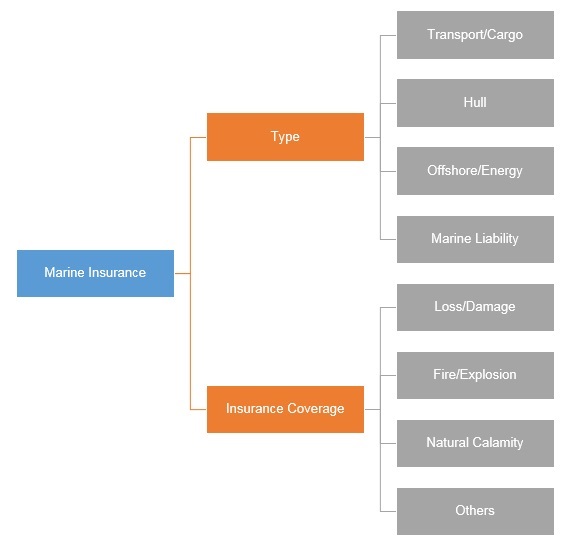

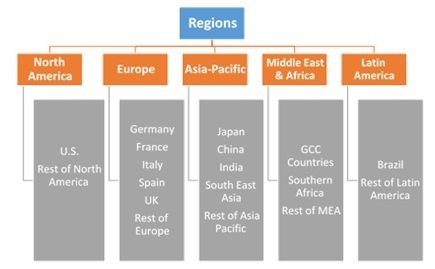

Marine Insurance Market by Type (Transport/Cargo, Hull, Offshore/Energy, Marine Liability); by Insurance Coverage (Loss/Damage, Fire/Explosion, Natural Calamity, Others); by Region outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, Rest of World) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018 – 2026

Industry Trends

Marine Insurance deals with cover of loss or damage of ships, cargos, terminals, and any transport of cargo by which property is transferred, acquired, or held between the points of origin and final destination. It is one of the oldest forms of insurance which was developed with expansion of international trade. Marine insurance is a very wide subject which requires definite categorization of various types of insurance and insurance policies. As per the requirement and specification of carrier/shipper, an appropriate type of insurance can be selected to be put into operation. When it comes to shipment of goods and cargos via marine transportation, the risks involved due to environmental or accidental causes are very high, which may lead to loss of valuables and personals. Thus, to ensure all the risk can be managed without loss of monetary funds, various marine insurance are made mandatory for ships and ship owners.

The marine insurance market, in terms of revenue, was estimated at US$ 28,483.6 Mn in 2017 and is expected to reach US$ 33,471.5 Mn in 2022.

Marine insurance becomes a crucial aspect for ship-owners and other transporters who can be assured if claiming damages in case of any kind of accident. Along with natural hazard, there are other incidents and aspects of the marine transport which could disrupt the cargo vessel and can cause huge financial losses. Incidents such as piracy, possibilities of cross-border firing, oil spillage on the ocean bed are few of the high risk situation for the transportation of cargos. Thus, marine insurance becomes a basic necessity which each and every ship-owner or transporter bares in order to save themselves from incurring huge monetary losses. In recent times there are many online portals giving faster and better options for insurance application, which has made it easier for ship-owner to opt for the same. With increasing international trade scenario the marine insurance industry is likely to see further growth in the market. Variation in global economic trends impacts the insurer’s obligation to cover major losses, particularly of large vessels, this failure in payments would further impact the overall marine transport business which could adversely impact the marine insurance market. Emerging Countries such as China, Singapore and India in Asia are likely to propel the growth of this market in the future years. In these countries the trade industry is booming and as transport via marine is of the important route of export and import of goods, the marine insurance market is likely to face a boom in the forecast period.

Marine Insurance Market, By Type

Transport/cargo holds the highest market share in 2017. Cargo holds a huge array of goods from raw materials to finished goods, which may range from low to high risk. Millions of cargos are lost in transit annually, thus measures to safe guard such goods is a necessity. Marine cargos face exposure on many levels and this makes the need of correct insurance options even more important. In July 2016, the SOLAS regulation was introduced in respect to misdeclared cargo which stated that shippers were required to declare complete details of the cargo, failure to do so would prohibit the loading of the cargo. This regulation allows to manage the claims and payments of insurance in a more effective manner which is impacting the growth of the market.

