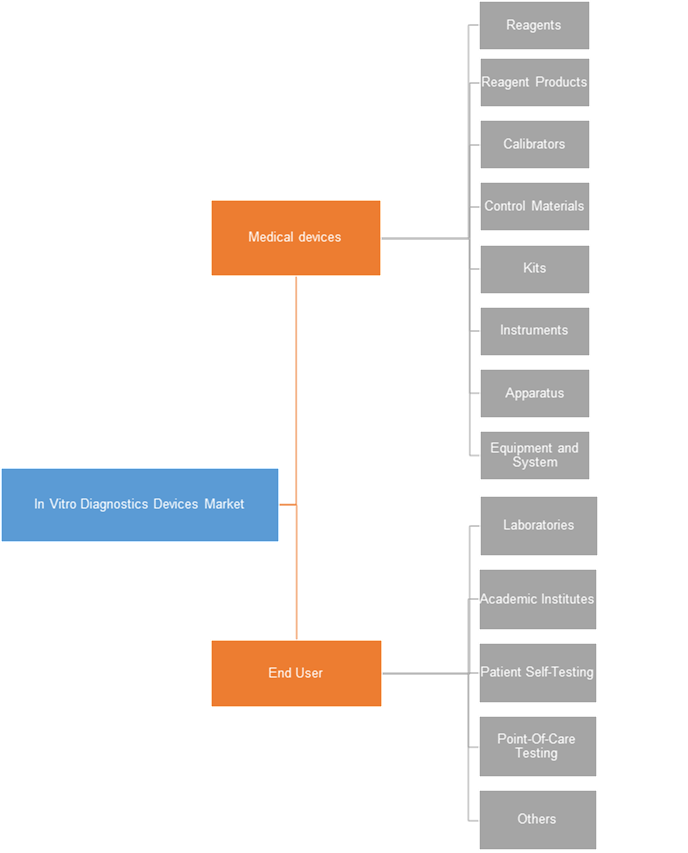

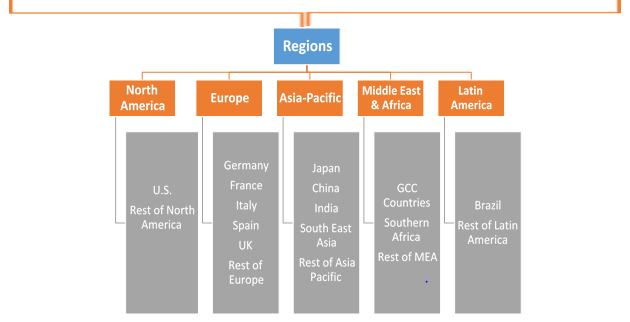

In Vitro Diagnostics Devices Market by Medical Devices (Reagents, Reagent Products, Calibrators, Control Materials, Kits, Instruments, Apparatus, Equipment and System); by Applications (Hospitals, Laboratories, Academic Institutes, Patient Self-Testing, Point-Of-Care Testing, Others); by Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 - 2026

Industry Trends

In vitro diagnostics are tests conducted to determine infections, diseases or conditions. These tests are performed in laboratory, at professional health settings or are used by consumers at home. In-vitro diagnostics medical devices are accessories used for the examination of specimens derived from the human body to deliver information for diagnostics, monitoring or compatibility purposes. This would help to prevent disease, help to detect infection, monitor drug therapies and diagnose a medical condition. These tests could either be used alone or in combination. The devices used, vary from simple tests to sophisticated DNA technology that includes reagents, kits, calibrators, software, control materials and other instruments. Clinical chemistry, urine test strips, HIV tests or hepatitis, coagulation test systems, diabetic blood sugar monitoring systems, pregnancy tests, are few examples of in-vitro diagnostic medical devices. These could be used by doctors as well as by individuals at home. The global in vitro diagnostics devices market was valued at US$ 69.08 Bn in 2017 and is expected to reach US$ 90.86 Bn by 2022.

