products, hence it is dominating the market for biologics outsourcing globally. The Asia Pacific is anticipated to be the most profitable region, owing to the increasing pharmaceutical sector and rising government initiatives for the healthcare industry.

Competitive Market Share

The report provides both, subjective and quantitative research of the market, as well as integrates worthy insights into the rational scenario and favored development methods adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as M&A, affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their manufacturing base, competitors, product type, application and specification, pricing, and gross margin.

Some of the significant players functioning in the Global Biologics Outsourcing Market include Boehringer Ingelheim GmbH, Catalent, Inc., GenScript, Albany Molecular Research Inc., Shanghai Medicilon Inc., Sino Biological Inc., Syngene, THE JACKSON LABORATORY, GL Biochem Corporation Ltd., GVK Biosciences Private Limited, Horizon Discovery Group plc., Innovent Biologics, Inc., JHL BIOTECH, INC., ProteoGenix, Inc., Selexis SA, Lonza, Abzena PLC, and Adimab LLC., among others.

Global Biologics Outsourcing Market Industry Background

1.

Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2.

Biological Organic

Fertilizers Market Snapshot

3.

Executive Summary:

Biological Organic Fertilizers Market

4.

Qualitative Analysis:

Biological Organic Fertilizers Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Trends in Market

5.

Global Biological Organic

Fertilizers Market Analysis and Forecasts, 2018 – 2026

5.1. Overview

5.1.1. Global Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts

5.2. Global Market Revenue (US$ Mn) and Forecasts, By Type

5.2.1. Microorganism (Definition, Market Penetration, Market Revenue

Expected to Increase by 2026, Compound Annual Growth Rate (CAGR) and

information on Rhizobium, Azotobacter, Azospirillum, Blue-green algae,

Phosphate solubilizing bacteria, Mycorrhiza, Others)

5.2.1.1. Rhizobium

5.2.1.2. Azotobacter

5.2.1.3. Azospirillum

5.2.1.4. Blue-green algae

5.2.1.5. Phosphate solubilizing bacteria

5.2.1.6. Mycorrhiza

5.2.1.7. Others

5.2.2. Organic residues (Definition, Market Penetration, Market

Revenue Expected to Increase by 2026, Compound Annual Growth Rate (CAGR) and

information on Fym, Crop residues, Green manure, Others)

5.2.2.1. Fym

5.2.2.2. Crop residues

5.2.2.3. Green manure

5.2.2.4. Others

5.3. Key Segment for Channeling Investments

5.3.1. By Type

6.

Global Biological Organic

Fertilizers Market Analysis and Forecasts, 2018 – 2026

6.1. Overview

6.2. Global Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

6.2.1. Cereals

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Legumes

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. Fruits and Vegetables

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Plantations

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.2.5. Others

6.2.5.1. Definition

6.2.5.2. Market Penetration

6.2.5.3. Market Revenue Expected to Increase by 2026

6.2.5.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By Application

7.

North America Biological

Organic Fertilizers Market Analysis and Forecasts, 2018 – 2026

7.1. Overview

7.1.1. North America Biological Organic Fertilizers Market Revenue

(US$ Mn)

