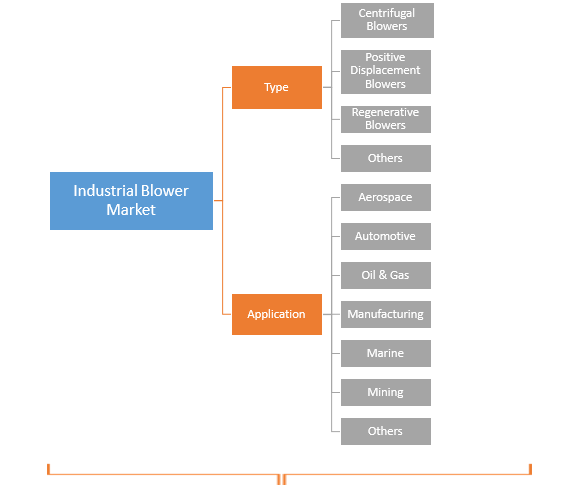

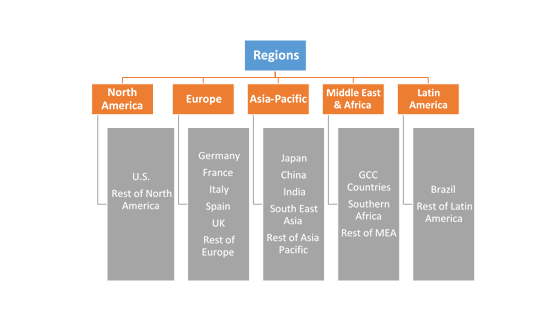

Industrial Blower Market by Type (Centrifugal Blowers, Positive Displacement Blowers, Regenerative Blowers, Others); by End-Use (Aerospace, Automotive, Oil & Gas, Manufacturing, Marine, Mining, Others); by Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Industry Trends, Price Trends, Growth, Size, Supply, Demand, Comparative Analysis, Competitive Market Share and Forecast, 2018-2026

Industry Trends

Industrial blowers are electro-mechanical or mechanical machines used to instigate gas flow through hardware chassis, process stacks, and ducting. It is required for cooling, exhaustion, ventilation, suction and flow in industrial machines. The industrial blower works on the same principle on which a fan works. Both of them belong to the same group of machines. The only difference between both of them is that the fan operates at a low pressure and on the other hand, the industrial blower operates at a comparative high pressure. The industrial blower market was valued at USD 1,783.3 Mn in 2017 and is expected to reach US$ 2,242.1 Mn by 2022.

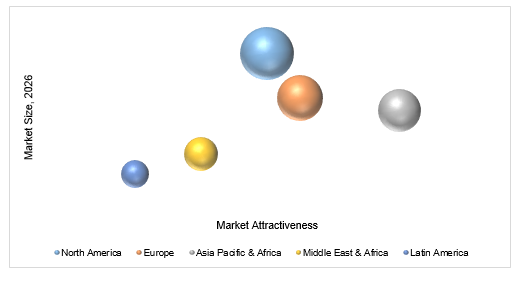

Global Industrial Blower Market Size, By Region, 2018 - 2026

The industrial sector has witnessed a rapid growth over the last few years. Countries such as China, Japan, India, Qatar, Saudi Arabia, and Oman are the major contributors to the growth of the industrial sector. Moreover, countries such as China and India are largely investing in industrial development to attract more foreign investments.

For instance, the government of India has launched the ‘Make in India’ initiative. As per the policy, tax exemptions would be granted to the foreign companies that will set up their manufacturing units in India. After the launch of this initiative in 2014, the country received US$ 250 million worth of investment. It has been driving the industrialization in the country. Such a trend has further led to the rise in the demand for the use of industrial blowers in major industries.

