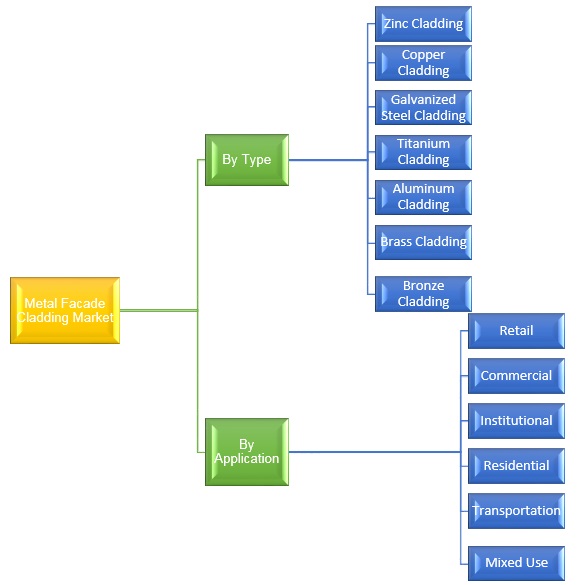

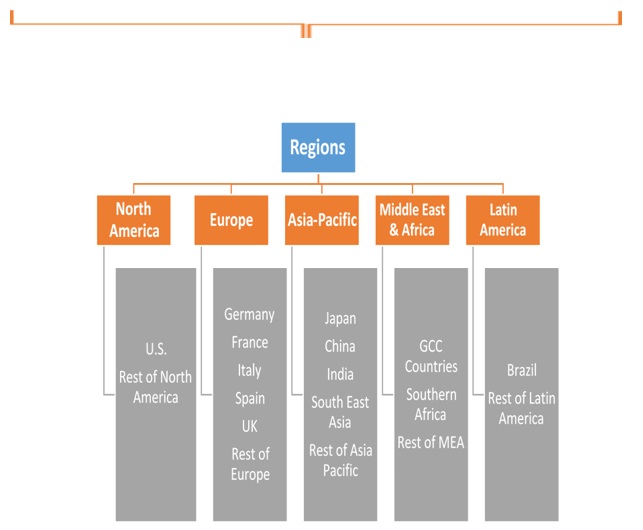

Metal Facade Cladding Market by Type (Zinc Cladding, Copper Cladding, Galvanized Steel Cladding, Titanium Cladding, Aluminium Cladding, Brass Cladding, Bronze Cladding); by Application (Retail, Commercial, Institutional, Residential, Transportation, Mixed Use); by Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 – 2026

Industry Trends

Metal facade cladding provides protection to the exterior frame of the building by inlaying metal cladding to the surface of the building structure. The cladding is highly sustainable and qualitative solution, in order to retain the facade of the building structure throughout the years. The cladding elements are made of different metals that are fixed to the substrate wall by means of a lightweight substructure. Rapid advancement in technology has introduced the sheet metal facades, having an advantage of easy installation on the building structure, cost-effective, and lifelong. Therefore, the demand for metal façade cladding is growing with a high pace. The Metal Facade Cladding Market was valued at US$ 2631.43 Mn in 2017 and is expected to reach US$ 3534.07 Mn by 2022.

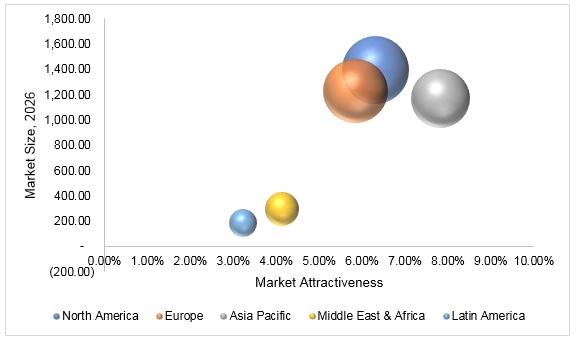

Metal Facade Cladding Market, By Region, 2018-2026, (US$ Million)

Modern buildings are becoming the part of metal cladding. They represent the very hi-tech look to the building. In many cases it is used to give a modern look to old buildings. Novel applications are also being introduced for newly developed composite panels, which is expected to enhance the demand for façade panels.