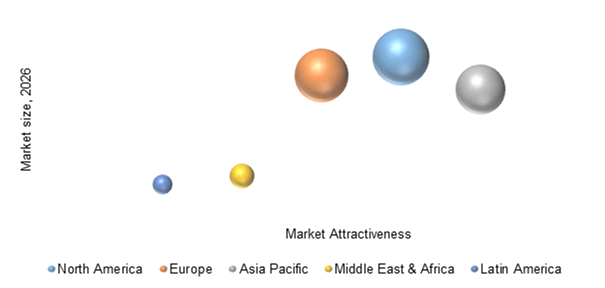

Global In Vitro Diagnostics Devices Market, By Region, 2018-2026 (US$ Billion)

In Vitro Diagnostics Devices Market, By End User

On the basis of end user, laboratories held the largest market share. The expansion of healthcare industry has resulted in the emergence of a large number of laboratories offering various sampling tests. The automation of this processes ensures efficient and accurate results. This has led to the adoption of in vitro diagnostics devices in these laboratories. Laboratories are one of the major consumers utilizing in-vitro diagnostics devices on a large scale. The in vitro diagnostics devices applications include next generation sequencing tests, detecting genomic variations, etc. This segment is estimated to be the most attractive in the forecast period due to the increasing number of laboratories and the consequent wide spread adoption of in vitro diagnostics devices.

In Vitro Diagnostics Devices Market, By Region

North America is anticipated to display sustainable growth in in-vitro diagnostic devices market owing advantages such as, accessibility to technologies, and diagnostics opportunities in genetic testing and cancer screening. Moreover, technological advancements and strong research by the large number of market players such as Abbott Laboratories, Inc., Becton, Dickson and Company and Johnson & Johnson in North American region, are driving the market. Many companies are collaborating or acquiring small companies, which is significantly growing the market. For instance, in February 2016, Abbott

In Vitro Diagnostics Devices Industry Background

Laboratories, Inc., a global healthcare company acquired Alere. This transaction helped Abbott become one of the leading diagnostics provider of point of the care testing and offer flexible, new, cost-effective and high-quality products.

Competitive Market Share

The report provides both, qualitative and quantitative research of the market, as well as integrates worthy insights into the rational scenario and favored development methods adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as Mergers & Acquisitions (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their manufacturing base, competitors, product type, application and specification, pricing, and gross margin.

Some of the primary participants in global in vitro diagnostics market includes Abbott Laboratories, Inc., Becton, Dickson and Company, Johnson & Johnson, Beckman Coulter, Inc., bioMérieux SA, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., Roche Holding AG, Siemens AG, Sysmex Corporation, Thermo Fisher Scientific, amongst others.

In Vitro Diagnostics Devices Industry Background

1.

Introduction

1.1.

Market Scope

1.2.

Market Segmentation

1.3.

Methodology

1.4.

Assumptions

2.

In Vitro Diagnostics Devices

Market Snapshot

3.

Executive Summary: In Vitro

Diagnostics Devices Market

4.

Qualitative Analysis: In Vitro

Diagnostics Devices Market

4.1.

Introduction

4.1.1.

Product Definition

4.1.2.

Industry Development

4.2.

Market Dynamics

4.2.1.

Drivers

4.2.2.

Restraints

4.2.3.

Opportunities

4.3.

Trends in fMarket

5.

Global In Vitro Diagnostics

Devices Market Analysis and Forecasts, 2018 – 2026

5.1.

Overview

5.1.1.

Global Market Revenue (US$ Mn)

and Forecasts

5.2.

Global In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

5.2.1.

Reagents

5.2.1.1.

Definition

5.2.1.2.

Market Penetration

5.2.1.3.

Market Revenue Expected to

Increase by 2026

5.2.1.4.

Compound Annual Growth Rate

(CAGR)

5.2.2.

Reagent Products

5.2.2.1.

Definition

5.2.2.2.

Market Penetration

5.2.2.3.

Market Revenue Expected to

Increase by 2026

5.2.2.4.

Compound Annual Growth Rate

(CAGR)

5.2.3.

Calibrators

5.2.3.1.

Definition

5.2.3.2.

Market Penetration

5.2.3.3.

Market Revenue Expected to

Increase by 2026

5.2.3.4.

Compound Annual Growth Rate

(CAGR)

5.2.4.

Control Materials

5.2.4.1.

Definition

5.2.4.2.

Market Penetration

5.2.4.3.

Market Revenue Expected to

Increase by 2026

5.2.4.4.