Industrial Blower Market, by Type

Industrial Blower types include centrifugal blowers, positive displacement blowers, regenerative blower and others. Among all the blowers, the centrifugal type is the most preferred one and dominated the market during the year 2017. It is very cost effective and is easily available in the market, unlike other blowers. It uses much less horsepower to create flow, thus it consumes less energy. Also, its spare parts are available easily and its usage is not restricted to a particular industry. It is expected to dominate the market for the forecast year 2018-2026.

Industrial Blower Market, by Region

The market has been segmented into regions such as North America, Europe, Asia-Pacific, Middle East and Africa and Latin America. The Asia-Pacific region is growing significantly due to the industrial development in developing markets. The projected growth of the chemical industry in China and the development of petrochemical industry in India, are further contributing to the growth of the industrial blower market in Asia. Additionally, the development of the food and beverage industry, mainly oils and fats, grain mill products, meat and dairy products in the region will increase the demand for high-pressure industrial blowers.

Competitive Benchmark

This report provides both, qualitative and quantitative research of the market, as well as integrates worthy insights into the rational scenario and favored development methods adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as M&A, affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the industrial blower market report recognizes their manufacturing base, competitors, product type, application and specification, pricing, and gross margin.

Market participants include Acme Engineering & Manufacturing Corporation, Air Control Industries Ltd, Air System Components Inc., Atlas Copco Group, Continental Blower LLC, Gardner Denver Inc., Hoffman & Lamson, Howden Group, Loren Cook Company, and Shandong Huadong Blower Co., Ltd. amongst others.

Industrial Blower Industry Background

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Industrial Blower Market Snapshot

3. Executive Summary: Industrial Blower Market

4. Qualitative Analysis: Industrial Blower Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Trends in Market

5. Global Industrial Blower Market Analysis and Forecasts, 2018

– 2026

5.1. Overview

5.1.1. Global Market Revenue (US$ Mn) and Forecasts

5.2. Global Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

5.2.1. Centrifugal Blowers

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Positive Displacement Blowers