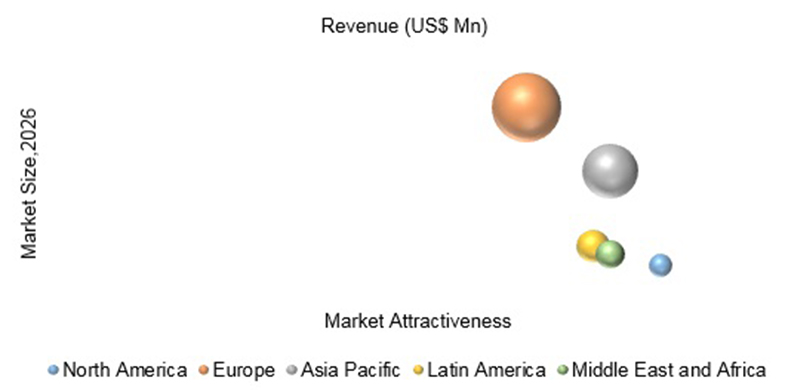

Marine Insurance Market, By Region

Europe region holds the highest market share in the global marine insurance market. Marine transport is one of the most important driver of European economy. It carries half of Europe’s goods and supports millions of jobs, thus there is huge demand of marine insurance in Europe which is enhancing the market growth. In Jan, 2016, ACE limited acquired Europe based marine insurance company Chubb and retained the brand name Chubb which is one of the biggest player in the market. Insurance Solutions provided by Chubb will help the transporters to make claims more efficiently which will indirectly impact European economy.

The report provides both, qualitative and quantitative research of the market, as well as provides worthy insights into the rational scenario and favored development methods adopted by the key contenders. The report also offers extensive research on the key players in this market and detailed insights on the competitiveness of these players. The key business strategies such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their competitors, product type, application and specification, pricing, and gross margin.

The primary market participants include Lockton Companies, Jardine Lloyd Thompson Group plc, HDFC ERGO General Insurance Company Limited, Gallagher, Marsh LLC, Lampe & Schwartze KG, Hannover Re, American International Group, Inc., Anderson Insurance Agency, ARIES MARINE INSURANCE BROKERS LTD, Atrium, Ascot, AXA Insurance Company, MS&AD Insurance Group Holdings, Inc., Tokio Marine Holdings, Inc., United India Insurance Co. Ltd., Gard, Allianz Global Corporate & Specialty SE, Eidgenössische Technische Hochschule Zürich, Berkshire Hathaway Inc. (Berkshire Hathaway Specialty Insurance), Swiss Re, SOMPO Taiwan Brokers Co., Ltd, Beazley, Willis Towers Watson, AXA XL, Thomas Miller, Sirius International Insurance Corporation, Munich Re Group, Brown & Brown Insurance, Aon plc, The Chubb Corporation.

Marine Insurance Market Background

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Marine Insurance

Market Snapshot

3. Executive Summary: Marine Insurance Market

4. Qualitative Analysis: Marine Insurance Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3.

Trends in Marine

Insurance Market

4.4. Porter’s Five Forces Analysis

5. Global Marine Insurance

Market Analysis and Forecasts, 2018 – 2026

5.1. Overview

5.1.1. Global Marine Insurance

Market Revenue (US$ Mn) and Forecasts

5.2. Global Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

5.2.1. Transport/Cargo

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Hull

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.2.3. Offshore/Energy

5.2.3.1. Definition

5.2.3.2. Market Penetration

5.2.3.3. Market Revenue Expected to Increase by 2026

5.2.3.4. Compound Annual Growth Rate (CAGR)

5.2.4. Marine Liability

5.2.4.1. Definition

5.2.4.2. Market Penetration

5.2.4.3. Market Revenue Expected to Increase by 2026

5.2.4.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Type

6. Global Marine Insurance

Market Analysis and Forecasts, 2018 – 2026

6.1. Overview

6.2. Global Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

6.2.1. Loss/Damage

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Fire/Explosion

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. Natural Calamity

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Others

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By Insurance Coverage

7. North America Marine Insurance Market Analysis and Forecasts, 2018 – 2026

7.1. Overview

7.1.1. North America Marine Insurance

Market Revenue (US$ Mn)