7.2. North America Market Revenue (US$ Mn) and Forecasts, By Type

7.2.1. Microorganism

7.2.1.1. Rhizobium

7.2.1.2. Azotobacter

7.2.1.3. Azospirillum

7.2.1.4. Blue-green algae

7.2.1.5. Phosphate solubilizing bacteria

7.2.1.6. Mycorrhiza

7.2.1.7. Others

7.2.2. Organic residues

7.2.2.1. Fym

7.2.2.2. Crop residues

7.2.2.3. Green manure

7.2.2.4. Others

7.3. North America Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

7.3.1. Cereals

7.3.2. Legumes

7.3.3. Fruits and Vegetables

7.3.4. Plantations

7.3.5. Others

7.4. North America Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Country

7.4.1. U.S.

7.4.1.1. U.S. Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

7.4.1.1.1. Microorganism

7.4.1.1.1.1. Rhizobium

7.4.1.1.1.2. Azotobacter

7.4.1.1.1.3. Azospirillum

7.4.1.1.1.4. Blue-green algae

7.4.1.1.1.5. Phosphate solubilizing bacteria

7.4.1.1.1.6. Mycorrhiza

7.4.1.1.1.7. Others

7.4.1.1.2. Organic residues

7.4.1.1.2.1. Fym

7.4.1.1.2.2. Crop residues

7.4.1.1.2.3. Green manure

7.4.1.1.2.4. Others

7.4.1.2. U.S. Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

7.4.1.2.1. Cereals

7.4.1.2.2. Legumes

7.4.1.2.3. Fruits and Vegetables

7.4.1.2.4. Plantations

7.4.1.2.5. Others

7.4.2. Rest of North America

7.4.2.1. Rest of North America Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Type

7.4.2.1.1. Microorganism

7.4.2.1.1.1. Rhizobium

7.4.2.1.1.2. Azotobacter

7.4.2.1.1.3. Azospirillum

7.4.2.1.1.4. Blue-green algae

7.4.2.1.1.5. Phosphate solubilizing bacteria

7.4.2.1.1.6. Mycorrhiza

7.4.2.1.1.7. Others

7.4.2.1.2. Organic residues

7.4.2.1.2.1. Fym

7.4.2.1.2.2. Crop residues

7.4.2.1.2.3. Green manure

7.4.2.1.2.4. Others

7.4.2.2. Rest of North America Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Application

7.4.2.2.1. Cereals

7.4.2.2.2. Legumes

7.4.2.2.3. Fruits and Vegetables

7.4.2.2.4. Plantations

7.4.2.2.5. Others

7.5. Key Segment for Channeling Investments

7.5.1. By Country

7.5.2. By Type

7.5.3. By Application

8.