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.2.3. Regenerative Blowers

5.2.3.1. Definition

5.2.3.2. Market Penetration

5.2.3.3. Market Revenue Expected to Increase by 2026

5.2.3.4. Compound Annual Growth Rate (CAGR)

5.2.4. Others

5.2.4.1. Definition

5.2.4.2. Market Penetration

5.2.4.3. Market Revenue Expected to Increase by 2026

5.2.4.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Type

6. Global Industrial Blower Market Analysis and Forecasts, 2018

– 2026

6.1. Overview

6.2. Global Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

6.2.1. Aerospace

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Automotive

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. Oil and Gas

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Manufacturing

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.2.5. Marine

6.2.5.1. Definition

6.2.5.2. Market Penetration

6.2.5.3. Market Revenue Expected to Increase by 2026

6.2.5.4. Compound Annual Growth Rate (CAGR)

6.2.6. Mining

6.2.6.1. Definition

6.2.6.2. Market Penetration

6.2.6.3. Market Revenue Expected to Increase by 2026

6.2.6.4. Compound Annual Growth Rate (CAGR)

6.2.7. Others

6.2.7.1. Definition

6.2.7.2. Market Penetration

6.2.7.3. Market Revenue Expected to Increase by 2026

6.2.7.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By End-use Industry

7. North America Industrial Blower Market Analysis and

Forecasts, 2018 – 2026

7.1. Overview

7.1.1. North America Market Revenue (US$ Mn)

7.2. North America Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

7.2.1. Centrifugal Blowers

7.2.2. Positive Displacement Blowers

7.2.3. Regenerative Blowers

7.2.4. Others

7.3. North America Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

7.3.1. Aerospace

7.3.2. Automotive

7.3.3. Oil and Gas

7.3.4. Manufacturing

7.3.5. Marine

7.3.6. Mining

7.3.7. Others

7.4. North America Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Country

7.4.1. U.S.

7.4.1.1. U.S. Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Type

7.4.1.1.1. Centrifugal Blowers

7.4.1.1.2. Positive Displacement Blowers

7.4.1.1.3. Regenerative Blowers

7.4.1.1.4. Others

7.4.1.2. U.S. Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By End-use Industry

7.4.1.2.1. Aerospace

7.4.1.2.2. Automotive

7.4.1.2.3. Oil and Gas

7.4.1.2.4. Manufacturing

7.4.1.2.5. Marine

7.4.1.2.6. Mining

7.4.1.2.7. Others

7.4.2. Rest of North America

7.4.2.1. Rest of North America Industrial Blower Market Revenue (US$

Mn) and Forecasts, By Type

7.4.2.1.1. Centrifugal Blowers

7.4.2.1.2. Positive Displacement Blowers

7.4.2.1.3. Regenerative Blowers

7.4.2.1.4. Others

7.4.2.2. Rest of North America Industrial Blower Market Revenue (US$

Mn) and Forecasts, By End-use Industry

7.4.2.2.1. Aerospace

7.4.2.2.2. Automotive

7.4.2.2.3. Oil and Gas

7.4.2.2.4. Manufacturing

7.4.2.2.5. Marine

7.4.2.2.6. Mining

7.4.2.2.7. Others

7.5. Key Segment for Channeling Investments

7.5.1. By Country

7.5.2. By Type

7.5.3. By End-use Industry

8. Europe Industrial Blower Market Analysis and Forecasts, 2018

– 2026

8.1. Overview

8.1.1. Europe Market Revenue (US$ Mn)

8.2. Europe Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

8.2.1. Centrifugal Blowers

8.2.2. Positive Displacement Blowers

8.2.3. Regenerative Blowers

8.2.4. Others

8.3. Europe Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

8.3.1. Aerospace

8.3.2. Automotive

8.3.3. Oil and Gas

8.3.4. Manufacturing

8.3.5. Marine

8.3.6. Mining

8.3.7. Others

8.4. Europe Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Country

8.4.1. France

8.4.1.1. France Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.1.1.1. Centrifugal Blowers

8.4.1.1.2. Positive Displacement Blowers

8.4.1.1.3. Regenerative Blowers

8.4.1.1.4. Others

8.4.1.2. France Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

8.4.1.2.1. Aerospace