Metal Facade Cladding Market, By Application

Metal facade cladding structure is mainly used in commercial application. During the forecasting period, commercial application is anticipated to share largest market and is holding the largest market at present as well. For commercial application, metal facade cladding provides external noise absorbing features making it ideal for applications requiring both sound absorption and design. Also, it is used for exterior or interior wall cladding, showroom displays, restaurants and bars, offices & apartment buildings, ceiling tiles, furniture, flooring, signs, lighting, fixtures, exhibits and for other application.

Metal Facade Cladding Market, By Region

The main factors driving the market in the North America regions are presence of major players in the region as well as technological advancement in the region. U.S. region holds the largest share in the region due to presence of metal facade cladding in the construction & building industry. Owing to the success of many recent projects, having advanced façade designs, there is increase in the use of new technologies for building designs, such as NACIA award recipients include several Canadian projects this year in 2018, such as the roof replacement of the Currie and Mackenzie buildings of the royal military college in Kingston, Ontario. However, all new and restored copper cornices, acanthus leaves, dormer cladding and ornamentation are replaced. Additionally, the use of metal wall cladding systems is rising in the energy sector for the U.S.A., as there are ample of opportunities in the energy sector.

Competitive Landscape

The report provides both, qualitative and quantitative research of the market, as well as strategic insights along with developments that are being adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as mergers and acquisition (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their competitors, service type, application and specification, pricing, and gross margin.

Metal facade cladding market participants include A. Zahner, Anclajes Grapamar S.L, Ancon Limited, Anping Kingdelong Wiremesh Co., Ltd., ArcelorMittal Construction, ASTEC Industries Inc., ATAS International, BASF, Bemo Systems, BlueScope Steel, Huntsman Corporation, James & Taylor, Kalzip Ltd, POHL Fassaden (Christian Pohl GmbH), amongst others.

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Metal Facade Cladding Market Snapshot

3. Executive Summary: Metal Facade Cladding Market

4. Qualitative Analysis: Metal Facade Cladding Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Trends in Market

5. Global Metal Facade Cladding Market Analysis and Forecasts,

2018 – 2026

5.1. Overview

5.1.1. Global Market Revenue (US$ Mn) and Forecasts

5.2. Global Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

5.2.1. Zinc Cladding

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Copper Cladding

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.2.3. Galvanized Steel Cladding

