The IoT in banking and financial services market is estimated to grow at a CAGR of 55.3% over the forecast period (2019 – 2027), owing to an increasing need for insights on customer behavior: says Absolute Markets Insights.

There is a growing need for banks and other financial institutions to closely monitor the spending and buying behavior of prospective clients and existing customer. It is crucial for banks to track and study such behavior in order to gain deep insights and compete with other players in IoT in banking and financial services market. These institutions are therefore adopting IoT technology in the form of mobile apps and wearables to accomplish this requirement. Banks also use data gathered through IoT technology to find ways to decrease expenses, increase efficiency and improve risk management. There has been a significant increase in the use of mobile devices for banking. This causes constant generation of large volumes of data which gives banks and other financial service institutions access to more customer insights. Data is also collected through a network of bank-owned assets, such as ATMs and other points of financial transactions namely credit/debit card readers. During the next five years, the technological advancement in IoT is estimated to increase by manifolds, thereby positively impacting the demand for this technology in banking and financial services.

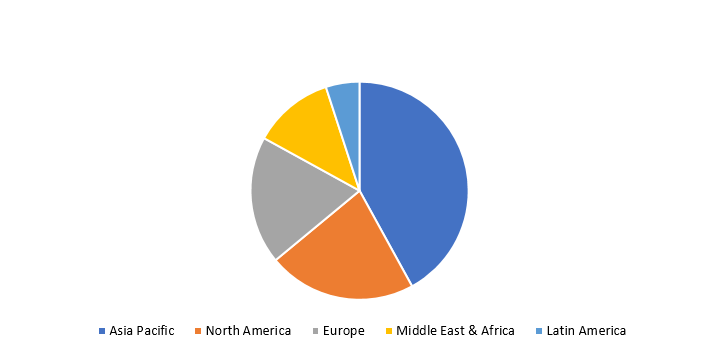

“Over the span of the next five years, more than half of the IoT in banking and financial services market demand would be generated from the regions of Asia Pacific, followed by North America and Europe. The steady demand for technologically advanced IoT solutions with security and monitoring enabled features from emerging markets is expected to further boost the market growth.”

This research study aims at providing the reader with quantitative and qualitative analysis of the global IoT in banking and financial services market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further, across all the major countries. The supply side analysis covers the prominent players and their regional and global presence and key business strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East, Africa, and Latin America.

Global IoT in Banking and Financial Services (US$ Million), 2018, By Region

Some of the major players operating in the global IoT in banking and financial services market include Hewlett Packard Enterprise Development LP, IBM, Infosys Limited, Microsoft, Oracle, SAP SE, Software AG, Tata Consultancy Services Limited, Vodafone Group Services Limited and EdgeVerve Limited amongst others.

IoT in Banking and Financial Services Market:

By Solution

- Customer Management

- Payment Management

- Security and Monitoring

- Others

By Service

- Professional Services

- Business Consulting Services

- Integrated Services

- Deployment Services

- Others

- Managed Services

By Organization Size

- Small and Medium Enterprise

- Large Enterprise

By End User

- Banks

- Public

- Private

- Non-banking Financial Companies

- Insurance

By Geography

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic

- Denmark

- Finland

- Iceland

- Norway

- Sweden

- Rest of Nordic

- The Benelux Union

- Belgium

- the Netherlands

- Luxemburg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- New Zealand

- Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- GCC Countries

- Southern Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America