8.4.1.2.2. Automotive

8.4.1.2.3. Oil and Gas

8.4.1.2.4. Manufacturing

8.4.1.2.5. Marine

8.4.1.2.6. Mining

8.4.1.2.7. Others

8.4.2. The UK

8.4.2.1. The UK Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.2.1.1. Centrifugal Blowers

8.4.2.1.2. Positive Displacement Blowers

8.4.2.1.3. Regenerative Blowers

8.4.2.1.4. Others

8.4.2.2. The UK Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

8.4.2.2.1. Aerospace

8.4.2.2.2. Automotive

8.4.2.2.3. Oil and Gas

8.4.2.2.4. Manufacturing

8.4.2.2.5. Marine

8.4.2.2.6. Mining

8.4.2.2.7. Others

8.4.3. Spain

8.4.3.1. Spain Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Type

8.4.3.1.1. Centrifugal Blowers

8.4.3.1.2. Positive Displacement Blowers

8.4.3.1.3. Regenerative Blowers

8.4.3.1.4. Others

8.4.3.2. Spain Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By End-use Industry

8.4.3.2.1. Aerospace

8.4.3.2.2. Automotive

8.4.3.2.3. Oil and Gas

8.4.3.2.4. Manufacturing

8.4.3.2.5. Marine

8.4.3.2.6. Mining

8.4.3.2.7. Others

8.4.4. Germany

8.4.4.1. Germany Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.4.1.1. Centrifugal Blowers

8.4.4.1.2. Positive Displacement Blowers

8.4.4.1.3. Regenerative Blowers

8.4.4.1.4. Others

8.4.4.2. Germany Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

8.4.4.2.1. Aerospace

8.4.4.2.2. Automotive

8.4.4.2.3. Oil and Gas

8.4.4.2.4. Manufacturing

8.4.4.2.5. Marine

8.4.4.2.6. Mining

8.4.4.2.7. Others

8.4.5. Italy

8.4.5.1. Italy Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Type

8.4.5.1.1. Centrifugal Blowers

8.4.5.1.2. Positive Displacement Blowers

8.4.5.1.3. Regenerative Blowers

8.4.5.1.4. Others

8.4.5.2. Italy Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By End-use Industry

8.4.5.2.1. Aerospace

8.4.5.2.2. Automotive

8.4.5.2.3. Oil and Gas

8.4.5.2.4. Manufacturing

8.4.5.2.5. Marine

8.4.5.2.6. Mining

8.4.5.2.7. Others

8.4.6. Rest of Europe

8.4.6.1. Rest of Europe Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.6.1.1. Centrifugal Blowers

8.4.6.1.2. Positive Displacement Blowers

8.4.6.1.3. Regenerative Blowers

8.4.6.1.4. Others

8.4.6.2. Rest of Europe Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

8.4.6.2.1. Aerospace

8.4.6.2.2. Automotive

8.4.6.2.3. Oil and Gas

8.4.6.2.4. Manufacturing

8.4.6.2.5. Marine

8.4.6.2.6. Mining

8.4.6.2.7. Others

8.5. Key Segment for Channeling Investments

8.5.1. By Country

8.5.2. By Type

8.5.3. By End-use Industry

9. Asia Pacific

Industrial Blower Market Analysis and Forecasts, 2018 – 2026

9.1. Overview

9.1.1. Asia Pacific Market Revenue (US$ Mn)

9.2. Asia Pacific Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

9.2.1. Centrifugal Blowers

9.2.2. Positive Displacement Blowers

9.2.3. Regenerative Blowers

9.2.4. Others

9.3. Asia Pacific Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

9.3.1. Aerospace

9.3.2. Automotive

9.3.3. Oil and Gas

9.3.4. Manufacturing

9.3.5. Marine

9.3.6. Mining

9.3.7. Others

9.4. Asia Pacific Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Country

9.4.1. China

9.4.1.1. China Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Type

9.4.1.1.1. Centrifugal Blowers

9.4.1.1.2. Positive Displacement Blowers

9.4.1.1.3. Regenerative Blowers

9.4.1.1.4. Others

9.4.1.2. China Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By End-use Industry

9.4.1.2.1. Aerospace

9.4.1.2.2. Automotive

9.4.1.2.3. Oil and Gas

9.4.1.2.4. Manufacturing

9.4.1.2.5. Marine

9.4.1.2.6. Mining

9.4.1.2.7. Others

9.4.2. Japan

9.4.2.1. Japan Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Type

9.4.2.1.1. Centrifugal Blowers

9.4.2.1.2. Positive Displacement Blowers

9.4.2.1.3. Regenerative Blowers

9.4.2.1.4. Others

9.4.2.2. Japan Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By End-use Industry

9.4.2.2.1. Aerospace

9.4.2.2.2. Automotive

9.4.2.2.3. Oil and Gas

9.4.2.2.4. Manufacturing

9.4.2.2.5. Marine

