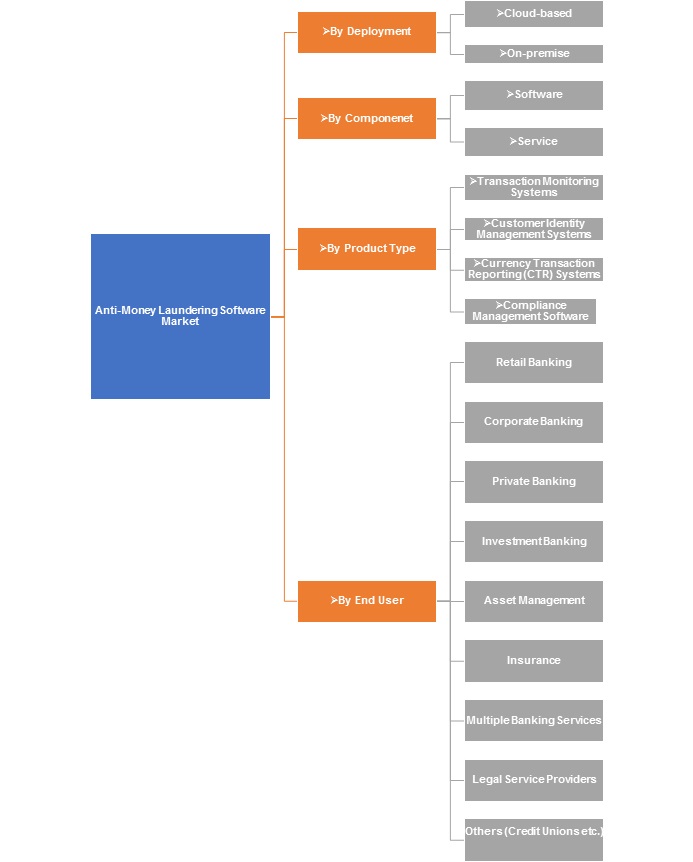

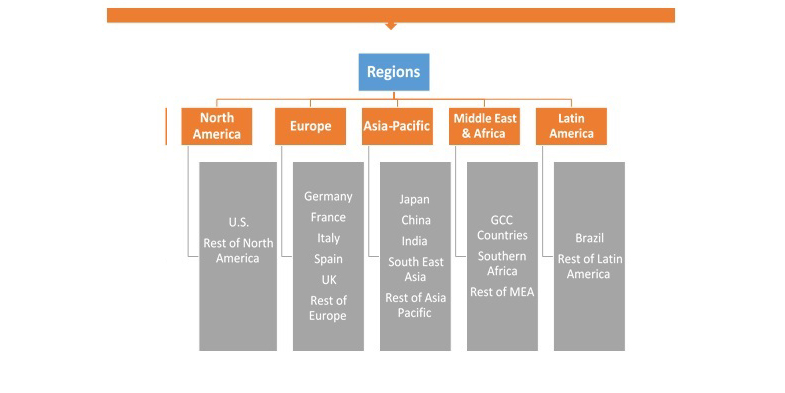

Anti-Money Laundering Software Market by Component (Software, Services); by Product Type (Transaction Monitoring Systems, Customer Identity Management Systems, Currency Transaction Reporting Systems, Compliance Management Software); by Deployment (On-Premise, Cloud); by End User (Retail Banking, Corporate Banking, Private Banking, Investment Banking, Asset Management, Insurance, Multiple Banking Services, Legal Service Providers, Others (Credit Unions, Etc.)); by Solution Type ( Transactional Monitoring, KYC, Fraud, Risk and Compliance Management, Watch-list Screening, Data Warehouse Management, Analytics and Visualization, Alert Management and Reporting, Case Management); Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026

Industry Trends

Anti-Money laundering software is primarily used in the financial and legal industry in order to detect, identify, control and prevent rampant money laundering. Vast amounts of financial data consisting of individual customer information and transactions are generated on a regular basis. This data is extensive in nature and cannot be managed solely by human capabilities. Anti-money laundering software is competent and can process large amounts of data and filter information efficiently and with much accuracy. Increased need for risk management and suspicious activity reporting (SAR) amongst industries like banking, financial services and insurance is a major cause for growth in demand for anti-money laundering software. Increased need for transaction monitoring in the field of real estate is also a factor that is boosting demand for the software.

There are several factors which are assisting in the acceleration of the demand of anti-money laundering software. In recent times, major global banks such as the IMF and the World Bank have increasingly been encouraging other correspondent banks across the world to meet minimum anti-money laundering requirements. This has further led to other major banks belonging to various nations to pressurize their respective correspondent banks to comply with anti-money laundering programs. Such developments aim at simplifying the process of strategizing plans in times of financial emergencies by facilitating the utilization of shared findings.

Although, anti-money laundering software furnishes results in terms of numbers, it requires skilled and competent individuals to analyze complex data in the form of numbers and transactions and interpret them in the form of systematic, comprehensible reports. This lacking feature hence turns into a potential restraint for the market. Another factor which causes significant hindrance in the growth of the market is the high cost of implementation. Small and medium sized banks and other financial institutions commonly find the cost of installing and implementing such anti-money laundering software extremely expensive. Additionally, newly emerging concepts like electronic currency and blockchain technology pose a potential threat to the demand of the software.

With the onset of new-emerging and breakthrough industrial sciences such as big data, artificial intelligence and robotics, the technology of anti-money laundering software is expected to further advance and thrive.

The global anti-money laundering software market, in terms of revenue, which was estimated at US$ 1,195.08 million in 2017 is expected to rise to US$ 2,186.21 million in 2022.

Anti-money Laundering Software Market, By Product Type

On the basis of product type, transaction monitoring systems held the largest market during the forecast period. Transaction monitoring systems is the most commonly adopted form of anti-money laundering software. The process of transaction supervision successfully eliminates half the problem of money laundering. Transaction monitoring system has also evolved largely in response to regulations that emerged in order to curb money laundering activities. The wide implementation of transaction monitoring system has made it hold the second largest market in the forecast period.

Anti-money Laundering Software Market, By End User

On the basis of end user, retail banking is expected to hold the largest market during the forecast period, 2018 to 2026. Retail banking is exposed to the highest number of money laundering activities. Retail banking is by far the most affected industry by malpractices involving money laundering due to the high rates of exposure to cash transactions. In order to secure their operations and minimize chances of risk, anti-money laundering software was largely implemented in the retail banking sector.