7.2. North America Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

7.2.1. Transport/Cargo

7.2.2. Hull

7.2.3. Offshore/Energy

7.2.4. Marine Liability

7.3. North America Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

7.3.1. Loss/Damage

7.3.2. Fire/Explosion

7.3.3. Natural Calamity

7.3.4. Others

7.4. North America Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Country

7.4.1. U.S.

7.4.1.1. U.S. Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

7.4.1.1.1. Transport/Cargo

7.4.1.1.2. Hull

7.4.1.1.3. Offshore/Energy

7.4.1.1.4. Marine Liability

7.4.1.2. U.S. Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

7.4.1.2.1. Loss/Damage

7.4.1.2.2. Fire/Explosion

7.4.1.2.3. Natural Calamity

7.4.1.2.4. Others

7.4.2. Rest of North America

7.4.2.1. Rest of North America Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

7.4.2.1.1. Transport/Cargo

7.4.2.1.2. Hull

7.4.2.1.3. Offshore/Energy

7.4.2.1.4. Marine Liability

7.4.2.2. Rest of North America Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

7.4.2.2.1. Loss/Damage

7.4.2.2.2. Fire/Explosion

7.4.2.2.3. Natural Calamity

7.4.2.2.4. Others

7.5. Key Segment for Channeling Investments

7.5.1. By Country

7.5.2. By Type

7.5.3. By Insurance Coverage

8. Europe Marine Insurance

Market Analysis and Forecasts, 2018 – 2026

8.1. Overview

8.1.1. Europe Marine Insurance

Market Revenue (US$ Mn)

8.2. Europe Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

8.2.1. Transport/Cargo

8.2.2. Hull

8.2.3. Offshore/Energy

8.2.4. Marine Liability

8.3. Europe Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

8.3.1. Loss/Damage

8.3.2. Fire/Explosion

8.3.3. Natural Calamity

8.3.4. Others

8.4. Europe Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Country

8.4.1. France

8.4.1.1. France Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

8.4.1.1.1. Transport/Cargo

8.4.1.1.2. Hull

8.4.1.1.3. Offshore/Energy

8.4.1.1.4. Marine Liability

8.4.1.2. France Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

8.4.1.2.1. Loss/Damage

8.4.1.2.2. Fire/Explosion

8.4.1.2.3. Natural Calamity

8.4.1.2.4. Others

8.4.2. The UK

8.4.2.1. The UK Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

8.4.2.1.1. Transport/Cargo

8.4.2.1.2. Hull

8.4.2.1.3. Offshore/Energy

8.4.2.1.4. Marine Liability

8.4.2.2. The UK Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

8.4.2.2.1. Loss/Damage

8.4.2.2.2. Fire/Explosion

8.4.2.2.3. Natural Calamity

8.4.2.2.4. Others

8.4.3. Spain

8.4.3.1. Spain Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

8.4.3.1.1. Transport/Cargo

8.4.3.1.2. Hull

8.4.3.1.3. Offshore/Energy

8.4.3.1.4. Marine Liability

8.4.3.2. Spain Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

8.4.3.2.1. Loss/Damage

8.4.3.2.2. Fire/Explosion

8.4.3.2.3. Natural Calamity

8.4.3.2.4. Others

8.4.4. Germany

8.4.4.1. Germany Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

8.4.4.1.1. Transport/Cargo

8.4.4.1.2. Hull

8.4.4.1.3. Offshore/Energy

8.4.4.1.4. Marine Liability

8.4.4.2. Germany Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

8.4.4.2.1. Loss/Damage

8.4.4.2.2. Fire/Explosion

8.4.4.2.3. Natural Calamity

8.4.4.2.4. Others

8.4.5. Italy

8.4.5.1. Italy Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

8.4.5.1.1. Transport/Cargo

8.4.5.1.2. Hull

8.4.5.1.3. Offshore/Energy

8.4.5.1.4. Marine Liability

8.4.5.2. Italy Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

8.4.5.2.1. Loss/Damage

8.4.5.2.2. Fire/Explosion

8.4.5.2.3. Natural Calamity

8.4.5.2.4. Others

8.4.6. Rest of Europe

8.4.6.1. Rest of Europe Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

8.4.6.1.1. Transport/Cargo

8.4.6.1.2. Hull

8.4.6.1.3. Offshore/Energy

8.4.6.1.4. Marine Liability

8.4.6.2. Rest of Europe Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

8.4.6.2.1. Loss/Damage

8.4.6.2.2. Fire/Explosion

8.4.6.2.3. Natural Calamity

8.4.6.2.4. Others

8.5. Key Segment for Channeling Investments

8.5.1. By Country

8.5.2. By Type

8.5.3. By Insurance Coverage

9. Asia Pacific Marine

Insurance Market Analysis and Forecasts,

2018 – 2026

9.1. Overview

9.1.1. Asia Pacific Marine Insurance

Market Revenue (US$ Mn)