9.4.2.2.6. Mining

9.4.2.2.7. Others

9.4.3. India

9.4.3.1. India Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By Type

9.4.3.1.1. Centrifugal Blowers

9.4.3.1.2. Positive Displacement Blowers

9.4.3.1.3. Regenerative Blowers

9.4.3.1.4. Others

9.4.3.2. India Industrial Blower Market Revenue (US$ Mn) and Forecasts,

By End-use Industry

9.4.3.2.1. Aerospace

9.4.3.2.2. Automotive

9.4.3.2.3. Oil and Gas

9.4.3.2.4. Manufacturing

9.4.3.2.5. Marine

9.4.3.2.6. Mining

9.4.3.2.7. Others

9.4.4. Southeast Asia

9.4.4.1. Southeast Asia Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.4.1.1. Centrifugal Blowers

9.4.4.1.2. Positive Displacement Blowers

9.4.4.1.3. Regenerative Blowers

9.4.4.1.4. Others

9.4.4.2. Southeast Asia Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

9.4.4.2.1. Aerospace

9.4.4.2.2. Automotive

9.4.4.2.3. Oil and Gas

9.4.4.2.4. Manufacturing

9.4.4.2.5. Marine

9.4.4.2.6. Mining

9.4.4.2.7. Others

9.4.5. Rest of Asia Pacific

9.4.5.1. Rest of Asia Pacific Industrial Blower Market Revenue (US$ Mn)

and Forecasts, By Type

9.4.5.1.1. Centrifugal Blowers

9.4.5.1.2. Positive Displacement Blowers

9.4.5.1.3. Regenerative Blowers

9.4.5.1.4. Others

9.4.5.2. Rest of Asia Pacific Industrial Blower Market Revenue (US$ Mn)

and Forecasts, By End-use Industry

9.4.5.2.1. Aerospace

9.4.5.2.2. Automotive

9.4.5.2.3. Oil and Gas

9.4.5.2.4. Manufacturing

9.4.5.2.5. Marine

9.4.5.2.6. Mining

9.4.5.2.7. Others

9.5. Key Segment for Channeling Investments

9.5.1. By Country

9.5.2. By Type

9.5.3. By End-use Industry

10. Middle East and Africa

Industrial Blower Market Analysis and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Market Revenue (US$ Mn)

10.2. Middle East and Africa Industrial Blower Market Revenue (US$ Mn)

and Forecasts, By Type

10.2.1. Centrifugal Blowers

10.2.2. Positive Displacement Blowers

10.2.3. Regenerative Blowers

10.2.4. Others

10.3. Middle East and Africa Industrial Blower Market Revenue (US$

Mn) and Forecasts, By End-use Industry

10.3.1. Aerospace

10.3.2. Automotive

10.3.3. Oil and Gas

10.3.4. Manufacturing

10.3.5. Marine

10.3.6. Mining

10.3.7. Others

10.4. Middle East and Africa Industrial Blower Market Revenue (US$

Mn) and Forecasts, By Country

10.4.1. GCC Countries

10.4.1.1. GCC Countries Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

10.4.1.1.1. Centrifugal Blowers

10.4.1.1.2. Positive Displacement Blowers

10.4.1.1.3. Regenerative Blowers

10.4.1.1.4. Others

10.4.1.2. GCC Countries Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

10.4.1.2.1. Aerospace

10.4.1.2.2. Automotive

10.4.1.2.3. Oil and Gas

10.4.1.2.4. Manufacturing

10.4.1.2.5. Marine

10.4.1.2.6. Mining

10.4.1.2.7. Others

10.4.2. Southern Africa

10.4.2.1. Southern Africa Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

10.4.2.1.1. Centrifugal Blowers

10.4.2.1.2. Positive Displacement Blowers

10.4.2.1.3. Regenerative Blowers

10.4.2.1.4. Others

10.4.2.2. Southern Africa Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

10.4.2.2.1. Aerospace

10.4.2.2.2. Automotive

10.4.2.2.3. Oil and Gas

10.4.2.2.4. Manufacturing

10.4.2.2.5. Marine

10.4.2.2.6. Mining

10.4.2.2.7. Others

10.4.3. Rest of MEA

10.4.3.1. Rest of MEA Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

10.4.3.1.1. Centrifugal Blowers

10.4.3.1.2. Positive Displacement Blowers

10.4.3.1.3. Regenerative Blowers

10.4.3.1.4. Others

10.4.3.2. Rest of MEA Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

10.4.3.2.1. Aerospace

10.4.3.2.2. Automotive

10.4.3.2.3. Oil and Gas

10.4.3.2.4. Manufacturing

10.4.3.2.5. Marine

10.4.3.2.6. Mining

10.4.3.2.7. Others

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Type

10.5.3. By Material

10.5.4. By End-use Industry

11. Latin America Industrial Blower Market Analysis and

Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America Market Revenue (US$ Mn)