Competitive Landscape

The report provides both, qualitative and quantitative research of the market, as well as provides worthy insights into the rational scenario and favored development methods adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their manufacturing base, competitors, product type, application and specification, pricing, and gross margin.

The primary market participants include Nelito Systems Limited, Tipalti, Open Text Corporation, Trulioo, 3i Infotech, EastNets, Verafin Inc., Tata Consultancy Services Limited, Accenture, Fiserv Inc. and Cognizant amongst others.

In May 2016, Tipatli launched the first ever end-to-end AP automation platform for businesses. The newly launched cloud-based solution offers invoice collection and approval technology, management of supplier payment operations, tax compliance and fraud detection.

Anti-money Laundering Software Market Background

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Anti-Money Laundering Software Market Snapshot

3. Executive Summary: Anti-Money Laundering Software Market

4. Qualitative Analysis: Anti-Money Laundering Software Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3.

Trends in Anti-Money

Laundering Software Market

4.4. Porter’s

Five Forces Analysis

4.5.

SWOT Analysis: Anti-Money Laundering Software Market

5. Global Anti-Money Laundering Software Market Analysis and

Forecasts, 2018 – 2026

5.1. Overview

5.1.1. Global Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts

5.2. Global Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

5.2.1. Service

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Software

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Component

6. Global Anti-Money Laundering Software Market Analysis and

Forecasts, 2018 – 2026

6.1. Overview

6.2. Global Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

6.2.1. Retail Banking

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Corporate Banking

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. Private Banking

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Investment Banking

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.2.5. Asset Management

6.2.5.1. Definition

6.2.5.2. Market Penetration

6.2.5.3. Market Revenue Expected to Increase by 2026

6.2.5.4. Compound Annual Growth Rate (CAGR)

6.2.6. Insurance

6.2.6.1. Definition

6.2.6.2. Market Penetration

6.2.6.3. Market Revenue Expected to Increase by 2026

6.2.6.4. Compound Annual Growth Rate (CAGR)

6.2.7. Multiple Banking Services

6.2.7.1. Definition

6.2.7.2. Market Penetration

6.2.7.3. Market Revenue Expected to Increase by 2026

6.2.7.4. Compound Annual Growth Rate (CAGR)

6.2.8. Legal Service Providers

6.2.8.1. Definition

6.2.8.2. Market Penetration

6.2.8.3. Market Revenue Expected to Increase by 2026

6.2.8.4. Compound Annual Growth Rate (CAGR)

6.2.9. Others (Credit Unions etc.)

6.2.9.1. Definition

6.2.9.2. Market Penetration

6.2.9.3. Market Revenue Expected to Increase by 2026

6.2.9.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By End User

7. Global Anti-Money Laundering Software Market Analysis and

Forecasts, 2018 – 2026

7.1. Overview

7.2. Global Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

7.2.1. On-premise

7.2.1.1. Definition

7.2.1.2. Market Penetration

7.2.1.3. Market Revenue Expected to Increase by 2026

7.2.1.4. Compound Annual Growth Rate (CAGR)

7.2.2. Cloud-based

7.2.2.1. Definition

7.2.2.2. Market Penetration

7.2.2.3. Market Revenue Expected to Increase by 2026

7.2.2.4. Compound Annual Growth Rate (CAGR)

7.3. Key Segment for Channeling Investments

7.3.1. By Deployment Type

8. Global Anti-Money Laundering Software Market Analysis and

Forecasts, 2018 – 2026

8.1. Overview

8.2. Global Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

8.2.1. Compliance Management Software

8.2.1.1. Definition

8.2.1.2. Market Penetration

8.2.1.3. Market Revenue Expected to Increase by 2026

8.2.1.4. Compound Annual Growth Rate (CAGR)

8.2.2. Currency Transaction Reporting (CTR) Systems

8.2.2.1. Definition

8.2.2.2. Market Penetration

8.2.2.3. Market Revenue Expected to Increase by 2026

8.2.2.4. Compound Annual Growth Rate (CAGR)

8.2.3. Customer Identity Management Systems

8.2.3.1. Definition

8.2.3.2. Market Penetration

8.2.3.3. Market Revenue Expected to Increase by 2026

8.2.3.4. Compound Annual Growth Rate (CAGR)

8.2.4. Transaction Monitoring Systems

8.2.4.1. Definition

8.2.4.2. Market Penetration

8.2.4.3. Market Revenue Expected to Increase by 2026

8.2.4.4. Compound Annual Growth Rate (CAGR)

8.3. Key Segment for Channeling Investments

8.3.1. By Product Type

9. Global Anti-Money Laundering Software Market Analysis and

Forecasts, 2018 – 2026

9.1. Overview

9.2. Global Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

9.2.1. Transaction Monitoring

9.2.1.1. Definition

9.2.1.2. Market Penetration

9.2.1.3. Market Revenue Expected to Increase by 2026

9.2.1.4. Compound Annual Growth Rate (CAGR)

9.2.2. KYC (Know Your Customer)

9.2.2.1. Definition

9.2.2.2. Market Penetration

9.2.2.3. Market Revenue Expected to Increase by 2026

9.2.2.4. Compound Annual Growth Rate (CAGR)

9.2.3. Fraud, Risk and Compliance Management

9.2.3.1. Definition

9.2.3.2. Market Penetration

9.2.3.3. Market Revenue Expected to Increase by 2026

9.2.3.4. Compound Annual Growth Rate (CAGR)

9.2.4. Watch-list Screening

9.2.4.1. Definition

9.2.4.2. Market Penetration

9.2.4.3. Market Revenue Expected to Increase by 2026

9.2.4.4. Compound Annual Growth Rate (CAGR)

9.2.5. Data Warehouse Management

9.2.5.1. Definition

9.2.5.2. Market Penetration

9.2.5.3. Market Revenue Expected to Increase by 2026

9.2.5.4. Compound Annual Growth Rate (CAGR)

9.2.6. Analytics and Visualization

9.2.6.1. Definition

9.2.6.2. Market Penetration

9.2.6.3. Market Revenue Expected to Increase by 2026

9.2.6.4. Compound Annual Growth Rate (CAGR)

9.2.7. Alert Management and Reporting

9.2.7.1. Definition

9.2.7.2. Market Penetration

9.2.7.3. Market Revenue Expected to Increase by 2026

9.2.7.4. Compound Annual Growth Rate (CAGR)

9.2.8. Case Management

9.2.8.1. Definition

9.2.8.2. Market Penetration

9.2.8.3. Market Revenue Expected to Increase by 2026

9.2.8.4. Compound Annual Growth Rate (CAGR)

9.3. Key Segment for Channeling Investments

9.3.1. By Solution Type

10. North America Anti-Money Laundering Software Market Analysis

and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. North America Anti-Money Laundering Software Market Revenue