5.2.3.1. Definition

5.2.3.2. Market Penetration

5.2.3.3. Market Revenue Expected to Increase by 2026

5.2.3.4. Compound Annual Growth Rate (CAGR)

5.2.4. Titanium Cladding

5.2.4.1. Definition

5.2.4.2. Market Penetration

5.2.4.3. Market Revenue Expected to Increase by 2026

5.2.4.4. Compound Annual Growth Rate (CAGR)

5.2.5. Aluminum Cladding

5.2.5.1. Definition

5.2.5.2. Market Penetration

5.2.5.3. Market Revenue Expected to Increase by 2026

5.2.5.4. Compound Annual Growth Rate (CAGR)

5.2.6. Brass Cladding

5.2.6.1. Definition

5.2.6.2. Market Penetration

5.2.6.3. Market Revenue Expected to Increase by 2026

5.2.6.4. Compound Annual Growth Rate (CAGR)

5.2.7. Bronze Cladding

5.2.7.1. Definition

5.2.7.2. Market Penetration

5.2.7.3. Market Revenue Expected to Increase by 2026

5.2.7.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Type

6. Global Metal Facade Cladding Market Analysis and Forecasts,

2018 – 2026

6.1. Overview

6.2. Global Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

6.2.1. Retail

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Commercial

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. Institutional

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Residential

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.2.5. Transportation

6.2.5.1. Definition

6.2.5.2. Market Penetration

6.2.5.3. Market Revenue Expected to Increase by 2026

6.2.5.4. Compound Annual Growth Rate (CAGR)

6.2.6. Mixed Use

6.2.6.1. Definition

6.2.6.2. Market Penetration

6.2.6.3. Market Revenue Expected to Increase by 2026

6.2.6.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By Application

7. North America Metal Facade Cladding Market Analysis and

Forecasts, 2018 – 2026

7.1. Overview

7.1.1. North America Market Revenue (US$ Mn)

7.2. North America Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Type

7.2.1. Zinc Cladding

7.2.2. Copper Cladding

7.2.3. Galvanized Steel Cladding

7.2.4. Titanium Cladding

7.2.5. Aluminum Cladding

7.2.6. Brass Cladding

7.2.7. Bronze Cladding

7.3. North America Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Application

7.3.1. Retail

7.3.2. Commercial

7.3.3. Institutional

7.3.4. Residential

7.3.5. Transportation

7.3.6. Mixed Use

7.4. North America Market Revenue (US$ Mn) and Forecasts, By

Country

7.4.1. U.S.

7.4.1.1. U.S. Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

7.4.1.1.1. Zinc Cladding

7.4.1.1.2. Copper Cladding

7.4.1.1.3. Galvanized Steel Cladding

7.4.1.1.4. Titanium Cladding

7.4.1.1.5. Aluminum Cladding

7.4.1.1.6. Brass Cladding

7.4.1.1.7. Bronze Cladding

7.4.1.2. U.S. Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

7.4.1.2.1. Retail

7.4.1.2.2. Commercial

7.4.1.2.3. Institutional

7.4.1.2.4. Residential

7.4.1.2.5. Transportation

7.4.1.2.6. Mixed Use

7.4.2. Rest of North America

7.4.2.1. Rest of North America Metal Facade Cladding Market Revenue

(US$ Mn) and Forecasts, By Type

7.4.2.1.1. Zinc Cladding

7.4.2.1.2. Copper Cladding

7.4.2.1.3. Galvanized Steel Cladding

7.4.2.1.4. Titanium Cladding

7.4.2.1.5. Aluminum Cladding

7.4.2.1.6. Brass Cladding

7.4.2.1.7. Bronze Cladding

7.4.2.2. Rest of North America Metal Facade Cladding Market Revenue

(US$ Mn) and Forecasts, By Application

7.4.2.2.1. Retail

7.4.2.2.2. Commercial