Compound Annual Growth Rate

(CAGR)

5.2.5.

Kits

5.2.5.1.

Definition

5.2.5.2.

Market Penetration

5.2.5.3.

Market Revenue Expected to

Increase by 2026

5.2.5.4.

Compound Annual Growth Rate

(CAGR)

5.2.6.

Instruments

5.2.6.1.

Definition

5.2.6.2.

Market Penetration

5.2.6.3.

Market Revenue Expected to

Increase by 2026

5.2.6.4.

Compound Annual Growth Rate

(CAGR)

5.2.7.

Apparatus

5.2.7.1.

Definition

5.2.7.2.

Market Penetration

5.2.7.3.

Market Revenue Expected to

Increase by 2026

5.2.7.4.

Compound Annual Growth Rate

(CAGR)

5.2.8.

Equipment and System

5.2.8.1.

Definition

5.2.8.2.

Market Penetration

5.2.8.3.

Market Revenue Expected to Increase

by 2026

5.2.8.4.

Compound Annual Growth Rate

(CAGR)

5.3.

Key Segment for Channeling

Investments

5.3.1.

By Medical Devices

6.

Global In Vitro Diagnostics

Devices Market Analysis and Forecasts, 2018 – 2026

6.1.

Overview

6.2.

Global In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

6.2.1.

Laboratories

6.2.1.1.

Definition

6.2.1.2.

Market Penetration

6.2.1.3.

Market Revenue Expected to

Increase by 2026

6.2.1.4.

Compound Annual Growth Rate

(CAGR)

6.2.2.

Academic Institutes

6.2.2.1.

Definition

6.2.2.2.

Market Penetration

6.2.2.3.

Market Revenue Expected to

Increase by 2026

6.2.2.4.

Compound Annual Growth Rate

(CAGR)

6.2.3.

Patient Self-Testing

6.2.3.1.

Definition

6.2.3.2.

Market Penetration

6.2.3.3.

Market Revenue Expected to

Increase by 2026

6.2.3.4.

Compound Annual Growth Rate

(CAGR)

6.2.4.

Point-Of-Care Testing

6.2.4.1.

Definition

6.2.4.2.

Market Penetration

6.2.4.3.

Market Revenue Expected to

Increase by 2026

6.2.4.4.

Compound Annual Growth Rate

(CAGR)

6.2.5.

Others

6.2.5.1.

Definition

6.2.5.2.

Market Penetration

6.2.5.3.

Market Revenue Expected to

Increase by 2026

6.2.5.4.

Compound Annual Growth Rate

(CAGR)

6.3.

Key Segment for Channeling

Investments

6.3.1.

By End User

7.

North America In Vitro

Diagnostics Devices Market Analysis and Forecasts, 2018 – 2026

7.1.

Overview

7.1.1.

North America Market Revenue

(US$ Mn)

7.2.

North America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

7.2.1.

Reagents

7.2.2.

Reagent Products

7.2.3.

Calibrators

7.2.4.

Control Materials

7.2.5.

Kits

7.2.6.

Instruments

7.2.7.

Apparatus

7.2.8.

Equipment and System

7.3.

North America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

7.3.1.

Laboratories

7.3.2.

Academic Institutes

7.3.3.

Patient Self-Testing

7.3.4.

Point-Of-Care Testing

7.3.5.

Others

7.4.

North America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Country

7.4.1.

U.S.

7.4.1.1.

U.S. In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

7.4.1.1.1.

Reagents

7.4.1.1.2.

Reagent Products

7.4.1.1.3.

Calibrators

7.4.1.1.4.

Control Materials

7.4.1.1.5.

Kits

7.4.1.1.6.

Instruments

7.4.1.1.7.

Apparatus

7.4.1.1.8.

Equipment and System

7.4.1.2.

U.S. In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

7.4.1.2.1.

Laboratories

7.4.1.2.2.

Academic Institutes

7.4.1.2.3.

Patient Self-Testing

7.4.1.2.4.

Point-Of-Care Testing

7.4.1.2.5.

Others

7.4.2.

Rest of North America

7.4.2.1.

Rest of North America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

7.4.2.1.1.

Reagents

7.4.2.1.2.