(US$ Mn)

10.2. North America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

10.2.1. Service

10.2.2. Software

10.3. North America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

10.3.1. Retail Banking

10.3.2. Corporate Banking

10.3.3. Private Banking

10.3.4. Investment Banking

10.3.5. Asset Management

10.3.6. Insurance

10.3.7. Multiple Banking Services

10.3.8. Legal Service Providers

10.3.9. Others (Credit Unions etc.)

10.4. North America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

10.4.1. On-premise

10.4.2. Cloud-based

10.5. North America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

10.5.1. Compliance Management Software

10.5.2. Currency Transaction Reporting (CTR) Systems

10.5.3. Customer Identity Management Systems

10.5.4. Transaction Monitoring Systems

10.6. North America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

10.6.1. Transaction Monitoring

10.6.2. KYC (Know Your Customer)

10.6.3. Fraud, Risk and Compliance Management

10.6.4. Watch-list Screening

10.6.5. Data Warehouse Management

10.6.6. Analytics and Visualization

10.6.7. Alert Management and Reporting

10.6.8. Case Management

10.7. North America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Country

10.7.1. U.S.

10.7.1.1. U.S. Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

10.7.1.1.1. Service

10.7.1.1.2. Software

10.7.1.2. U.S. Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

10.7.1.2.1. Retail Banking

10.7.1.2.2. Corporate Banking

10.7.1.2.3. Private Banking

10.7.1.2.4. Investment Banking

10.7.1.2.5. Asset Management

10.7.1.2.6. Insurance

10.7.1.2.7. Multiple Banking Services

10.7.1.2.8. Legal Service Providers

10.7.1.2.9. Others (Credit Unions etc.)

10.7.1.3. U.S. Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

10.7.1.3.1. On-premise

10.7.1.3.2. Cloud-based

10.7.1.4. U.S. Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

10.7.1.4.1. Compliance Management Software

10.7.1.4.2. Currency Transaction Reporting (CTR) Systems

10.7.1.4.3. Customer Identity Management Systems

10.7.1.4.4. Transaction Monitoring Systems

10.7.1.5. U.S. Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

10.7.1.5.1. Transaction Monitoring

10.7.1.5.2. KYC (Know Your Customer)

10.7.1.5.3. Fraud, Risk and Compliance Management

10.7.1.5.4. Watch-list Screening

10.7.1.5.5. Data Warehouse Management

10.7.1.5.6. Analytics and Visualization

10.7.1.5.7. Alert Management and Reporting

10.7.1.5.8. Case Management

10.7.2. Rest of North America

10.7.2.1. Rest of North America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Component

10.7.2.1.1. Service

10.7.2.1.2. Software

10.7.2.2. Rest of North America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By End User

10.7.2.2.1. Retail Banking

10.7.2.2.2. Corporate Banking

10.7.2.2.3. Private Banking

10.7.2.2.4. Investment Banking

10.7.2.2.5. Asset Management

10.7.2.2.6. Insurance

10.7.2.2.7. Multiple Banking Services

10.7.2.2.8. Legal Service Providers

10.7.2.2.9. Others (Credit Unions etc.)

10.7.2.3. Rest of North America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Deployment Type

10.7.2.3.1. On-premise

10.7.2.3.2. Cloud-based

10.7.2.4. Rest of North America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Product Type

10.7.2.4.1. Compliance Management Software

10.7.2.4.2. Currency Transaction Reporting (CTR) Systems

10.7.2.4.3. Customer Identity Management Systems

10.7.2.4.4. Transaction Monitoring Systems

10.7.2.5. Rest of North America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Solution Type

10.7.2.5.1. Transaction Monitoring

10.7.2.5.2. KYC (Know Your Customer)

10.7.2.5.3. Fraud, Risk and Compliance Management

10.7.2.5.4. Watch-list Screening

10.7.2.5.5. Data Warehouse Management

10.7.2.5.6. Analytics and Visualization

10.7.2.5.7. Alert Management and Reporting

10.7.2.5.8. Case Management

10.8. Key Segment for Channeling Investments

10.8.1. By Country

10.8.2. By Component

10.8.3. By End User

10.8.4. By Deployment Type

10.8.5. By Product Type

10.8.6. By Solution Type

11. Europe Anti-Money Laundering Software Market Analysis and

Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

11.2. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

11.2.1. Service

11.2.2. Software

11.3. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

11.3.1. Retail Banking

11.3.2. Corporate Banking

11.3.3. Private Banking

11.3.4. Investment Banking

11.3.5. Asset Management

11.3.6. Insurance

11.3.7. Multiple Banking Services

11.3.8. Legal Service Providers

11.3.9. Others (Credit Unions etc.)

11.4. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

11.4.1. On-premise

11.4.2. Cloud-based

11.5. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

11.5.1. Compliance Management Software

11.5.2. Currency Transaction Reporting (CTR) Systems

11.5.3. Customer Identity Management Systems

11.5.4. Transaction Monitoring Systems

11.6. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

11.6.1. Transaction Monitoring

11.6.2. KYC (Know Your Customer)

11.6.3. Fraud, Risk and Compliance Management

11.6.4. Watch-list Screening

11.6.5. Data Warehouse Management

11.6.6. Analytics and Visualization

11.6.7. Alert Management and Reporting

11.6.8. Case Management

11.7. Europe Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Country

11.7.1. France

11.7.1.1. France Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

11.7.1.1.1. Service

11.7.1.1.2. Software

11.7.1.2. France Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

11.7.1.2.1. Retail Banking

11.7.1.2.2. Corporate Banking

11.7.1.2.3. Private Banking

11.7.1.2.4. Investment Banking

11.7.1.2.5. Asset Management

11.7.1.2.6. Insurance

11.7.1.2.7. Multiple Banking Services

11.7.1.2.8. Legal Service Providers

11.7.1.2.9. Others (Credit Unions etc.)

11.7.1.3. France Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

11.7.1.3.1. On-premise

11.7.1.3.2. Cloud-based

11.7.1.4. France Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

11.7.1.4.1. Compliance Management Software

11.7.1.4.2. Currency Transaction Reporting (CTR) Systems

11.7.1.4.3. Customer Identity Management Systems

11.7.1.4.4. Transaction Monitoring Systems

11.7.1.5. France Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

11.7.1.5.1. Transaction Monitoring

11.7.1.5.2. KYC (Know Your Customer)

11.7.1.5.3. Fraud, Risk and Compliance Management

11.7.1.5.4. Watch-list Screening

11.7.1.5.5. Data Warehouse Management

11.7.1.5.6. Analytics and Visualization

11.7.1.5.7. Alert Management and Reporting

11.7.1.5.8. Case Management

11.7.2. The UK