7.4.2.2.3. Institutional

7.4.2.2.4. Residential

7.4.2.2.5. Transportation

7.4.2.2.6. Mixed Use

7.5. Key Segment for Channeling Investments

7.5.1. By Country

7.5.2. By Type

7.5.3. By Application

8. Europe Metal Facade Cladding Market Analysis and Forecasts,

2018 – 2026

8.1. Overview

8.1.1. Europe Market Revenue (US$ Mn)

8.2. Europe Market Revenue (US$ Mn) and Forecasts, By Type

8.2.1. Zinc Cladding

8.2.2. Copper Cladding

8.2.3. Galvanized Steel Cladding

8.2.4. Titanium Cladding

8.2.5. Aluminum Cladding

8.2.6. Brass Cladding

8.2.7. Bronze Cladding

8.3. Europe Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

8.3.1. Retail

8.3.2. Commercial

8.3.3. Institutional

8.3.4. Residential

8.3.5. Transportation

8.3.6. Mixed Use

8.4. Europe Metal Market Revenue (US$ Mn) and Forecasts, By Country

8.4.1. France

8.4.1.1. France Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.1.1.1. Zinc Cladding

8.4.1.1.2. Copper Cladding

8.4.1.1.3. Galvanized Steel Cladding

8.4.1.1.4. Titanium Cladding

8.4.1.1.5. Aluminum Cladding

8.4.1.1.6. Brass Cladding

8.4.1.1.7. Bronze Cladding

8.4.1.2. France Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

8.4.1.2.1. Retail

8.4.1.2.2. Commercial

8.4.1.2.3. Institutional

8.4.1.2.4. Residential

8.4.1.2.5. Transportation

8.4.1.2.6. Mixed Use

8.4.2. The UK

8.4.2.1. The UK Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.2.1.1. Zinc Cladding

8.4.2.1.2. Copper Cladding

8.4.2.1.3. Galvanized Steel Cladding

8.4.2.1.4. Titanium Cladding

8.4.2.1.5. Aluminum Cladding

8.4.2.1.6. Brass Cladding

8.4.2.1.7. Bronze Cladding

8.4.2.2. The UK Metal Facade Cladding Market Revenue (US$ Mn) and Forecasts,

By Application

8.4.2.2.1. Retail

8.4.2.2.2. Commercial

8.4.2.2.3. Institutional

8.4.2.2.4. Residential

8.4.2.2.5. Transportation

8.4.2.2.6. Mixed Use

8.4.3. Spain

8.4.3.1. Spain Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.3.1.1. Zinc Cladding

8.4.3.1.2. Copper Cladding

8.4.3.1.3. Galvanized Steel Cladding

8.4.3.1.4. Titanium Cladding

8.4.3.1.5. Aluminum Cladding

8.4.3.1.6. Brass Cladding

8.4.3.1.7. Bronze Cladding

8.4.3.2. Spain Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

8.4.3.2.1. Retail

8.4.3.2.2. Commercial

8.4.3.2.3. Institutional

8.4.3.2.4. Residential

8.4.3.2.5. Transportation

8.4.3.2.6. Mixed Use

8.4.4. Germany

8.4.4.1. Germany Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.4.1.1. Zinc Cladding

8.4.4.1.2. Copper Cladding

8.4.4.1.3. Galvanized Steel Cladding

8.4.4.1.4. Titanium Cladding

8.4.4.1.5. Aluminum Cladding

8.4.4.1.6. Brass Cladding

8.4.4.1.7. Bronze Cladding

8.4.4.2. Germany Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

8.4.4.2.1. Retail

8.4.4.2.2. Commercial

8.4.4.2.3. Institutional

8.4.4.2.4. Residential

8.4.4.2.5. Transportation

8.4.4.2.6. Mixed Use

8.4.5. Italy

8.4.5.1. Italy Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.5.1.1. Zinc Cladding

8.4.5.1.2. Copper Cladding

8.4.5.1.3. Galvanized Steel Cladding

8.4.5.1.4. Titanium Cladding

8.4.5.1.5. Aluminum Cladding

8.4.5.1.6. Brass Cladding

8.4.5.1.7. Bronze Cladding

8.4.5.2. Italy Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

8.4.5.2.1. Retail

8.4.5.2.2. Commercial

8.4.5.2.3. Institutional

8.4.5.2.4. Residential

