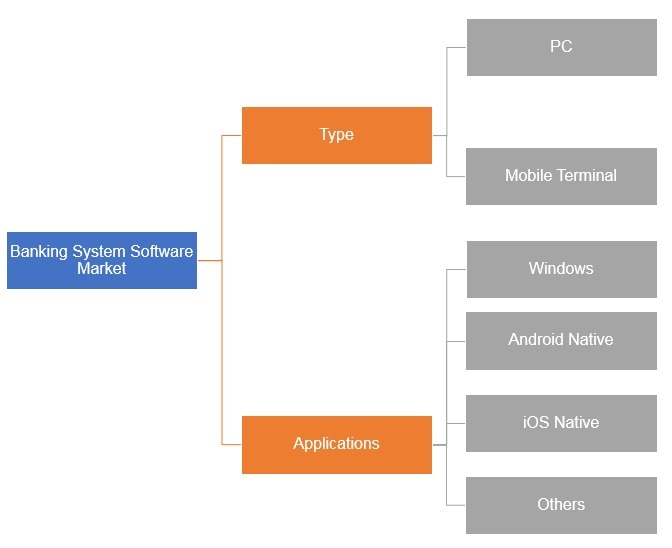

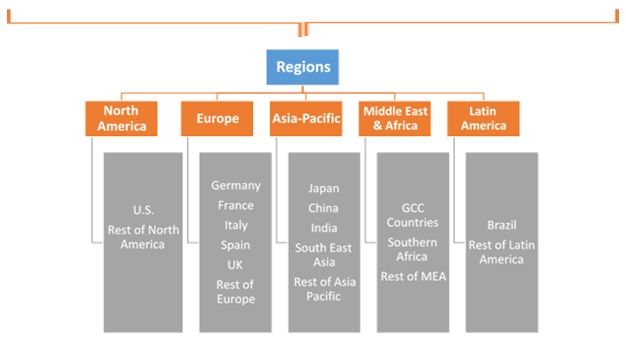

Banking System Software Market by Type (PC, Mobile Terminal); by Application (Windows, Android Native, iOs Native, Others); by Regional outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026

Industry Trends

Banking System Software is a software which enables a connection between commercial banks and other modular software and the interbank networks. To access the capital markets, this software is used as trading software by investment banks. It helps to record and manage the transactions of bank customers to their banks and optimize the operations in back and front office of the banks. It enables the need of banks for system integration and maintains core banking system. Banking software provides customer management suits which help the banks to view client’s relationship with the bank. Financial institution requires purchase order management, financial information management, positions and risk management. Banking software serves the purpose by offering more efficient and organized mechanism of the processes in these institutions.

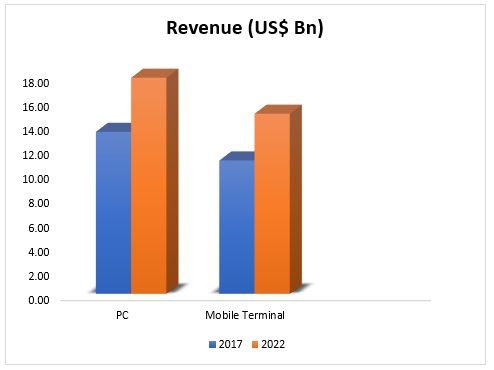

Global Banking System Software market, in terms of revenue, which was estimated at US$ 24.37 billion in 2017, is expected to reach US$ 32.70 billion in 2022.

Global Banking System Software Market, By Component, 2017 & 2022 (US$ Billion)

In recent times, advances in digital technology has offered countless of channels for customer interaction. Mobile banking has transformed how customer engage with the banks. Such customer interaction via digital channels is generating beneficial transactional data. Such data helps to develop more ways to engage customers. Mobile banking has been growing with the growing number of smartphone owners with a bank account. The growth in mobile banking has shifted banks focus to customer mobile transactions and provide better opportunities for banks to gain competitive edge in the market. Therefore, the increasing adoption of mobile banking is driving the banking system software market globally.