11.7.2.1. The UK Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

11.7.2.1.1. Service

11.7.2.1.2. Software

11.7.2.2. The UK Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

11.7.2.2.1. Retail Banking

11.7.2.2.2. Corporate Banking

11.7.2.2.3. Private Banking

11.7.2.2.4. Investment Banking

11.7.2.2.5. Asset Management

11.7.2.2.6. Insurance

11.7.2.2.7. Multiple Banking Services

11.7.2.2.8. Legal Service Providers

11.7.2.2.9. Others (Credit Unions etc.)

11.7.2.3. The UK Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

11.7.2.3.1. On-premise

11.7.2.3.2. Cloud-based

11.7.2.4. The UK Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

11.7.2.4.1. Compliance Management Software

11.7.2.4.2. Currency Transaction Reporting (CTR) Systems

11.7.2.4.3. Customer Identity Management Systems

11.7.2.4.4. Transaction Monitoring Systems

11.7.2.5. The UK Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

11.7.2.5.1. Transaction Monitoring

11.7.2.5.2. KYC (Know Your Customer)

11.7.2.5.3. Fraud, Risk and Compliance Management

11.7.2.5.4. Watch-list Screening

11.7.2.5.5. Data Warehouse Management

11.7.2.5.6. Analytics and Visualization

11.7.2.5.7. Alert Management and Reporting

11.7.2.5.8. Case Management

11.7.3. Spain

11.7.3.1. Spain Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

11.7.3.1.1. Service

11.7.3.1.2. Software

11.7.3.2. Spain Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

11.7.3.2.1. Retail Banking

11.7.3.2.2. Corporate Banking

11.7.3.2.3. Private Banking

11.7.3.2.4. Investment Banking

11.7.3.2.5. Asset Management

11.7.3.2.6. Insurance

11.7.3.2.7. Multiple Banking Services

11.7.3.2.8. Legal Service Providers

11.7.3.2.9. Others (Credit Unions etc.)

11.7.3.3. Spain Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

11.7.3.3.1. On-premise

11.7.3.3.2. Cloud-based

11.7.3.4. Spain Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

11.7.3.4.1. Compliance Management Software

11.7.3.4.2. Currency Transaction Reporting (CTR) Systems

11.7.3.4.3. Customer Identity Management Systems

11.7.3.4.4. Transaction Monitoring Systems

11.7.3.5. Spain Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

11.7.3.5.1. Transaction Monitoring

11.7.3.5.2. KYC (Know Your Customer)

11.7.3.5.3. Fraud, Risk and Compliance Management

11.7.3.5.4. Watch-list Screening

11.7.3.5.5. Data Warehouse Management

11.7.3.5.6. Analytics and Visualization

11.7.3.5.7. Alert Management and Reporting

11.7.3.5.8. Case Management

11.7.4. Germany

11.7.4.1. Germany Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

11.7.4.1.1. Service

11.7.4.1.2. Software

11.7.4.2. Germany Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

11.7.4.2.1. Retail Banking

11.7.4.2.2. Corporate Banking

11.7.4.2.3. Private Banking

11.7.4.2.4. Investment Banking

11.7.4.2.5. Asset Management

11.7.4.2.6. Insurance

11.7.4.2.7. Multiple Banking Services

11.7.4.2.8. Legal Service Providers

11.7.4.2.9. Others (Credit Unions etc.)

11.7.4.3. Germany Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

11.7.4.3.1. On-premise

11.7.4.3.2. Cloud-based

11.7.4.4. Germany Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

11.7.4.4.1. Compliance Management Software

11.7.4.4.2. Currency Transaction Reporting (CTR) Systems

11.7.4.4.3. Customer Identity Management Systems

11.7.4.4.4. Transaction Monitoring Systems

11.7.4.5. Germany Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

11.7.4.5.1. Transaction Monitoring

11.7.4.5.2. KYC (Know Your Customer)

11.7.4.5.3. Fraud, Risk and Compliance Management

11.7.4.5.4. Watch-list Screening

11.7.4.5.5. Data Warehouse Management

11.7.4.5.6. Analytics and Visualization

11.7.4.5.7. Alert Management and Reporting

11.7.4.5.8. Case Management

11.7.5. Italy

11.7.5.1. Italy Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

11.7.5.1.1. Service

11.7.5.1.2. Software

11.7.5.2. Italy Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

11.7.5.2.1. Retail Banking

11.7.5.2.2. Corporate Banking

11.7.5.2.3. Private Banking

11.7.5.2.4. Investment Banking

11.7.5.2.5. Asset Management

11.7.5.2.6. Insurance

11.7.5.2.7. Multiple Banking Services

11.7.5.2.8. Legal Service Providers

11.7.5.2.9. Others (Credit Unions etc.)

11.7.5.3. Italy Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

11.7.5.3.1. On-premise

11.7.5.3.2. Cloud-based

11.7.5.4. Italy Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

11.7.5.4.1. Compliance Management Software

11.7.5.4.2. Currency Transaction Reporting (CTR) Systems

11.7.5.4.3. Customer Identity Management Systems

11.7.5.4.4. Transaction Monitoring Systems

11.7.5.5. Italy Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

11.7.5.5.1. Transaction Monitoring

11.7.5.5.2. KYC (Know Your Customer)

11.7.5.5.3. Fraud, Risk and Compliance Management

11.7.5.5.4. Watch-list Screening

11.7.5.5.5. Data Warehouse Management

11.7.5.5.6. Analytics and Visualization

11.7.5.5.7. Alert Management and Reporting

11.7.5.5.8. Case Management

11.7.6. Rest of Europe

11.7.6.1. Rest of Europe Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

11.7.6.1.1. Service

11.7.6.1.2. Software

11.7.6.2. Rest of Europe Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

11.7.6.2.1. Retail Banking

11.7.6.2.2. Corporate Banking

11.7.6.2.3. Private Banking

11.7.6.2.4. Investment Banking

11.7.6.2.5. Asset Management

11.7.6.2.6. Insurance

11.7.6.2.7. Multiple Banking Services

11.7.6.2.8. Legal Service Providers

11.7.6.2.9. Others (Credit Unions etc.)

11.7.6.3. Rest of Europe Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

11.7.6.3.1. On-premise

11.7.6.3.2. Cloud-based

11.7.6.4. Rest of Europe Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

11.7.6.4.1. Compliance Management Software

11.7.6.4.2. Currency Transaction Reporting (CTR) Systems

11.7.6.4.3. Customer Identity Management Systems

11.7.6.4.4. Transaction Monitoring Systems

11.7.6.5. Rest of Europe Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

11.7.6.5.1. Transaction Monitoring

11.7.6.5.2. KYC (Know Your Customer)

11.7.6.5.3. Fraud, Risk and Compliance Management

11.7.6.5.4. Watch-list Screening

11.7.6.5.5. Data Warehouse Management

11.7.6.5.6. Analytics and Visualization

11.7.6.5.7. Alert Management and Reporting

11.7.6.5.8. Case Management

11.8. Key Segment for Channeling Investments

11.8.1. By Country

11.8.2. By Component

11.8.3. By End User

11.8.4. By Deployment Type

11.8.5. By Product Type

11.8.6. By Solution Type

12. Asia Pacific Anti-Money Laundering Software Market Analysis

and Forecasts, 2018 – 2026

12.1. Overview

12.1.1. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn)