Reagent Products

7.4.2.1.3.

Calibrators

7.4.2.1.4.

Control Materials

7.4.2.1.5.

Kits

7.4.2.1.6.

Instruments

7.4.2.1.7.

Apparatus

7.4.2.1.8.

Equipment and System

7.4.2.2.

Rest of North America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

7.4.2.2.1.

Laboratories

7.4.2.2.2.

Academic Institutes

7.4.2.2.3.

Patient Self-Testing

7.4.2.2.4.

Point-Of-Care Testing

7.4.2.2.5.

Others

7.5.

Key Segment for Channeling

Investments

7.5.1.

By Country

7.5.2.

By Medical Devices

7.5.3.

By End User

8.

Europe In Vitro Diagnostics

Devices Market Analysis and Forecasts, 2018 – 2026

8.1.

Overview

8.1.1.

Europe Market Revenue (US$ Mn)

8.2.

Europe In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.2.1.

Reagents

8.2.2.

Reagent Products

8.2.3.

Calibrators

8.2.4.

Control Materials

8.2.5.

Kits

8.2.6.

Instruments

8.2.7.

Apparatus

8.2.8.

Equipment and System

8.3.

Europe In Vitro Diagnostics Devices

Market Revenue (US$ Mn) and Forecasts, By End User

8.3.1.

Laboratories

8.3.2.

Academic Institutes

8.3.3.

Patient Self-Testing

8.3.4.

Point-Of-Care Testing

8.3.5.

Others

8.4.

Europe In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Country

8.4.1.

France

8.4.1.1.

France In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.4.1.1.1.

Reagents

8.4.1.1.2.

Reagent Products

8.4.1.1.3.

Calibrators

8.4.1.1.4.

Control Materials

8.4.1.1.5.

Kits

8.4.1.1.6.

Instruments

8.4.1.1.7.

Apparatus

8.4.1.1.8.

Equipment and System

8.4.1.2.

France In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

8.4.1.2.1.

Laboratories

8.4.1.2.2.

Academic Institutes

8.4.1.2.3.

Patient Self-Testing

8.4.1.2.4.

Point-Of-Care Testing

8.4.1.2.5.

Others

8.4.2.

The UK

8.4.2.1.

The UK In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.4.2.1.1.

Reagents

8.4.2.1.2.

Reagent Products

8.4.2.1.3.

Calibrators

8.4.2.1.4.

Control Materials

8.4.2.1.5.

Kits

8.4.2.1.6.

Instruments

8.4.2.1.7.

Apparatus

8.4.2.1.8.

Equipment and System

8.4.2.2.

The UK In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

8.4.2.2.1.

Laboratories

8.4.2.2.2.

Academic Institutes

8.4.2.2.3.

Patient Self-Testing

8.4.2.2.4.

Point-Of-Care Testing

8.4.2.2.5.

Others

8.4.3.

Spain

8.4.3.1.

Spain In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.4.3.1.1.

Reagents

8.4.3.1.2.

Reagent Products

8.4.3.1.3.

Calibrators

8.4.3.1.4.

Control Materials

8.4.3.1.5.

Kits

8.4.3.1.6.

Instruments

8.4.3.1.7.

Apparatus

8.4.3.1.8.

Equipment and System

8.4.3.2.

Spain In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

8.4.3.2.1.

Laboratories

8.4.3.2.2.

Academic Institutes

8.4.3.2.3.

Patient Self-Testing

8.4.3.2.4.

Point-Of-Care Testing

8.4.3.2.5.

Others

8.4.4.

Germany

8.4.4.1.

Germany In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.4.4.1.1.

Reagents

8.4.4.1.2.

Reagent Products

8.4.4.1.3.

Calibrators

8.4.4.1.4.

Control Materials

8.4.4.1.5.

Kits

8.4.4.1.6.

Instruments

8.4.4.1.7.

Apparatus

8.4.4.1.8.

Equipment and System

8.4.4.2.

Germany In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

8.4.4.2.1.

Laboratories

8.4.4.2.2.

Academic Institutes

8.4.4.2.3.

Patient Self-Testing

8.4.4.2.4.

Point-Of-Care Testing

8.4.4.2.5.

Others

8.4.5.

Italy

8.4.5.1.