8.4.5.2.5. Transportation

8.4.5.2.6. Mixed Use

8.4.6. Rest of Europe

8.4.6.1. Rest of Europe Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.6.1.1. Zinc Cladding

8.4.6.1.2. Copper Cladding

8.4.6.1.3. Galvanized Steel Cladding

8.4.6.1.4. Titanium Cladding

8.4.6.1.5. Aluminum Cladding

8.4.6.1.6. Brass Cladding

8.4.6.1.7. Bronze Cladding

8.4.6.2. Rest of Europe Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Application

8.4.6.2.1. Retail

8.4.6.2.2. Commercial

8.4.6.2.3. Institutional

8.4.6.2.4. Residential

8.4.6.2.5. Transportation

8.4.6.2.6. Mixed Use

8.5. Key Segment for Channeling Investments

8.5.1. By Country

8.5.2. By Type

8.5.3. By Application

9. Asia Pacific Metal Facade Cladding Market Analysis and

Forecasts, 2018 – 2026

9.1. Overview

9.1.1. Asia Pacific Market Revenue (US$ Mn)

9.2. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By Type

9.2.1. Zinc Cladding

9.2.2. Copper Cladding

9.2.3. Galvanized Steel Cladding

9.2.4. Titanium Cladding

9.2.5. Aluminum Cladding

9.2.6. Brass Cladding

9.2.7. Bronze Cladding

9.3. Asia Pacific Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

9.3.1. Retail

9.3.2. Commercial

9.3.3. Institutional

9.3.4. Residential

9.3.5. Transportation

9.3.6. Mixed Use

9.4. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By Country

9.4.1. China

9.4.1.1. China Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.1.1.1. Zinc Cladding

9.4.1.1.2. Copper Cladding

9.4.1.1.3. Galvanized Steel Cladding

9.4.1.1.4. Titanium Cladding

9.4.1.1.5. Aluminum Cladding

9.4.1.1.6. Brass Cladding

9.4.1.1.7. Bronze Cladding

9.4.1.2. China Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

9.4.1.2.1. Retail

9.4.1.2.2. Commercial

9.4.1.2.3. Institutional

9.4.1.2.4. Residential

9.4.1.2.5. Transportation

9.4.1.2.6. Mixed Use

9.4.2. Japan

9.4.2.1. Japan Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.2.1.1. Zinc Cladding

9.4.2.1.2. Copper Cladding

9.4.2.1.3. Galvanized Steel Cladding

9.4.2.1.4. Titanium Cladding

9.4.2.1.5. Aluminum Cladding

9.4.2.1.6. Brass Cladding

9.4.2.1.7. Bronze Cladding

9.4.2.2. Japan Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

9.4.2.2.1. Retail

9.4.2.2.2. Commercial

9.4.2.2.3. Institutional

9.4.2.2.4. Residential

9.4.2.2.5. Transportation

9.4.2.2.6. Mixed Use

9.4.3. India

9.4.3.1. India Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.3.1.1. Zinc Cladding

9.4.3.1.2. Copper Cladding

9.4.3.1.3. Galvanized Steel Cladding

9.4.3.1.4. Titanium Cladding

9.4.3.1.5. Aluminum Cladding

9.4.3.1.6. Brass Cladding

9.4.3.1.7. Bronze Cladding

9.4.3.2. India Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

9.4.3.2.1. Retail

9.4.3.2.2. Commercial

9.4.3.2.3. Institutional

9.4.3.2.4. Residential

9.4.3.2.5. Transportation

9.4.3.2.6. Mixed Use

9.4.4. Southeast Asia

9.4.4.1. Southeast Asia Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Type

9.4.4.1.1. Zinc Cladding

9.4.4.1.2. Copper Cladding

9.4.4.1.3. Galvanized Steel Cladding

9.4.4.1.4. Titanium Cladding

9.4.4.1.5. Aluminum Cladding

9.4.4.1.6. Brass Cladding

9.4.4.1.7. Bronze Cladding

9.4.4.2. Southeast Asia Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Application

9.4.4.2.1. Retail

9.4.4.2.2. Commercial

9.4.4.2.3. Institutional

9.4.4.2.4. Residential