12.2. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

12.2.1. Service

12.2.2. Software

12.3. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

12.3.1. Retail Banking

12.3.2. Corporate Banking

12.3.3. Private Banking

12.3.4. Investment Banking

12.3.5. Asset Management

12.3.6. Insurance

12.3.7. Multiple Banking Services

12.3.8. Legal Service Providers

12.3.9. Others (Credit Unions etc.)

12.4. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

12.4.1. On-premise

12.4.2. Cloud-based

12.5. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

12.5.1. Compliance Management Software

12.5.2. Currency Transaction Reporting (CTR) Systems

12.5.3. Customer Identity Management Systems

12.5.4. Transaction Monitoring Systems

12.6. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

12.6.1. Transaction Monitoring

12.6.2. KYC (Know Your Customer)

12.6.3. Fraud, Risk and Compliance Management

12.6.4. Watch-list Screening

12.6.5. Data Warehouse Management

12.6.6. Analytics and Visualization

12.6.7. Alert Management and Reporting

12.6.8. Case Management

12.7. Asia Pacific Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Country

12.7.1. China

12.7.1.1. China Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

12.7.1.1.1. Service

12.7.1.1.2. Software

12.7.1.2. China Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

12.7.1.2.1. Retail Banking

12.7.1.2.2. Corporate Banking

12.7.1.2.3. Private Banking

12.7.1.2.4. Investment Banking

12.7.1.2.5. Asset Management

12.7.1.2.6. Insurance

12.7.1.2.7. Multiple Banking Services

12.7.1.2.8. Legal Service Providers

12.7.1.2.9. Others (Credit Unions etc.)

12.7.1.3. China Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

12.7.1.3.1. On-premise

12.7.1.3.2. Cloud-based

12.7.1.4. China Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

12.7.1.4.1. Compliance Management Software

12.7.1.4.2. Currency Transaction Reporting (CTR) Systems

12.7.1.4.3. Customer Identity Management Systems

12.7.1.4.4. Transaction Monitoring Systems

12.7.1.5. China Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

12.7.1.5.1. Transaction Monitoring

12.7.1.5.2. KYC (Know Your Customer)

12.7.1.5.3. Fraud, Risk and Compliance Management

12.7.1.5.4. Watch-list Screening

12.7.1.5.5. Data Warehouse Management

12.7.1.5.6. Analytics and Visualization

12.7.1.5.7. Alert Management and Reporting

12.7.1.5.8. Case Management

12.7.2. Japan

12.7.2.1. Japan Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

12.7.2.1.1. Service

12.7.2.1.2. Software

12.7.2.2. Japan Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

12.7.2.2.1. Retail Banking

12.7.2.2.2. Corporate Banking

12.7.2.2.3. Private Banking

12.7.2.2.4. Investment Banking

12.7.2.2.5. Asset Management

12.7.2.2.6. Insurance

12.7.2.2.7. Multiple Banking Services

12.7.2.2.8. Legal Service Providers

12.7.2.2.9. Others (Credit Unions etc.)

12.7.2.3. Japan Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

12.7.2.3.1. On-premise

12.7.2.3.2. Cloud-based

12.7.2.4. Japan Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

12.7.2.4.1. Compliance Management Software

12.7.2.4.2. Currency Transaction Reporting (CTR) Systems

12.7.2.4.3. Customer Identity Management Systems

12.7.2.4.4. Transaction Monitoring Systems

12.7.2.5. Japan Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

12.7.2.5.1. Transaction Monitoring

12.7.2.5.2. KYC (Know Your Customer)

12.7.2.5.3. Fraud, Risk and Compliance Management

12.7.2.5.4. Watch-list Screening

12.7.2.5.5. Data Warehouse Management

12.7.2.5.6. Analytics and Visualization

12.7.2.5.7. Alert Management and Reporting

12.7.2.5.8. Case Management

12.7.3. India

12.7.3.1. India Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

12.7.3.1.1. Service

12.7.3.1.2. Software

12.7.3.2. India Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

12.7.3.2.1. Retail Banking

12.7.3.2.2. Corporate Banking

12.7.3.2.3. Private Banking

12.7.3.2.4. Investment Banking

12.7.3.2.5. Asset Management

12.7.3.2.6. Insurance

12.7.3.2.7. Multiple Banking Services

12.7.3.2.8. Legal Service Providers

12.7.3.2.9. Others (Credit Unions etc.)

12.7.3.3. India Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

12.7.3.3.1. On-premise

12.7.3.3.2. Cloud-based

12.7.3.4. India Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

12.7.3.4.1. Compliance Management Software

12.7.3.4.2. Currency Transaction Reporting (CTR) Systems

12.7.3.4.3. Customer Identity Management Systems

12.7.3.4.4. Transaction Monitoring Systems

12.7.3.5. India Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

12.7.3.5.1. Transaction Monitoring

12.7.3.5.2. KYC (Know Your Customer)

12.7.3.5.3. Fraud, Risk and Compliance Management

12.7.3.5.4. Watch-list Screening

12.7.3.5.5. Data Warehouse Management

12.7.3.5.6. Analytics and Visualization

12.7.3.5.7. Alert Management and Reporting

12.7.3.5.8. Case Management

12.7.4. Southeast Asia

12.7.4.1. Southeast Asia Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

12.7.4.1.1. Service

12.7.4.1.2. Software

12.7.4.2. Southeast Asia Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

12.7.4.2.1. Retail Banking

12.7.4.2.2. Corporate Banking

12.7.4.2.3. Private Banking

12.7.4.2.4. Investment Banking

12.7.4.2.5. Asset Management

12.7.4.2.6. Insurance

12.7.4.2.7. Multiple Banking Services

12.7.4.2.8. Legal Service Providers

12.7.4.2.9. Others (Credit Unions etc.)

12.7.4.3. Southeast Asia Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

12.7.4.3.1. On-premise

12.7.4.3.2. Cloud-based

12.7.4.4. Southeast Asia Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

12.7.4.4.1. Compliance Management Software

12.7.4.4.2. Currency Transaction Reporting (CTR) Systems

12.7.4.4.3. Customer Identity Management Systems

12.7.4.4.4. Transaction Monitoring Systems

12.7.4.5. Southeast Asia Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

12.7.4.5.1. Transaction Monitoring

12.7.4.5.2. KYC (Know Your Customer)

12.7.4.5.3. Fraud, Risk and Compliance Management

12.7.4.5.4. Watch-list Screening

12.7.4.5.5. Data Warehouse Management

12.7.4.5.6. Analytics and Visualization

12.7.4.5.7. Alert Management and Reporting

12.7.4.5.8. Case Management

12.7.5. Rest of Asia Pacific

12.7.5.1. Rest of Asia Pacific Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Component

12.7.5.1.1. Service

12.7.5.1.2. Software

12.7.5.2. Rest of Asia Pacific Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By End User

12.7.5.2.1. Retail Banking

12.7.5.2.2. Corporate Banking

12.7.5.2.3. Private Banking

12.7.5.2.4. Investment Banking

12.7.5.2.5. Asset Management

12.7.5.2.6. Insurance

12.7.5.2.7. Multiple Banking Services

12.7.5.2.8. Legal Service Providers

12.7.5.2.9. Others (Credit Unions etc.)

12.7.5.3. Rest of Asia Pacific Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Deployment Type

12.7.5.3.1. On-premise

12.7.5.3.2. Cloud-based

12.7.5.4. Rest of Asia Pacific Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Product Type

12.7.5.4.1. Compliance Management Software

12.7.5.4.2. Currency Transaction Reporting (CTR) Systems

12.7.5.4.3. Customer Identity Management Systems

12.7.5.4.4. Transaction Monitoring Systems

12.7.5.5. Rest of Asia Pacific Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Solution Type

12.7.5.5.1. Transaction Monitoring

12.7.5.5.2. KYC (Know Your Customer)

12.7.5.5.3. Fraud, Risk and Compliance Management

12.7.5.5.4. Watch-list Screening

12.7.5.5.5. Data Warehouse Management

12.7.5.5.6. Analytics and Visualization

12.7.5.5.7. Alert Management and Reporting

12.7.5.5.8. Case Management

12.8. Key Segment for Channeling Investments

12.8.1. By Country

12.8.2. By Component

12.8.3. By End User

12.8.4. By Deployment Type

12.8.5. By Product Type

12.8.6. By Solution Type

13. Middle East and Africa Anti-Money Laundering Software Market

Analysis and Forecasts, 2018 – 2026

13.1. Overview

13.1.1. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn)