Europe Biological Organic

Fertilizers Market Analysis and Forecasts, 2018 – 2026

8.1. Overview

8.1.1. Europe Biological Organic Fertilizers Market Revenue (US$ Mn)

8.2. Europe Market Revenue (US$ Mn) and Forecasts, By Type

8.2.1. Microorganism

8.2.1.1. Rhizobium

8.2.1.2. Azotobacter

8.2.1.3. Azospirillum

8.2.1.4. Blue-green algae

8.2.1.5. Phosphate solubilizing bacteria

8.2.1.6. Mycorrhiza

8.2.1.7. Others

8.2.2. Organic residues

8.2.2.1. Fym

8.2.2.2. Crop residues

8.2.2.3. Green manure

8.2.2.4. Others

8.3. Europe Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

8.3.1. Cereals

8.3.2. Legumes

8.3.3. Fruits and Vegetables

8.3.4. Plantations

8.3.5. Others

8.4. Europe Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Country

8.4.1. France

8.4.1.1. France Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.1.1.1. Microorganism

8.4.1.1.1.1. Rhizobium

8.4.1.1.1.2. Azotobacter

8.4.1.1.1.3. Azospirillum

8.4.1.1.1.4. Blue-green algae

8.4.1.1.1.5. Phosphate solubilizing bacteria

8.4.1.1.1.6. Mycorrhiza

8.4.1.1.1.7. Others

8.4.1.1.2. Organic residues

8.4.1.1.2.1. Fym

8.4.1.1.2.2. Crop residues

8.4.1.1.2.3. Green manure

8.4.1.1.2.4. Others

8.4.1.2. France Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

8.4.1.2.1. Cereals

8.4.1.2.2. Legumes

8.4.1.2.3. Fruits and Vegetables

8.4.1.2.4. Plantations

8.4.1.2.5. Others

8.4.2. The UK

8.4.2.1. The UK Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.2.1.1. Microorganism

8.4.2.1.1.1. Rhizobium

8.4.2.1.1.2. Azotobacter

8.4.2.1.1.3. Azospirillum

8.4.2.1.1.4. Blue-green algae

8.4.2.1.1.5. Phosphate solubilizing bacteria

8.4.2.1.1.6. Mycorrhiza

8.4.2.1.1.7. Others

8.4.2.1.2. Organic residues

8.4.2.1.2.1. Fym

8.4.2.1.2.2. Crop residues

8.4.2.1.2.3. Green manure

8.4.2.1.2.4. Others

8.4.2.2. The UK Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

8.4.2.2.1. Cereals

8.4.2.2.2. Legumes

8.4.2.2.3. Fruits and Vegetables

8.4.2.2.4. Plantations

8.4.2.2.5. Others

8.4.3. Spain

8.4.3.1. Spain Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.3.1.1. Microorganism

8.4.3.1.1.1. Rhizobium

8.4.3.1.1.2. Azotobacter

8.4.3.1.1.3. Azospirillum

8.4.3.1.1.4. Blue-green algae

8.4.3.1.1.5. Phosphate solubilizing bacteria

8.4.3.1.1.6. Mycorrhiza

8.4.3.1.1.7. Others

8.4.3.1.2. Organic residues

8.4.3.1.2.1. Fym

8.4.3.1.2.2. Crop residues

8.4.3.1.2.3. Green manure

8.4.3.1.2.4. Others

8.4.3.2. Spain Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

8.4.3.2.1. Cereals

8.4.3.2.2. Legumes

8.4.3.2.3. Fruits and Vegetables

8.4.3.2.4. Plantations

8.4.3.2.5. Others

8.4.4. Germany

8.4.4.1. Germany Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.4.1.1. Microorganism

8.4.4.1.1.1. Rhizobium

8.4.4.1.1.2. Azotobacter

8.4.4.1.1.3. Azospirillum

8.4.4.1.1.4. Blue-green algae

8.4.4.1.1.5. Phosphate solubilizing bacteria

8.4.4.1.1.6. Mycorrhiza

8.4.4.1.1.7. Others

8.4.4.1.2. Organic residues

8.4.4.1.2.1. Fym

8.4.4.1.2.2. Crop residues

8.4.4.1.2.3. Green manure

8.4.4.1.2.4. Others

8.4.4.2. Germany Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

8.4.4.2.1. Cereals

8.4.4.2.2. Legumes

8.4.4.2.3. Fruits and Vegetables

8.4.4.2.4. Plantations

8.4.4.2.5. Others

8.4.5. Italy

8.4.5.1. Italy Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.5.1.1. Microorganism

8.4.5.1.1.1. Rhizobium

8.4.5.1.1.2. Azotobacter

8.4.5.1.1.3. Azospirillum

8.4.5.1.1.4. Blue-green algae

8.4.5.1.1.5. Phosphate solubilizing bacteria

8.4.5.1.1.6. Mycorrhiza

8.4.5.1.1.7. Others

8.4.5.1.2. Organic residues

8.4.5.1.2.1. Fym

8.4.5.1.2.2. Crop residues

8.4.5.1.2.3. Green manure

8.4.5.1.2.4. Others

8.4.5.2. Italy Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

8.4.5.2.1. Cereals

8.4.5.2.2. Legumes

8.4.5.2.3. Fruits and Vegetables

8.4.5.2.4. Plantations

8.4.5.2.5. Others

8.4.6. Rest of Europe

8.4.6.1. Rest of Europe Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Type

8.4.6.1.1. Microorganism

8.4.6.1.1.1. Rhizobium

8.4.6.1.1.2. Azotobacter

8.4.6.1.1.3. Azospirillum

8.4.6.1.1.4. Blue-green algae

8.4.6.1.1.5. Phosphate solubilizing bacteria

8.4.6.1.1.6. Mycorrhiza

8.4.6.1.1.7. Others

8.4.6.1.2. Organic residues

8.4.6.1.2.1. Fym

8.4.6.1.2.2. Crop residues

8.4.6.1.2.3. Green manure

8.4.6.1.2.4. Others

8.4.6.2. Rest of Europe Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

8.4.6.2.1. Cereals

8.4.6.2.2. Legumes

8.4.6.2.3. Fruits and Vegetables

8.4.6.2.4. Plantations

8.4.6.2.5. Others

8.5. Key Segment for Channeling Investments

8.5.1. By Country

8.5.2. By Type

8.5.3. By Application

9.