Italy In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.4.5.1.1.

Reagents

8.4.5.1.2.

Reagent Products

8.4.5.1.3.

Calibrators

8.4.5.1.4.

Control Materials

8.4.5.1.5.

Kits

8.4.5.1.6.

Instruments

8.4.5.1.7.

Apparatus

8.4.5.1.8.

Equipment and System

8.4.5.2.

Italy In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

8.4.5.2.1.

Laboratories

8.4.5.2.2.

Academic Institutes

8.4.5.2.3.

Patient Self-Testing

8.4.5.2.4.

Point-Of-Care Testing

8.4.5.2.5.

Others

8.4.6.

Rest of Europe

8.4.6.1.

Rest of Europe In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

8.4.6.1.1.

Reagents

8.4.6.1.2.

Reagent Products

8.4.6.1.3.

Calibrators

8.4.6.1.4.

Control Materials

8.4.6.1.5.

Kits

8.4.6.1.6.

Instruments

8.4.6.1.7.

Apparatus

8.4.6.1.8.

Equipment and System

8.4.6.2.

Rest of Europe In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

8.4.6.2.1.

Laboratories

8.4.6.2.2.

Academic Institutes

8.4.6.2.3.

Patient Self-Testing

8.4.6.2.4.

Point-Of-Care Testing

8.4.6.2.5.

Others

8.5.

Key Segment for Channeling

Investments

8.5.1.

By Country

8.5.2.

By Medical Devices

8.5.3.

By End User

9.

Asia Pacific In Vitro Diagnostics Devices Market Analysis

and Forecasts, 2018 – 2026

9.1.

Overview

9.1.1.

Asia Pacific Market Revenue (US$

Mn)

9.2.

Asia Pacific In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

9.2.1.

Reagents

9.2.2.

Reagent Products

9.2.3.

Calibrators

9.2.4.

Control Materials

9.2.5.

Kits

9.2.6.

Instruments

9.2.7.

Apparatus

9.2.8.

Equipment and System

9.3.

Asia Pacific In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

9.3.1.

Laboratories

9.3.2.

Academic Institutes

9.3.3.

Patient Self-Testing

9.3.4.

Point-Of-Care Testing

9.3.5.

Others

9.4.

Asia Pacific In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Country

9.4.1.

China

9.4.1.1.

China In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

9.4.1.1.1.

Reagents

9.4.1.1.2.

Reagent Products

9.4.1.1.3.

Calibrators

9.4.1.1.4.

Control Materials

9.4.1.1.5.

Kits

9.4.1.1.6.

Instruments

9.4.1.1.7.

Apparatus

9.4.1.1.8.

Equipment and System

9.4.1.2.

China In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

9.4.1.2.1.

Laboratories

9.4.1.2.2.

Academic Institutes

9.4.1.2.3.

Patient Self-Testing

9.4.1.2.4.

Point-Of-Care Testing

9.4.1.2.5.

Others

9.4.2.

Japan

9.4.2.1.

Japan In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

9.4.2.1.1.

Reagents

9.4.2.1.2.

Reagent Products

9.4.2.1.3.

Calibrators

9.4.2.1.4.

Control Materials

9.4.2.1.5.

Kits

9.4.2.1.6.

Instruments

9.4.2.1.7.

Apparatus

9.4.2.1.8.

Equipment and System

9.4.2.2.

Japan In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

9.4.2.2.1.

Laboratories

9.4.2.2.2.

Academic Institutes

9.4.2.2.3.

Patient Self-Testing

9.4.2.2.4.

Point-Of-Care Testing

9.4.2.2.5.

Others

9.4.3.

India

9.4.3.1.

India In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

9.4.3.1.1.

Reagents

9.4.3.1.2.

Reagent Products

9.4.3.1.3.

Calibrators

9.4.3.1.4.

Control Materials

9.4.3.1.5.

Kits

9.4.3.1.6.

Instruments

9.4.3.1.7.

Apparatus

9.4.3.1.8.

Equipment and System

9.4.3.2.

India In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

9.4.3.2.1.

Laboratories

9.4.3.2.2.

Academic Institutes

9.4.3.2.3.

Patient Self-Testing

9.4.3.2.4.