However, issues such as lack of security due to cyber-attacks is leading to illegal exploitation of vital financial data and is hindering the market growth of this software.

Banking System Software Market, By Application

Amongst the applications, Windows held the largest market share in terms of revenue. This rapid and fast paced growth is attribute to the increasing use of windows by large banks. A great number of mid-tier and large banks are processing their core banking system on Window-based platform. In 2014, before Microsoft stopped support for XP, US Bank moved all its ATMs on Windows 7. It is reported that 95% of ATMs in the world run on Windows. To support banking services such as branch, ATM, Internet banking and call center operations, Windows serve as a universal platform, which makes it a dominating application platform in the banking software industry.

Banking System Software Market, By Region

On the basis of geography, North America region occupies the largest share in terms of implementation and demand for the market globally. North America is a leading region in fast technology adoption and implementation processes. The major share of banking IT expenditure in the US market is more service oriented. Vast usage of internet services and mobile banking for carrying out transactions has been driving the demand for banking system software in North America. To maximize the banking efficiency, North American companies such as Strategic Information Technology Ltd. provides such software to enhance the shareholder and customer value in technology enabled business. The U.S. dominated the banking system software market in North America.

Competitive Landscape

The report provides both, qualitative and quantitative research of the market, as well as integrates worthy insights into the rational scenario and favored development methods adopted by the key contenders. The banking system software market report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as mergers & acquisitions (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their corporate headquarter, competitors, product/service type, application and specification, pricing, and gross margin.

Some of the primary market participants are Millennium Information Solution Ltd., Strategic Information Technology Ltd., Aspekt, Automated Workflow Pvt. Ltd, Canopus EpaySuite, Cashbook, CoBIS Microfinance Software, Probanx Information Systems, Megasol Technologies, EBANQ Holdings BV, Infosys Limited, Kapowai, Crystal Clear Software Ltd., Infrasoft Technologies Ltd., Misys, Banking.Systems, ABBA d.o.o., SecurePaymentz, Tata Consultancy Services, TEMENOS Headquarters SA amongst others.

Global Banking System Software Industry Background

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Banking System Software Market Snapshot