11.2. Latin America Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

11.2.1. Centrifugal Blowers

11.2.2. Positive Displacement Blowers

11.2.3. Regenerative Blowers

11.2.4. Others

11.3. Latin America Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

11.3.1. Aerospace

11.3.2. Automotive

11.3.3. Oil and Gas

11.3.4. Manufacturing

11.3.5. Marine

11.3.6. Mining

11.3.7. Others

11.4. Latin America Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Country

11.4.1. Brazil

11.4.1.1. Brazil Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By Type

11.4.1.1.1. Centrifugal Blowers

11.4.1.1.2. Positive Displacement Blowers

11.4.1.1.3. Regenerative Blowers

11.4.1.1.4. Others

11.4.1.2. Brazil Industrial Blower Market Revenue (US$ Mn) and

Forecasts, By End-use Industry

11.4.1.2.1. Aerospace

11.4.1.2.2. Automotive

11.4.1.2.3. Oil and Gas

11.4.1.2.4. Manufacturing

11.4.1.2.5. Marine

11.4.1.2.6. Mining

11.4.1.2.7. Others

11.4.2. Rest of Latin America

11.4.2.1. Rest of Latin America Industrial Blower Market Revenue (US$

Mn) and Forecasts, By Type

11.4.2.1.1. Centrifugal Blowers

11.4.2.1.2. Positive Displacement Blowers

11.4.2.1.3. Regenerative Blowers

11.4.2.1.4. Others

11.4.2.2. Rest of Latin America Industrial Blower Market Revenue (US$

Mn) and Forecasts, By End-use Industry

11.4.2.2.1. Aerospace

11.4.2.2.2. Automotive

11.4.2.2.3. Oil and Gas

11.4.2.2.4. Manufacturing

11.4.2.2.5. Marine

11.4.2.2.6. Mining

11.4.2.2.7. Others

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Type

11.5.3. By End-use Industry

12. Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13. Player Profiles

13.1. Acme Engineering & Manufacturing Corporation

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. Air Control Industries Ltd

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Air System Components, Inc.

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. AirPro Fan & Blower Co.

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. Atlas Copco Group

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. Continental Blower LLC

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. EVEREST

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. Gardner Denver, Inc.

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. Hoffman & Lamson

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10. Howden Group

13.10.1. Company Details

13.10.2. Company Overview

13.10.3. Product Offerings

13.10.4. Key Developments

13.10.5. Financial Analysis

13.10.6. SWOT Analysis

13.10.7. Business Strategies

13.11.

HSI Blowers

13.11.1. Company Details

13.11.2. Company Overview

13.11.3. Product Offerings

13.11.4. Key Developments

13.11.5. Financial Analysis

13.11.6. SWOT Analysis

13.11.7.

Business Strategies

13.12.

J.E. PHILLIPS CO., INC.

13.12.1.

Company Details

13.12.2.

Company Overview

13.12.3.

Product Offerings

13.12.4.

Key Developments

13.12.5.

Financial Analysis

13.12.6.

SWOT Analysis

13.12.7.

Business Strategies

13.13.

Loren Cook Company

13.13.1.

Company Details

13.13.2.

Company Overview

13.13.3.

Product Offerings

13.13.4.

Key Developments

13.13.5.

Financial Analysis

13.13.6.

SWOT Analysis

13.13.7.

Business Strategies

13.14.

Shandong Huadong Blower

Co.,Ltd

13.14.1.

Company Details

13.14.2.

Company Overview

13.14.3.

Product Offerings

13.14.4.

Key Developments

13.14.5.

Financial Analysis

13.14.6.

SWOT Analysis

13.14.7.

Business Strategies

Note: This ToC is tentative and can be changed according

to the research study conducted during the course of report completion.

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Reach to us

Call us on

+91-74002-42424

Drop us an email at

sales@absolutemarketsinsights.com

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.