13.2. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Component

13.2.1. Service

13.2.2. Software

13.3. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By End User

13.3.1. Retail Banking

13.3.2. Corporate Banking

13.3.3. Private Banking

13.3.4. Investment Banking

13.3.5. Asset Management

13.3.6. Insurance

13.3.7. Multiple Banking Services

13.3.8. Legal Service Providers

13.3.9. Others (Credit Unions etc.)

13.4. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Deployment Type

13.4.1. On-premise

13.4.2. Cloud-based

13.5. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Product Type

13.5.1. Compliance Management Software

13.5.2. Currency Transaction Reporting (CTR) Systems

13.5.3. Customer Identity Management Systems

13.5.4. Transaction Monitoring Systems

13.6. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Solution Type

13.6.1. Transaction Monitoring

13.6.2. KYC (Know Your Customer)

13.6.3. Fraud, Risk and Compliance Management

13.6.4. Watch-list Screening

13.6.5. Data Warehouse Management

13.6.6. Analytics and Visualization

13.6.7. Alert Management and Reporting

13.6.8. Case Management

13.7. Middle East and Africa Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Country

13.7.1. GCC Countries

13.7.1.1. GCC Countries Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

13.7.1.1.1. Service

13.7.1.1.2. Software

13.7.1.2. GCC Countries Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

13.7.1.2.1. Retail Banking

13.7.1.2.2. Corporate Banking

13.7.1.2.3. Private Banking

13.7.1.2.4. Investment Banking

13.7.1.2.5. Asset Management

13.7.1.2.6. Insurance

13.7.1.2.7. Multiple Banking Services

13.7.1.2.8. Legal Service Providers

13.7.1.2.9. Others (Credit Unions etc.)

13.7.1.3. GCC Countries Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

13.7.1.3.1. On-premise

13.7.1.3.2. Cloud-based

13.7.1.4. GCC Countries Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

13.7.1.4.1. Compliance Management Software

13.7.1.4.2. Currency Transaction Reporting (CTR) Systems

13.7.1.4.3. Customer Identity Management Systems

13.7.1.4.4. Transaction Monitoring Systems

13.7.1.5. GCC Countries Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

13.7.1.5.1. Transaction Monitoring

13.7.1.5.2. KYC (Know Your Customer)

13.7.1.5.3. Fraud, Risk and Compliance Management

13.7.1.5.4. Watch-list Screening

13.7.1.5.5. Data Warehouse Management

13.7.1.5.6. Analytics and Visualization

13.7.1.5.7. Alert Management and Reporting

13.7.1.5.8. Case Management

13.7.2. Southern Africa

13.7.2.1. Southern Africa Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

13.7.2.1.1. Service

13.7.2.1.2. Software

13.7.2.2. Southern Africa Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

13.7.2.2.1. Retail Banking

13.7.2.2.2. Corporate Banking

13.7.2.2.3. Private Banking

13.7.2.2.4. Investment Banking

13.7.2.2.5. Asset Management

13.7.2.2.6. Insurance

13.7.2.2.7. Multiple Banking Services

13.7.2.2.8. Legal Service Providers

13.7.2.2.9. Others (Credit Unions etc.)

13.7.2.3. Southern Africa Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

13.7.2.3.1. On-premise

13.7.2.3.2. Cloud-based

13.7.2.4. Southern Africa Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

13.7.2.4.1. Compliance Management Software

13.7.2.4.2. Currency Transaction Reporting (CTR) Systems

13.7.2.4.3. Customer Identity Management Systems

13.7.2.4.4. Transaction Monitoring Systems

13.7.2.5. Southern Africa Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

13.7.2.5.1. Transaction Monitoring

13.7.2.5.2. KYC (Know Your Customer)

13.7.2.5.3. Fraud, Risk and Compliance Management

13.7.2.5.4. Watch-list Screening

13.7.2.5.5. Data Warehouse Management

13.7.2.5.6. Analytics and Visualization

13.7.2.5.7. Alert Management and Reporting

13.7.2.5.8. Case Management

13.7.3. Rest of MEA

13.7.3.1. Rest of MEA Anti-Money Laundering Software Market Revenue (US$

Mn) and Forecasts, By Component

13.7.3.1.1. Service

13.7.3.1.2. Software

13.7.3.2. Rest of MEA Anti-Money Laundering Software Market Revenue (US$

Mn) and Forecasts, By End User

13.7.3.2.1. Retail Banking

13.7.3.2.2. Corporate Banking

13.7.3.2.3. Private Banking

13.7.3.2.4. Investment Banking

13.7.3.2.5. Asset Management

13.7.3.2.6. Insurance

13.7.3.2.7. Multiple Banking Services

13.7.3.2.8. Legal Service Providers

13.7.3.2.9. Others (Credit Unions etc.)

13.7.3.3. Rest of MEA Anti-Money Laundering Software Market Revenue (US$

Mn) and Forecasts, By Deployment Type

13.7.3.3.1. On-premise

13.7.3.3.2. Cloud-based

13.7.3.4. Rest of MEA Anti-Money Laundering Software Market Revenue (US$

Mn) and Forecasts, By Product Type

13.7.3.4.1. Compliance Management Software

13.7.3.4.2. Currency Transaction Reporting (CTR) Systems

13.7.3.4.3. Customer Identity Management Systems

13.7.3.4.4. Transaction Monitoring Systems

13.7.3.5. Rest of MEA Anti-Money Laundering Software Market Revenue (US$

Mn) and Forecasts, By Solution Type

13.7.3.5.1. Transaction Monitoring

13.7.3.5.2. KYC (Know Your Customer)

13.7.3.5.3. Fraud, Risk and Compliance Management

13.7.3.5.4. Watch-list Screening

13.7.3.5.5. Data Warehouse Management

13.7.3.5.6. Analytics and Visualization

13.7.3.5.7. Alert Management and Reporting

13.7.3.5.8. Case Management

13.8. Key Segment for Channeling Investments

13.8.1. By Country

13.8.2. By Component

13.8.3. By End User

13.8.4. By Deployment Type

13.8.5. By Product Type

13.8.6. By Solution Type

14. Latin America Anti-Money Laundering Software Market Analysis

and Forecasts, 2018 – 2026

14.1. Overview

14.1.1. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn)