Asia Pacific Biological

Organic Fertilizers Market Analysis and Forecasts, 2018 – 2026

9.1. Overview

9.1.1. Asia Pacific Market Revenue (US$ Mn)

9.2. Asia Pacific Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Type

9.2.1. Microorganism

9.2.1.1. Rhizobium

9.2.1.2. Azotobacter

9.2.1.3. Azospirillum

9.2.1.4. Blue-green algae

9.2.1.5. Phosphate solubilizing bacteria

9.2.1.6. Mycorrhiza

9.2.1.7. Others

9.2.2. Organic residues

9.2.2.1. Fym

9.2.2.2. Crop residues

9.2.2.3. Green manure

9.2.2.4. Others

9.3. Asia Pacific Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

9.3.1. Cereals

9.3.2. Legumes

9.3.3. Fruits and Vegetables

9.3.4. Plantations

9.3.5. Others

9.4. Asia Pacific Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Country

9.4.1. China

9.4.1.1. China Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

9.4.1.1.1. Microorganism

9.4.1.1.1.1. Rhizobium

9.4.1.1.1.2. Azotobacter

9.4.1.1.1.3. Azospirillum

9.4.1.1.1.4. Blue-green algae

9.4.1.1.1.5. Phosphate solubilizing bacteria

9.4.1.1.1.6. Mycorrhiza

9.4.1.1.1.7. Others

9.4.1.1.2. Organic residues

9.4.1.1.2.1. Fym

9.4.1.1.2.2. Crop residues

9.4.1.1.2.3. Green manure

9.4.1.1.2.4. Others

9.4.1.2. China Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

9.4.1.2.1. Cereals

9.4.1.2.2. Legumes

9.4.1.2.3. Fruits and Vegetables

9.4.1.2.4. Plantations

9.4.1.2.5. Others

9.4.2. Japan

9.4.2.1. Japan Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

9.4.2.1.1. Microorganism

9.4.2.1.1.1. Rhizobium

9.4.2.1.1.2. Azotobacter

9.4.2.1.1.3. Azospirillum

9.4.2.1.1.4. Blue-green algae

9.4.2.1.1.5. Phosphate solubilizing bacteria

9.4.2.1.1.6. Mycorrhiza

9.4.2.1.1.7. Others

9.4.2.1.2. Organic residues

9.4.2.1.2.1. Fym

9.4.2.1.2.2. Crop residues

9.4.2.1.2.3. Green manure

9.4.2.1.2.4. Others

9.4.2.2. Japan Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

9.4.2.2.1. Cereals

9.4.2.2.2. Legumes

9.4.2.2.3. Fruits and Vegetables

9.4.2.2.4. Plantations

9.4.2.2.5. Others

9.4.3. India

9.4.3.1. India Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

9.4.3.1.1. Microorganism

9.4.3.1.1.1. Rhizobium

9.4.3.1.1.2. Azotobacter

9.4.3.1.1.3. Azospirillum

9.4.3.1.1.4. Blue-green algae

9.4.3.1.1.5. Phosphate solubilizing bacteria

9.4.3.1.1.6. Mycorrhiza

9.4.3.1.1.7. Others

9.4.3.1.2. Organic residues

9.4.3.1.2.1. Fym

9.4.3.1.2.2. Crop residues

9.4.3.1.2.3. Green manure

9.4.3.1.2.4. Others

9.4.3.2. India Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

9.4.3.2.1. Cereals

9.4.3.2.2. Legumes

9.4.3.2.3. Fruits and Vegetables

9.4.3.2.4. Plantations

9.4.3.2.5. Others

9.4.4. Southeast Asia

9.4.4.1. Southeast Asia Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Type

9.4.4.1.1. Microorganism

9.4.4.1.1.1. Rhizobium

9.4.4.1.1.2. Azotobacter

9.4.4.1.1.3. Azospirillum

9.4.4.1.1.4. Blue-green algae

9.4.4.1.1.5. Phosphate solubilizing bacteria

9.4.4.1.1.6. Mycorrhiza

9.4.4.1.1.7. Others

9.4.4.1.2. Organic residues

9.4.4.1.2.1. Fym

9.4.4.1.2.2. Crop residues

9.4.4.1.2.3. Green manure

9.4.4.1.2.4. Others

9.4.4.2. Southeast Asia Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

9.4.4.2.1. Cereals

9.4.4.2.2. Legumes

9.4.4.2.3. Fruits and Vegetables

9.4.4.2.4. Plantations

9.4.4.2.5. Others

9.4.5. Rest of Asia Pacific

9.4.5.1. Rest of Asia Pacific Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Type

9.4.5.1.1. Microorganism

9.4.5.1.1.1. Rhizobium

9.4.5.1.1.2. Azotobacter

9.4.5.1.1.3. Azospirillum

9.4.5.1.1.4. Blue-green algae

9.4.5.1.1.5. Phosphate solubilizing bacteria

9.4.5.1.1.6. Mycorrhiza

9.4.5.1.1.7. Others

9.4.5.1.2. Organic residues

9.4.5.1.2.1. Fym

9.4.5.1.2.2. Crop residues

9.4.5.1.2.3. Green manure

9.4.5.1.2.4. Others

9.4.5.2. Rest of Asia Pacific Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Application

9.4.5.2.1. Cereals

9.4.5.2.2. Legumes

9.4.5.2.3. Fruits and Vegetables

9.4.5.2.4. Plantations

9.4.5.2.5. Others

9.5. Key Segment for Channeling Investments

9.5.1. By Country

9.5.2. By Type

9.5.3. By Application

10.

Middle East and Africa

Biological Organic Fertilizers Market Analysis and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Market Revenue (US$ Mn)