Point-Of-Care Testing

9.4.3.2.5.

Others

9.4.4.

Southeast Asia

9.4.4.1.

Southeast Asia In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

9.4.4.1.1.

Reagents

9.4.4.1.2.

Reagent Products

9.4.4.1.3.

Calibrators

9.4.4.1.4.

Control Materials

9.4.4.1.5.

Kits

9.4.4.1.6.

Instruments

9.4.4.1.7.

Apparatus

9.4.4.1.8.

Equipment and System

9.4.4.2.

Southeast Asia In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

9.4.4.2.1.

Laboratories

9.4.4.2.2.

Academic Institutes

9.4.4.2.3.

Patient Self-Testing

9.4.4.2.4.

Point-Of-Care Testing

9.4.4.2.5.

Others

9.4.5.

Rest of Asia Pacific

9.4.5.1.

Rest of Asia Pacific In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

9.4.5.1.1.

Reagents

9.4.5.1.2.

Reagent Products

9.4.5.1.3.

Calibrators

9.4.5.1.4.

Control Materials

9.4.5.1.5.

Kits

9.4.5.1.6.

Instruments

9.4.5.1.7.

Apparatus

9.4.5.1.8.

Equipment and System

9.4.5.2.

Rest of Asia Pacific In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

9.4.5.2.1.

Laboratories

9.4.5.2.2.

Academic Institutes

9.4.5.2.3.

Patient Self-Testing

9.4.5.2.4.

Point-Of-Care Testing

9.4.5.2.5.

Others

9.5.

Key Segment for Channeling

Investments

9.5.1.

By Country

9.5.2.

By Medical Devices

9.5.3.

By End User

10. Middle East and Africa

In Vitro Diagnostics Devices Market Analysis and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Market Revenue (US$ Mn)

10.2. Middle East and Africa In Vitro Diagnostics Devices Market

Revenue (US$ Mn) and Forecasts, By Medical Devices

10.2.1. Reagents

10.2.2. Reagent Products

10.2.3. Calibrators

10.2.4. Control Materials

10.2.5. Kits

10.2.6. Instruments

10.2.7. Apparatus

10.2.8. Equipment and System

10.3. Middle East and Africa In Vitro Diagnostics Devices Market

Revenue (US$ Mn) and Forecasts, By End User

10.3.1. Laboratories

10.3.2. Academic Institutes

10.3.3. Patient Self-Testing

10.3.4. Point-Of-Care Testing

10.3.5. Others

10.4. Middle East and Africa In Vitro Diagnostics Devices Market

Revenue (US$ Mn) and Forecasts, By Country

10.4.1. GCC Countries

10.4.1.1.

GCC Countries In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

10.4.1.1.1.

Reagents

10.4.1.1.2.

Reagent Products

10.4.1.1.3.

Calibrators

10.4.1.1.4.

Control Materials

10.4.1.1.5.

Kits

10.4.1.1.6.

Instruments

10.4.1.1.7.

Apparatus

10.4.1.1.8.

Equipment and System

10.4.1.2.

GCC Countries In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

10.4.1.2.1.

Laboratories

10.4.1.2.2.

Academic Institutes

10.4.1.2.3.

Patient Self-Testing

10.4.1.2.4.

Point-Of-Care Testing

10.4.1.2.5.

Others

10.4.2. Southern Africa

10.4.2.1.

Southern Africa In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

10.4.2.1.1.

Reagents

10.4.2.1.2.

Reagent Products

10.4.2.1.3.

Calibrators

10.4.2.1.4.

Control Materials

10.4.2.1.5.

Kits

10.4.2.1.6.

Instruments

10.4.2.1.7.

Apparatus

10.4.2.1.8.

Equipment and System

10.4.2.2.

Southern Africa In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

10.4.2.2.1.

Laboratories

10.4.2.2.2.

Academic Institutes

10.4.2.2.3.

Patient Self-Testing

10.4.2.2.4.

Point-Of-Care Testing

10.4.2.2.5.

Others

10.4.3. Rest of MEA

10.4.3.1.

Rest of MEA In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

10.4.3.1.1.

Reagents

10.4.3.1.2.

Reagent Products

10.4.3.1.3.

Calibrators

10.4.3.1.4.