14.2. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Component

14.2.1. Service

14.2.2. Software

14.3. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By End User

14.3.1. Retail Banking

14.3.2. Corporate Banking

14.3.3. Private Banking

14.3.4. Investment Banking

14.3.5. Asset Management

14.3.6. Insurance

14.3.7. Multiple Banking Services

14.3.8. Legal Service Providers

14.3.9. Others (Credit Unions etc.)

14.4. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Deployment Type

14.4.1. On-premise

14.4.2. Cloud-based

14.5. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Product Type

14.5.1. Compliance Management Software

14.5.2. Currency Transaction Reporting (CTR) Systems

14.5.3. Customer Identity Management Systems

14.5.4. Transaction Monitoring Systems

14.6. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Solution Type

14.6.1. Transaction Monitoring

14.6.2. KYC (Know Your Customer)

14.6.3. Fraud, Risk and Compliance Management

14.6.4. Watch-list Screening

14.6.5. Data Warehouse Management

14.6.6. Analytics and Visualization

14.6.7. Alert Management and Reporting

14.6.8. Case Management

14.7. Latin America Anti-Money Laundering Software Market Revenue

(US$ Mn) and Forecasts, By Country

14.7.1. Brazil

14.7.1.1. Brazil Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Component

14.7.1.1.1. Service

14.7.1.1.2. Software

14.7.1.2. Brazil Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By End User

14.7.1.2.1. Retail Banking

14.7.1.2.2. Corporate Banking

14.7.1.2.3. Private Banking

14.7.1.2.4. Investment Banking

14.7.1.2.5. Asset Management

14.7.1.2.6. Insurance

14.7.1.2.7. Multiple Banking Services

14.7.1.2.8. Legal Service Providers

14.7.1.2.9. Others (Credit Unions etc.)

14.7.1.3. Brazil Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Deployment Type

14.7.1.3.1. On-premise

14.7.1.3.2. Cloud-based

14.7.1.4. Brazil Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Product Type

14.7.1.4.1. Compliance Management Software

14.7.1.4.2. Currency Transaction Reporting (CTR) Systems

14.7.1.4.3. Customer Identity Management Systems

14.7.1.4.4. Transaction Monitoring Systems

14.7.1.5. Brazil Anti-Money Laundering Software Market Revenue (US$ Mn)

and Forecasts, By Solution Type

14.7.1.5.1. Transaction Monitoring

14.7.1.5.2. KYC (Know Your Customer)

14.7.1.5.3. Fraud, Risk and Compliance Management

14.7.1.5.4. Watch-list Screening

14.7.1.5.5. Data Warehouse Management

14.7.1.5.6. Analytics and Visualization

14.7.1.5.7. Alert Management and Reporting

14.7.1.5.8. Case Management

14.7.2. Rest of Latin America

14.7.2.1. Rest of Latin America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Component

14.7.2.1.1. Service

14.7.2.1.2. Software

14.7.2.2. Rest of Latin America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By End User

14.7.2.2.1. Retail Banking

14.7.2.2.2. Corporate Banking

14.7.2.2.3. Private Banking

14.7.2.2.4. Investment Banking

14.7.2.2.5. Asset Management

14.7.2.2.6. Insurance

14.7.2.2.7. Multiple Banking Services

14.7.2.2.8. Legal Service Providers

14.7.2.2.9. Others (Credit Unions etc.)

14.7.2.3. Rest of Latin America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Deployment Type

14.7.2.3.1. On-premise

14.7.2.3.2. Cloud-based

14.7.2.4. Rest of Latin America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Product Type

14.7.2.4.1. Compliance Management Software

14.7.2.4.2. Currency Transaction Reporting (CTR) Systems

14.7.2.4.3. Customer Identity Management Systems

14.7.2.4.4. Transaction Monitoring Systems

14.7.2.5. Rest of Latin America Anti-Money Laundering Software Market

Revenue (US$ Mn) and Forecasts, By Solution Type

14.7.2.5.1. Transaction Monitoring

14.7.2.5.2. KYC (Know Your Customer)

14.7.2.5.3. Fraud, Risk and Compliance Management

14.7.2.5.4. Watch-list Screening

14.7.2.5.5. Data Warehouse Management

14.7.2.5.6. Analytics and Visualization

14.7.2.5.7. Alert Management and Reporting