9.4.4.2.5. Transportation

9.4.4.2.6. Mixed Use

9.4.5. Rest of Asia Pacific

9.4.5.1. Rest of Asia Pacific Metal Facade Cladding Market Revenue (US$

Mn) and Forecasts, By Type

9.4.5.1.1. Zinc Cladding

9.4.5.1.2. Copper Cladding

9.4.5.1.3. Galvanized Steel Cladding

9.4.5.1.4. Titanium Cladding

9.4.5.1.5. Aluminum Cladding

9.4.5.1.6. Brass Cladding

9.4.5.1.7. Bronze Cladding

9.4.5.2. Rest of Asia Pacific Metal Facade Cladding Market Revenue (US$

Mn) and Forecasts, By Application

9.4.5.2.1. Retail

9.4.5.2.2. Commercial

9.4.5.2.3. Institutional

9.4.5.2.4. Residential

9.4.5.2.5. Transportation

9.4.5.2.6. Mixed Use

9.5. Key Segment for Channeling Investments

9.5.1. By Country

9.5.2. By Type

9.5.3. By Application

10. Middle East and Africa Metal Facade Cladding Market Analysis

and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Market Revenue (US$ Mn)

10.2. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By Type

10.2.1. Zinc Cladding

10.2.2. Copper Cladding

10.2.3. Galvanized Steel Cladding

10.2.4. Titanium Cladding

10.2.5. Aluminum Cladding

10.2.6. Brass Cladding

10.2.7. Bronze Cladding

10.3. Middle East and Africa Metal Facade Cladding Market Revenue

(US$ Mn) and Forecasts, By Application

10.3.1. Retail

10.3.2. Commercial

10.3.3. Institutional

10.3.4. Residential

10.3.5. Transportation

10.3.6. Mixed Use

10.4. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By Country

10.4.1. GCC Countries

10.4.1.1. GCC Countries Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Type

10.4.1.1.1. Zinc Cladding

10.4.1.1.2. Copper Cladding

10.4.1.1.3. Galvanized Steel Cladding

10.4.1.1.4. Titanium Cladding

10.4.1.1.5. Aluminum Cladding

10.4.1.1.6. Brass Cladding

10.4.1.1.7. Bronze Cladding

10.4.1.2. GCC Countries Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Application

10.4.1.2.1. Retail

10.4.1.2.2. Commercial

10.4.1.2.3. Institutional

10.4.1.2.4. Residential

10.4.1.2.5. Transportation

10.4.1.2.6. Mixed Use

10.4.2. Southern Africa

10.4.2.1. Southern Africa Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Type

10.4.2.1.1. Zinc Cladding

10.4.2.1.2. Copper Cladding

10.4.2.1.3. Galvanized Steel Cladding

10.4.2.1.4. Titanium Cladding

10.4.2.1.5. Aluminum Cladding

10.4.2.1.6. Brass Cladding

10.4.2.1.7. Bronze Cladding

10.4.2.2. Southern Africa Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Application

10.4.2.2.1. Retail

10.4.2.2.2. Commercial

10.4.2.2.3. Institutional

10.4.2.2.4. Residential

10.4.2.2.5. Transportation

10.4.2.2.6. Mixed Use

10.4.3. Rest of MEA

10.4.3.1. Rest of MEA Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

10.4.3.1.1. Zinc Cladding

10.4.3.1.2. Copper Cladding

10.4.3.1.3. Galvanized Steel Cladding

10.4.3.1.4. Titanium Cladding

10.4.3.1.5. Aluminum Cladding

10.4.3.1.6. Brass Cladding

10.4.3.1.7. Bronze Cladding

10.4.3.2. Rest of MEA Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

10.4.3.2.1. Retail

10.4.3.2.2. Commercial

10.4.3.2.3. Institutional

10.4.3.2.4. Residential

10.4.3.2.5. Transportation

10.4.3.2.6. Mixed Use

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Type

10.5.3. By Application

11. Latin America Metal Facade Cladding Market Analysis and

Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America Market Revenue (US$ Mn)