Control Materials

10.4.3.1.5.

Kits

10.4.3.1.6.

Instruments

10.4.3.1.7.

Apparatus

10.4.3.1.8.

Equipment and System

10.4.3.2.

Rest of MEA In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

10.4.3.2.1.

Laboratories

10.4.3.2.2.

Academic Institutes

10.4.3.2.3.

Patient Self-Testing

10.4.3.2.4.

Point-Of-Care Testing

10.4.3.2.5.

Others

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Medical Devices

10.5.3. By End User

11. Latin America In Vitro Diagnostics Devices Market Analysis

and Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America In Vitro Diagnostics Devices Market Revenue (US$

Mn)

11.2. Latin America In Vitro Diagnostics Devices Market Revenue (US$

Mn) and Forecasts, By Medical Devices

11.2.1. Reagents

11.2.2. Reagent Products

11.2.3. Calibrators

11.2.4. Control Materials

11.2.5. Kits

11.2.6. Instruments

11.2.7. Apparatus

11.2.8. Equipment and System

11.3. Latin America In Vitro Diagnostics Devices Market Revenue (US$

Mn) and Forecasts, By End User

11.3.1. Laboratories

11.3.2. Academic Institutes

11.3.3. Patient Self-Testing

11.3.4. Point-Of-Care Testing

11.3.5. Others

11.4. Latin America In Vitro Diagnostics Devices Market Revenue (US$

Mn) and Forecasts, By Country

11.4.1. Brazil

11.4.1.1.

Brazil In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

11.4.1.1.1.

Reagents

11.4.1.1.2.

Reagent Products

11.4.1.1.3.

Calibrators

11.4.1.1.4.

Control Materials

11.4.1.1.5.

Kits

11.4.1.1.6.

Instruments

11.4.1.1.7.

Apparatus

11.4.1.1.8.

Equipment and System

11.4.1.2.

Brazil In Vitro Diagnostics

Devices Market Revenue (US$ Mn) and Forecasts, By End User

11.4.1.2.1.

Laboratories

11.4.1.2.2.

Academic Institutes

11.4.1.2.3.

Patient Self-Testing

11.4.1.2.4.

Point-Of-Care Testing

11.4.1.2.5.

Others

11.4.2. Rest of Latin America

11.4.2.1.

Rest of Latin America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By Medical Devices

11.4.2.1.1.

Reagents

11.4.2.1.2.

Reagent Products

11.4.2.1.3.

Calibrators

11.4.2.1.4.

Control Materials

11.4.2.1.5.

Kits

11.4.2.1.6.

Instruments

11.4.2.1.7.

Apparatus

11.4.2.1.8.

Equipment and System

11.4.2.2.

Rest of Latin America In Vitro

Diagnostics Devices Market Revenue (US$ Mn) and Forecasts, By End User

11.4.2.2.1.

Laboratories

11.4.2.2.2.

Academic Institutes

11.4.2.2.3.

Patient Self-Testing

11.4.2.2.4.

Point-Of-Care Testing

11.4.2.2.5.

Others

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Medical Devices

11.5.3. By End User

12. Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13. Player Profiles

13.1. Abbott Laboratories, Inc.

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. Becton, Dickson & Company

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Johnson & Johnson

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. Beckman Coulter, Inc.

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. bioMérieux SA

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. Bio-Rad Laboratories, Inc.

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. Randox Laboratories Ltd.

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. Roche Holding AG

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. Siemens AG

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10.

Sysmex Corporation

13.10.1.

Company Details

13.10.2.

Company Overview

13.10.3.

Product Offerings

13.10.4.

Key Developments

13.10.5.

Financial Analysis

13.10.6.

SWOT Analysis

13.10.7.

Business Strategies

13.11. Thermo Fisher Scientific

13.11.1.

Company Details

13.11.2.

Company Overview

13.11.3.

Product Offerings

13.11.4.

Key Developments

13.11.5.

Financial Analysis

13.11.6.

SWOT Analysis

13.11.7.

Business Strategies

Note: This ToC is tentative and can be changed according to the research

study conducted during the course of report completion.

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Reach to us

Call us on

+91-74002-42424

Drop us an email at

sales@absolutemarketsinsights.com

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.