10.2. Middle East and Africa Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Type

10.2.1. Microorganism

10.2.1.1. Rhizobium

10.2.1.2. Azotobacter

10.2.1.3. Azospirillum

10.2.1.4. Blue-green algae

10.2.1.5. Phosphate solubilizing bacteria

10.2.1.6. Mycorrhiza

10.2.1.7. Others

10.2.2. Organic residues

10.2.2.1. Fym

10.2.2.2. Crop residues

10.2.2.3. Green manure

10.2.2.4. Others

10.3. Middle East and Africa Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Application

10.3.1. Cereals

10.3.2. Legumes

10.3.3. Fruits and Vegetables

10.3.4. Plantations

10.3.5. Others

10.4. Middle East and Africa Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Country

10.4.1. GCC Countries

10.4.1.1. GCC Countries Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Type

10.4.1.1.1. Microorganism

10.4.1.1.1.1. Rhizobium

10.4.1.1.1.2. Azotobacter

10.4.1.1.1.3. Azospirillum

10.4.1.1.1.4. Blue-green

algae

10.4.1.1.1.5. Phosphate

solubilizing bacteria

10.4.1.1.1.6. Mycorrhiza

10.4.1.1.1.7. Others

10.4.1.1.2. Organic residues

10.4.1.1.2.1. Fym

10.4.1.1.2.2. Crop residues

10.4.1.1.2.3. Green manure

10.4.1.1.2.4. Others

10.4.1.2. GCC Countries Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

10.4.1.2.1. Cereals

10.4.1.2.2. Legumes

10.4.1.2.3. Fruits and Vegetables

10.4.1.2.4. Plantations

10.4.1.2.5. Others

10.4.2. Southern Africa

10.4.2.1. Southern Africa Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Type

10.4.2.1.1. Microorganism

10.4.2.1.1.1. Rhizobium

10.4.2.1.1.2. Azotobacter

10.4.2.1.1.3. Azospirillum

10.4.2.1.1.4. Blue-green algae

10.4.2.1.1.5. Phosphate solubilizing bacteria

10.4.2.1.1.6. Mycorrhiza

10.4.2.1.1.7. Others

10.4.2.1.2. Organic residues

10.4.2.1.2.1. Fym

10.4.2.1.2.2. Crop residues

10.4.2.1.2.3. Green manure

10.4.2.1.2.4. Others

10.4.2.2. Southern Africa Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

10.4.2.2.1. Cereals

10.4.2.2.2. Legumes

10.4.2.2.3. Fruits and Vegetables

10.4.2.2.4. Plantations

10.4.2.2.5. Others

10.4.3. Rest of MEA

10.4.3.1. Rest of MEA Biological Organic Fertilizers Market Revenue (US$

Mn) and Forecasts, By Type

10.4.3.1.1. Microorganism

10.4.3.1.1.1. Rhizobium

10.4.3.1.1.2. Azotobacter

10.4.3.1.1.3. Azospirillum

10.4.3.1.1.4. Blue-green algae

10.4.3.1.1.5. Phosphate solubilizing bacteria

10.4.3.1.1.6. Mycorrhiza

10.4.3.1.1.7. Others

10.4.3.1.2. Organic residues

10.4.3.1.2.1. Fym

10.4.3.1.2.2. Crop residues

10.4.3.1.2.3. Green manure

10.4.3.1.2.4. Others

10.4.3.2. Rest of MEA Biological Organic Fertilizers Market Revenue (US$