11.2. Latin America Market Revenue (US$ Mn) and Forecasts, By Type

11.2.1. Zinc Cladding

11.2.2. Copper Cladding

11.2.3. Galvanized Steel Cladding

11.2.4. Titanium Cladding

11.2.5. Aluminum Cladding

11.2.6. Brass Cladding

11.2.7. Bronze Cladding

11.3. Latin America Metal Facade Cladding Market Revenue (US$ Mn)

and Forecasts, By Application

11.3.1. Retail

11.3.2. Commercial

11.3.3. Institutional

11.3.4. Residential

11.3.5. Transportation

11.3.6. Mixed Use

11.4. Latin America Market Revenue (US$ Mn) and Forecasts, By

Country

11.4.1. Brazil

11.4.1.1. Brazil Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Type

11.4.1.1.1. Zinc Cladding

11.4.1.1.2. Copper Cladding

11.4.1.1.3. Galvanized Steel Cladding

11.4.1.1.4. Titanium Cladding

11.4.1.1.5. Aluminum Cladding

11.4.1.1.6. Brass Cladding

11.4.1.1.7. Bronze Cladding

11.4.1.2. Brazil Metal Facade Cladding Market Revenue (US$ Mn) and

Forecasts, By Application

11.4.1.2.1. Retail

11.4.1.2.2. Commercial

11.4.1.2.3. Institutional

11.4.1.2.4. Residential

11.4.1.2.5. Transportation

11.4.1.2.6. Mixed Use

11.4.2. Rest of Latin America

11.4.2.1. Rest of Latin America Metal Facade Cladding Market Revenue

(US$ Mn) and Forecasts, By Type

11.4.2.1.1. Zinc Cladding

11.4.2.1.2. Copper Cladding

11.4.2.1.3. Galvanized Steel Cladding

11.4.2.1.4. Titanium Cladding

11.4.2.1.5. Aluminum Cladding

11.4.2.1.6. Brass Cladding

11.4.2.1.7. Bronze Cladding

11.4.2.2. Rest of Latin America Metal Facade Cladding Market Revenue

(US$ Mn) and Forecasts, By Application

11.4.2.2.1. Retail

11.4.2.2.2. Commercial

11.4.2.2.3. Institutional

11.4.2.2.4. Residential

11.4.2.2.5. Transportation

11.4.2.2.6. Mixed Use

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Type

11.5.3. By Application

12. Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13. Player Profiles

13.1. A.Zahner

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. Anclajes Grapamar S.L

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Ancon Limited

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. Anping Kingdelong Wiremesh Co., Ltd.

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. ArcelorMittal Construction

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. ASTEC Industries Inc.

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. ATAS International

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. BASF

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. Bemo Systems

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10. BlueScope

Steel

13.10.1. Company Details

13.10.2. Company Overview

13.10.3. Product Offerings

13.10.4. Key Developments

13.10.5. Financial Analysis

13.10.6. SWOT Analysis

13.10.7. Business Strategies

13.11. Huntsman

Corporation

13.11.1. Company Details

13.11.2. Company Overview

13.11.3. Product Offerings

13.11.4. Key Developments

13.11.5. Financial Analysis

13.11.6. SWOT Analysis

13.11.7. Business Strategies

13.12. James

& Taylor

13.12.1. Company Details

13.12.2. Company Overview

13.12.3. Product Offerings

13.12.4. Key Developments

13.12.5. Financial Analysis

13.12.6. SWOT Analysis

13.12.7. Business Strategies

13.13. Kalzip

Ltd

13.13.1. Company Details

13.13.2. Company Overview

13.13.3. Product Offerings

13.13.4. Key Developments

13.13.5. Financial Analysis

13.13.6. SWOT Analysis

13.13.7. Business Strategies

13.14. POHL Fassaden

(Christian Pohl GmbH)

13.14.1. Company

Details

13.14.2. Company

Overview

13.14.3. Product

Offerings

13.14.4. Key

Developments

13.14.5. Financial

Analysis

13.14.6. SWOT

Analysis

13.14.7. Business Strategies

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Reach to us

Call us on

+91-74002-42424

Drop us an email at

sales@absolutemarketsinsights.com

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.