3. Executive Summary: Banking System Software Market

4. Qualitative Analysis: Banking System Software Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Trends in Market

5. Global Banking System Software Market Analysis and Forecasts,

2018 – 2026

5.1. Overview

5.1.1. Global Market Revenue (US$ Mn) and Forecasts

5.2. Global Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

5.2.1. PC

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Mobile Terminal

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Type

6. Global Banking System Software Market Analysis and Forecasts,

2018 – 2026

6.1. Overview

6.2. Global Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Applications

6.2.1. Windows

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Android Native

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. iOS Native

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Others

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By Applications

7. North America Banking System Software Market Analysis and

Forecasts, 2018 – 2026

7.1. Overview

7.1.1. North America Market Revenue (US$ Mn)

7.2. North America Market Revenue (US$ Mn) and Forecasts, By Type

7.2.1. PC

7.2.2. Mobile Terminal

7.3. North America Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Applications

7.3.1. Windows

7.3.2. Android Native

7.3.3. iOS Native

7.3.4. Others

7.4. North America Market Revenue (US$ Mn) and Forecasts, By

Country

7.4.1. U.S.

7.4.1.1. U.S. Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

7.4.1.1.1. PC

7.4.1.1.2. Mobile Terminal

7.4.1.2. U.S. Market Revenue (US$ Mn) and Forecasts, By Applications

7.4.1.2.1. Windows

7.4.1.2.2. Android Native

7.4.1.2.3. iOS Native

7.4.1.2.4. Others

7.4.2. Rest of North America

7.4.2.1. Rest of North America Banking System Software Market Revenue

(US$ Mn) and Forecasts, By Type

7.4.2.1.1. PC

7.4.2.1.2. Mobile Terminal

7.4.2.2. Rest of North America Market Revenue (US$ Mn) and Forecasts,

By Applications

7.4.2.2.1. Windows

7.4.2.2.2. Android Native

7.4.2.2.3. iOS Native

7.4.2.2.4. Others

7.5. Key Segment for Channeling Investments

7.5.1. By Country

7.5.2. By Type

7.5.3. By Applications

8. Europe Banking System Software Market Analysis and Forecasts,

2018 – 2026

8.1. Overview

8.1.1. Europe Market Revenue (US$ Mn)

8.2. Europe Market Revenue (US$ Mn) and Forecasts, By Type

8.2.1. PC

8.2.2. Mobile Terminal

8.3. Europe Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Applications

8.3.1. Windows

8.3.2. Android Native

8.3.3. iOS Native

8.3.4. Others

8.4. Europe Market Revenue (US$ Mn) and Forecasts, By Country

8.4.1. France

8.4.1.1. France Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.1.1.1. PC

8.4.1.1.2. Mobile Terminal

8.4.1.2. France Market Revenue (US$ Mn) and Forecasts, By Applications

8.4.1.2.1. Windows

8.4.1.2.2. Android Native

8.4.1.2.3. iOS Native

8.4.1.2.4. Others

8.4.2. The UK

8.4.2.1. The UK Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.2.1.1. PC

8.4.2.1.2. Mobile Terminal

8.4.2.2. The UK Market Revenue (US$ Mn) and Forecasts, By Applications

8.4.2.2.1. Windows

8.4.2.2.2. Android Native

8.4.2.2.3. iOS Native

8.4.2.2.4. Others

8.4.3. Spain

8.4.3.1. Spain Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.3.1.1. PC

8.4.3.1.2. Mobile Terminal

8.4.3.2. Spain Market Revenue (US$ Mn) and Forecasts, By Applications

8.4.3.2.1. Windows

8.4.3.2.2. Android Native

8.4.3.2.3. iOS Native

8.4.3.2.4. Others

8.4.4. Germany

8.4.4.1. Germany Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.4.1.1. PC

8.4.4.1.2. Mobile Terminal

8.4.4.2. Germany Market Revenue (US$ Mn) and Forecasts, By Applications

8.4.4.2.1. Windows

8.4.4.2.2. Android Native

8.4.4.2.3. iOS Native

8.4.4.2.4. Others

8.4.5. Italy

8.4.5.1. Italy Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

8.4.5.1.1. PC

8.4.5.1.2. Mobile Terminal

8.4.5.2. Italy Market Revenue (US$ Mn) and Forecasts, By Applications

8.4.5.2.1. Windows

8.4.5.2.2. Android Native

8.4.5.2.3. iOS Native

8.4.5.2.4. Others

8.4.6. Rest of Europe

8.4.6.1. Rest of Europe Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Type