Mn) and Forecasts, By Application

10.4.3.2.1. Cereals

10.4.3.2.2. Legumes

10.4.3.2.3. Fruits and Vegetables

10.4.3.2.4. Plantations

10.4.3.2.5. Others

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Type

10.5.3. By Application

11.

Latin America Biological

Organic Fertilizers Market Analysis and Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America Biological Organic Fertilizers Market Revenue

(US$ Mn)

11.2. Latin America Market Revenue (US$ Mn) and Forecasts, By Type

11.2.1. Microorganism

11.2.1.1. Rhizobium

11.2.1.2. Azotobacter

11.2.1.3. Azospirillum

11.2.1.4. Blue-green algae

11.2.1.5. Phosphate solubilizing bacteria

11.2.1.6. Mycorrhiza

11.2.1.7. Others

11.2.2. Organic residues

11.2.2.1. Fym

11.2.2.2. Crop residues

11.2.2.3. Green manure

11.2.2.4. Others

11.3. Latin America Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Application

11.3.1. Cereals

11.3.2. Legumes

11.3.3. Fruits and Vegetables

11.3.4. Plantations

11.3.5. Others

11.4. Latin America Biological Organic Fertilizers Market Revenue

(US$ Mn) and Forecasts, By Country

11.4.1. Brazil

11.4.1.1. Brazil Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Type

11.4.1.1.1. Microorganism

11.4.1.1.1.1. Rhizobium

11.4.1.1.1.2. Azotobacter

11.4.1.1.1.3. Azospirillum

11.4.1.1.1.4. Blue-green algae

11.4.1.1.1.5. Phosphate solubilizing bacteria

11.4.1.1.1.6. Mycorrhiza

11.4.1.1.1.7. Others

11.4.1.1.2. Organic residues

11.4.1.1.2.1. Fym

11.4.1.1.2.2. Crop residues

11.4.1.1.2.3. Green manure

11.4.1.1.2.4. Others

11.4.1.2. Brazil Biological Organic Fertilizers Market Revenue (US$ Mn)

and Forecasts, By Application

11.4.1.2.1. Cereals

11.4.1.2.2. Legumes

11.4.1.2.3. Fruits and Vegetables

11.4.1.2.4. Plantations

11.4.1.2.5. Others

11.4.2. Rest of Latin America

11.4.2.1. Rest of Latin America Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Type

11.4.2.1.1. Microorganism

11.4.2.1.1.1. Rhizobium

11.4.2.1.1.2. Azotobacter

11.4.2.1.1.3. Azospirillum

11.4.2.1.1.4. Blue-green algae

11.4.2.1.1.5. Phosphate solubilizing bacteria

11.4.2.1.1.6. Mycorrhiza

11.4.2.1.1.7. Others

11.4.2.1.2. Organic residues

11.4.2.1.2.1. Fym

11.4.2.1.2.2. Crop residues

11.4.2.1.2.3. Green manure

11.4.2.1.2.4. Others

11.4.2.2. Rest of Latin America Biological Organic Fertilizers Market

Revenue (US$ Mn) and Forecasts, By Application

11.4.2.2.1. Cereals

11.4.2.2.2. Legumes

11.4.2.2.3. Fruits and Vegetables

11.4.2.2.4. Plantations

11.4.2.2.5. Others

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Type

11.5.3. By Application

12.

Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13.

Player Profiles

13.1. Agri Life

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. Bio Protan

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Camson Bio Technologies Limited

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. Ferm O Feed

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. Fertagon

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. Futureco Bioscience S.A.

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. Gujarat State Fertilizers & Chemicals Ltd

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. Italpollina spa

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. Kribhco

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10. Lallemand

Inc.

13.10.1. Company

Details

13.10.2. Company

Overview

13.10.3. Product

Offerings

13.10.4. Key Developments

13.10.5. Financial

Analysis

13.10.6. SWOT

Analysis

13.10.7. Business

Strategies

13.11. Madras Fertilizers Limited

13.11.1. Company

Details

13.11.2. Company

Overview

13.11.3. Product

Offerings

13.11.4. Key

Developments

13.11.5. Financial

Analysis

13.11.6. SWOT

Analysis

13.11.7. Business

Strategies

13.12. Multiplex Group

13.12.1. Company Details

13.12.2. Company Overview

13.12.3. Product Offerings

13.12.4. Key Developments

13.12.5. Financial Analysis

13.12.6. SWOT Analysis

13.12.7. Business Strategies

13.13. National Fertilizers Limited

13.13.1. Company Details

13.13.2. Company Overview

13.13.3. Product Offerings

13.13.4. Key Developments

13.13.5. Financial Analysis

13.13.6. SWOT Analysis

13.13.7. Business Strategies

13.14. Neochim

13.14.1. Company Details

13.14.2. Company Overview

13.14.3. Product Offerings

13.14.4. Key Developments

13.14.5. Financial Analysis

13.14.6. SWOT Analysis

13.14.7. Business Strategies

13.15. Novozymes A/S

13.15.1. Company Details

13.15.2. Company Overview

13.15.3. Product Offerings

13.15.4. Key Developments

13.15.5. Financial Analysis

13.15.6. SWOT Analysis

13.15.7. Business Strategies

13.16. Nutramax Laboratories Inc.

13.16.1. Company Details

13.16.2. Company Overview

13.16.3. Product Offerings

13.16.4. Key Developments

13.16.5. Financial Analysis

13.16.6. SWOT Analysis

13.16.7. Business Strategies

13.17. Premier Tech

13.17.1. Company Details

13.17.2. Company Overview

13.17.3. Product Offerings

13.17.4. Key Developments

13.17.5. Financial Analysis

13.17.6. SWOT Analysis

13.17.7. Business Strategies

13.18. Rashtriya Chemicals & Fertilizers Ltd

13.18.1. Company Details

13.18.2. Company Overview

13.18.3. Product Offerings

13.18.4. Key Developments

13.18.5. Financial Analysis

13.18.6. SWOT Analysis

13.18.7. Business Strategies

13.19. Rizobacter Argentina S.A.

13.19.1. Company Details

13.19.2. Company Overview

13.19.3. Product Offerings

13.19.4. Key Developments

13.19.5. Financial Analysis

13.19.6. SWOT Analysis

13.19.7. Business Strategies

13.20. SKS BIOPRODUCTS PVT LTD

13.20.1. Company Details

13.20.2. Company Overview

13.20.3. Product Offerings

13.20.4. Key Developments

13.20.5. Financial Analysis

13.20.6. SWOT Analysis

13.20.7. Business Strategies

13.21. Symborg

13.21.1. Company Details

13.21.2. Company Overview

13.21.3. Product Offerings

13.21.4. Key Developments

13.21.5. Financial Analysis

13.21.6. SWOT Analysis

13.21.7. Business Strategies

13.22. T Stanes & Company Limited

13.22.1. Company Details

13.22.2. Company Overview

13.22.3. Product Offerings

13.22.4. Key Developments

13.22.5. Financial Analysis

13.22.6. SWOT Analysis

13.22.7. Business Strategies

Note: This ToC is

tentative and can be changed according to the research study conducted during

the course of report completion.

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Reach to us

Call us on

+91-74002-42424

Drop us an email at

sales@absolutemarketsinsights.com

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.