14.7.2.5.8. Case Management

14.8. Key Segment for Channeling Investments

14.8.1. By Country

14.8.2. By Component

14.8.3. By End User

14.8.4. By Deployment Type

14.8.5. By Product Type

14.8.6. By Solution Type

15. Competitive Benchmarking

15.1. Player Positioning Analysis

15.2. Global Presence and Growth Strategies

16. Player Profiles

16.1. 3i Infotech

16.1.1. Company Details

16.1.2. Company Overview

16.1.3. Product Offerings

16.1.4. Key Developments

16.1.5. Financial Analysis

16.1.6. SWOT Analysis

16.1.7. Business Strategies

16.2. Accenture

16.2.1. Company Details

16.2.2. Company Overview

16.2.3. Product Offerings

16.2.4. Key Developments

16.2.5. Financial Analysis

16.2.6. SWOT Analysis

16.2.7. Business Strategies

16.3. ACI Worldwide, Inc.

16.3.1. Company Details

16.3.2. Company Overview

16.3.3. Product Offerings

16.3.4. Key Developments

16.3.5. Financial Analysis

16.3.6. SWOT Analysis

16.3.7. Business Strategies

16.4. Cognizant

16.4.1. Company Details

16.4.2. Company Overview

16.4.3. Product Offerings

16.4.4. Key Developments

16.4.5. Financial Analysis

16.4.6. SWOT Analysis

16.4.7. Business Strategies

16.5. EastNets.com

16.5.1. Company Details

16.5.2. Company Overview

16.5.3. Product Offerings

16.5.4. Key Developments

16.5.5. Financial Analysis

16.5.6. SWOT Analysis

16.5.7. Business Strategies

16.6. Experian Information Solutions, Inc.

16.6.1. Company Details

16.6.2. Company Overview

16.6.3. Product Offerings

16.6.4. Key Developments

16.6.5. Financial Analysis

16.6.6. SWOT Analysis

16.6.7. Business Strategies

16.7. Fiserv, Inc.

16.7.1. Company Details

16.7.2. Company Overview

16.7.3. Product Offerings

16.7.4. Key Developments

16.7.5. Financial Analysis

16.7.6. SWOT Analysis

16.7.7. Business Strategies

16.8. Grand Rapids Chair Company

16.8.1. Company Details

16.8.2. Company Overview

16.8.3. Product Offerings

16.8.4. Key Developments

16.8.5. Financial Analysis

16.8.6. SWOT Analysis

16.8.7. Business Strategies

16.9. Nelito Systems Ltd.

16.9.1. Company Details

16.9.2. Company Overview

16.9.3. Product Offerings

16.9.4. Key Developments

16.9.5. Financial Analysis

16.9.6. SWOT Analysis

16.9.7. Business Strategies

16.10. OpenText Corp.

16.10.1. Company Details

16.10.2. Company Overview

16.10.3. Product Offerings

16.10.4. Key Developments

16.10.5. Financial Analysis

16.10.6. SWOT Analysis

16.10.7. Business Strategies

16.11. Oracle

16.11.1.

Company Details

16.11.2.

Company Overview

16.11.3.

Product Offerings

16.11.4.

Key Developments

16.11.5.

Financial Analysis

16.11.6.

SWOT Analysis

16.11.7.

Business Strategies

16.12. RiskMS (AMLcheck)

16.12.1.

Company Details

16.12.2.

Company Overview

16.12.3.

Product Offerings

16.12.4.

Key Developments

16.12.5.

Financial Analysis

16.12.6.

SWOT Analysis

16.12.7.

Business Strategies

16.13. SAS Institute Inc.

16.13.1.

Company Details

16.13.2.

Company Overview

16.13.3.

Product Offerings

16.13.4.

Key Developments

16.13.5.

Financial Analysis

16.13.6.

SWOT Analysis

16.13.7.

Business Strategies

16.14. Tata Consultancy Services Limited

16.14.1.

Company Details

16.14.2.

Company Overview

16.14.3.

Product Offerings

16.14.4.

Key Developments

16.14.5.

Financial Analysis

16.14.6.

SWOT Analysis

16.14.7.

Business Strategies

16.15. Tipalti

16.15.1.

Company Details

16.15.2.

Company Overview

16.15.3.

Product Offerings

16.15.4.

Key Developments

16.15.5.

Financial Analysis

16.15.6.

SWOT Analysis

16.15.7.

Business Strategies

16.16. Trulioo

16.16.1.

Company Details

16.16.2.

Company Overview

16.16.3.

Product Offerings

16.16.4.

Key Developments

16.16.5.

Financial Analysis

16.16.6.

SWOT Analysis

16.16.7.

Business Strategies

16.17. Verafin Inc.

16.17.1.

Company Details

16.17.2.

Company Overview

16.17.3.

Product Offerings

16.17.4.

Key Developments

16.17.5.

Financial Analysis

16.17.6.

SWOT Analysis

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.