8.4.6.1.1. PC

8.4.6.1.2. Mobile Terminal

8.4.6.2. Rest of Europe Market Revenue (US$ Mn) and Forecasts, By

Applications

8.4.6.2.1. Windows

8.4.6.2.2. Android Native

8.4.6.2.3. iOS Native

8.4.6.2.4. Others

8.5. Key Segment for Channeling Investments

8.5.1. By Country

8.5.2. By Type

8.5.3. By Applications

9. Asia Pacific Banking System Software Market Analysis and

Forecasts, 2018 – 2026

9.1. Overview

9.1.1. Asia Pacific Market Revenue (US$ Mn)

9.2. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By Type

9.2.1. PC

9.2.2. Mobile Terminal

9.3. Asia Pacific Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Applications

9.3.1. Windows

9.3.2. Android Native

9.3.3. iOS Native

9.3.4. Others

9.4. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By Country

9.4.1. China

9.4.1.1. China Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.1.1.1. PC

9.4.1.1.2. Mobile Terminal

9.4.1.2. China Market Revenue (US$ Mn) and Forecasts, By Applications

9.4.1.2.1. Windows

9.4.1.2.2. Android Native

9.4.1.2.3. iOS Native

9.4.1.2.4. Others

9.4.2. Japan

9.4.2.1. Japan Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.2.1.1. PC

9.4.2.1.2. Mobile Terminal

9.4.2.2. Japan Market Revenue (US$ Mn) and Forecasts, By Applications

9.4.2.2.1. Windows

9.4.2.2.2. Android Native

9.4.2.2.3. iOS Native

9.4.2.2.4. Others

9.4.3. India

9.4.3.1. India Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

9.4.3.1.1. PC

9.4.3.1.2. Mobile Terminal

9.4.3.2. India Market Revenue (US$ Mn) and Forecasts, By Applications

9.4.3.2.1. Windows

9.4.3.2.2. Android Native

9.4.3.2.3. iOS Native

9.4.3.2.4. Others

9.4.4. Southeast Asia

9.4.4.1. Southeast Asia Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Type

9.4.4.1.1. PC

9.4.4.1.2. Mobile Terminal

9.4.4.2. Southeast Asia Market Revenue (US$ Mn) and Forecasts, By

Applications

9.4.4.2.1. Windows

9.4.4.2.2. Android Native

9.4.4.2.3. iOS Native

9.4.4.2.4. Others

9.4.5. Rest of Asia Pacific

9.4.5.1. Rest of Asia Pacific Banking System Software Market Revenue

(US$ Mn) and Forecasts, By Type

9.4.5.1.1. PC

9.4.5.1.2. Mobile Terminal

9.4.5.2. Rest of Asia Pacific Market Revenue (US$ Mn) and Forecasts, By

Applications

9.4.5.2.1. Windows

9.4.5.2.2. Android Native

9.4.5.2.3. iOS Native

9.4.5.2.4. Others

9.5. Key Segment for Channeling Investments

9.5.1. By Country

9.5.2. By Type

9.5.3. By Applications

10. Middle East and Africa Banking System Software Market

Analysis and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Market Revenue (US$ Mn)

10.2. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By Type

10.2.1. PC

10.2.2. Mobile Terminal

10.3. Middle East and Africa Banking System Software Market Revenue

(US$ Mn) and Forecasts, By Applications

10.3.1. Windows

10.3.2. Android Native

10.3.3. iOS Native

10.3.4. Others

10.4. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By Country

10.4.1. GCC Countries

10.4.1.1. GCC Countries Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Type

10.4.1.1.1. PC

10.4.1.1.2. Mobile Terminal

10.4.1.2. GCC Countries Market Revenue (US$ Mn) and Forecasts, By

Applications

10.4.1.2.1. Windows

10.4.1.2.2. Android Native

10.4.1.2.3. iOS Native

10.4.1.2.4. Others

10.4.2. Southern Africa

10.4.2.1. Southern Africa Banking System Software Market Revenue (US$

Mn) and Forecasts, By Type

10.4.2.1.1. PC

10.4.2.1.2. Mobile Terminal

10.4.2.2. Southern Africa Market Revenue (US$ Mn) and Forecasts, By

Applications

10.4.2.2.1. Windows

10.4.2.2.2. Android Native

10.4.2.2.3. iOS Native

10.4.2.2.4. Others

10.4.3. Rest of MEA

10.4.3.1. Rest of MEA Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Type

10.4.3.1.1. PC

10.4.3.1.2. Mobile Terminal

10.4.3.2. Rest of MEA Market Revenue (US$ Mn) and Forecasts, By

Applications

10.4.3.2.1. Windows

10.4.3.2.2. Android Native

10.4.3.2.3. iOS Native

10.4.3.2.4. Others

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Type

10.5.3. By Applications

11. Latin America Banking System Software Market Analysis and

Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America Market Revenue (US$ Mn)

11.2. Latin America Market Revenue (US$ Mn) and Forecasts, By Type

11.2.1. PC

11.2.2. Mobile Terminal

11.3. Latin America Banking System Software Market Revenue (US$ Mn)

and Forecasts, By Applications

11.3.1. Windows

11.3.2. Android Native

11.3.3. iOS Native

11.3.4. Others

11.4. Latin America Market Revenue (US$ Mn) and Forecasts, By

Country

11.4.1. Brazil

11.4.1.1. Brazil Banking System Software Market Revenue (US$ Mn) and

Forecasts, By Type

11.4.1.1.1. PC

11.4.1.1.2. Mobile Terminal

11.4.1.2. Brazil Market Revenue (US$ Mn) and Forecasts, By Applications

11.4.1.2.1. Windows

11.4.1.2.2. Android Native

11.4.1.2.3. iOS Native

11.4.1.2.4. Others

11.4.2. Rest of Latin America

11.4.2.1. Rest of Latin America Banking System Software Market Revenue

(US$ Mn) and Forecasts, By Type

11.4.2.1.1. PC

11.4.2.1.2. Mobile Terminal

11.4.2.2. Rest of Latin America Market Revenue (US$ Mn) and Forecasts,

By Applications

11.4.2.2.1. Windows

11.4.2.2.2. Android Native

11.4.2.2.3. iOS Native

11.4.2.2.4. Others

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Type

11.5.3. By Applications

12. Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13. Player Profiles

13.1. Millennium Information Solution Ltd.

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. Strategic Information Technology Ltd.

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Aspekt

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. Automated Workflow Pvt. Ltd

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. Canopus EpaySuite

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. Cashbook

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. CoBIS Microfinance Software

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. Probanx Information Systems

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. Megasol Technologies

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10. EBANQ Holdings BV

13.10.1.

Company Details

13.10.2.

Company Overview

13.10.3.

Product Offerings

13.10.4.

Key Developments

13.10.5.

Financial Analysis

13.10.6.

SWOT Analysis

13.10.7.

Business Strategies

13.11. Infosys Limited

13.11.1.

Company Details

13.11.2.

Company Overview

13.11.3.

Product Offerings

13.11.4.

Key Developments

13.11.5.

Financial Analysis

13.11.6.

SWOT Analysis

13.11.7.

Business Strategies

13.12. Kapowai

13.12.1.

Company Details

13.12.2.

Company Overview

13.12.3.

Product Offerings

13.12.4.

Key Developments

13.12.5.

Financial Analysis

13.12.6.

SWOT Analysis

13.12.7.

Business Strategies

13.13. Crystal Clear Software Ltd.

13.13.1.

Company Details

13.13.2.

Company Overview

13.13.3.

Product Offerings

13.13.4.

Key Developments

13.13.5.

Financial Analysis

13.13.6.

SWOT Analysis

13.13.7.

Business Strategies

13.14. Infrasoft Technologies Ltd.

13.14.1.

Company Details

13.14.2.

Company Overview

13.14.3.

Product Offerings

13.14.4.

Key Developments

13.14.5.

Financial Analysis

13.14.6.

SWOT Analysis

13.14.7.

Business Strategies

13.15. Misys

13.15.1.

Company Details

13.15.2.

Company Overview

13.15.3.

Product Offerings

13.15.4.

Key Developments

13.15.5.

Financial Analysis

13.15.6.

SWOT Analysis

13.15.7.

Business Strategies

13.16. Banking.Systems

13.16.1.

Company Details

13.16.2.

Company Overview

13.16.3.

Product Offerings

13.16.4.

Key Developments

13.16.5.

Financial Analysis

13.16.6.

SWOT Analysis

13.16.7.

Business Strategies

13.17. ABBA d.o.o.

13.17.1.

Company Details

13.17.2.

Company Overview

13.17.3.

Product Offerings

13.17.4.

Key Developments

13.17.5.

Financial Analysis

13.17.6.

SWOT Analysis

13.17.7.

Business Strategies

13.18. SecurePaymentz

13.18.1.

Company Details

13.18.2.

Company Overview

13.18.3.

Product Offerings

13.18.4.

Key Developments

13.18.5.

Financial Analysis

13.18.6.

SWOT Analysis

13.18.7.

Business Strategies

13.19. Tata Consultancy Services Limited

13.19.1.

Company Details

13.19.2.

Company Overview

13.19.3.

Product Offerings

13.19.4.

Key Developments

13.19.5.

Financial Analysis

13.19.6.

SWOT Analysis

13.19.7.

Business Strategies

13.20. Temenos Headquarters SA

13.20.1. Company Details

13.20.2. Company Overview

13.20.3. Product Offerings

13.20.4. Key Developments

13.20.5. Financial Analysis

13.20.6. SWOT Analysis

13.20.7. Business Strategies

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.