9.2. Asia Pacific Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

9.2.1. Transport/Cargo

9.2.2. Hull

9.2.3. Offshore/Energy

9.2.4. Marine Liability

9.3. Asia Pacific Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

9.3.1. Loss/Damage

9.3.2. Fire/Explosion

9.3.3. Natural Calamity

9.3.4. Others

9.4. Asia Pacific Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Country

9.4.1. China

9.4.1.1. China Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

9.4.1.1.1. Transport/Cargo

9.4.1.1.2. Hull

9.4.1.1.3. Offshore/Energy

9.4.1.1.4. Marine Liability

9.4.1.2. China Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

9.4.1.2.1. Loss/Damage

9.4.1.2.2. Fire/Explosion

9.4.1.2.3. Natural Calamity

9.4.1.2.4. Others

9.4.2. Japan

9.4.2.1. Japan Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

9.4.2.1.1. Transport/Cargo

9.4.2.1.2. Hull

9.4.2.1.3. Offshore/Energy

9.4.2.1.4. Marine Liability

9.4.2.2. Japan Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

9.4.2.2.1. Loss/Damage

9.4.2.2.2. Fire/Explosion

9.4.2.2.3. Natural Calamity

9.4.2.2.4. Others

9.4.3. India

9.4.3.1. India Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

9.4.3.1.1. Transport/Cargo

9.4.3.1.2. Hull

9.4.3.1.3. Offshore/Energy

9.4.3.1.4. Marine Liability

9.4.3.2. India Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

9.4.3.2.1. Loss/Damage

9.4.3.2.2. Fire/Explosion

9.4.3.2.3. Natural Calamity

9.4.3.2.4. Others

9.4.4. Southeast Asia

9.4.4.1. Southeast Asia Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

9.4.4.1.1. Transport/Cargo

9.4.4.1.2. Hull

9.4.4.1.3. Offshore/Energy

9.4.4.1.4. Marine Liability

9.4.4.2. Southeast Asia Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

9.4.4.2.1. Loss/Damage

9.4.4.2.2. Fire/Explosion

9.4.4.2.3. Natural Calamity

9.4.4.2.4. Others

9.4.5. Rest of Asia Pacific

9.4.5.1. Rest of Asia Pacific Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

9.4.5.1.1. Transport/Cargo

9.4.5.1.2. Hull

9.4.5.1.3. Offshore/Energy

9.4.5.1.4. Marine Liability

9.4.5.2. Rest of Asia Pacific Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

9.4.5.2.1. Loss/Damage

9.4.5.2.2. Fire/Explosion

9.4.5.2.3. Natural Calamity

9.4.5.2.4. Others

9.5. Key Segment for Channeling Investments

9.5.1. By Country

9.5.2. By Type

9.5.3. By Insurance Coverage

10. Middle East and Africa

Marine Insurance Market Analysis

and Forecasts, 2018 – 2026

10.1. Overview

10.1.1. Middle East and Africa Marine Insurance Market Revenue (US$ Mn)

10.2. Middle East and Africa Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

10.2.1. Transport/Cargo

10.2.2. Hull

10.2.3. Offshore/Energy

10.2.4. Marine Liability

10.3. Middle East and Africa Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

10.3.1. Loss/Damage

10.3.2. Fire/Explosion

10.3.3. Natural Calamity

10.3.4. Others

10.4. Middle East and Africa Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Country

10.4.1. GCC Countries

10.4.1.1. GCC Countries Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

10.4.1.1.1. Transport/Cargo

10.4.1.1.2. Hull

10.4.1.1.3. Offshore/Energy

10.4.1.1.4. Marine Liability

10.4.1.2. GCC Countries Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

10.4.1.2.1. Loss/Damage

10.4.1.2.2. Fire/Explosion

10.4.1.2.3. Natural Calamity

10.4.1.2.4. Others

10.4.2. Southern Africa

10.4.2.1. Southern Africa Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

10.4.2.1.1. Transport/Cargo

10.4.2.1.2. Hull

10.4.2.1.3. Offshore/Energy

10.4.2.1.4. Marine Liability

10.4.2.2. Southern Africa Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

10.4.2.2.1. Loss/Damage

10.4.2.2.2. Fire/Explosion

10.4.2.2.3. Natural Calamity

10.4.2.2.4. Others

10.4.3. Rest of MEA

10.4.3.1. Rest of MEA Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

10.4.3.1.1. Transport/Cargo

10.4.3.1.2. Hull

10.4.3.1.3. Offshore/Energy

10.4.3.1.4. Marine Liability

10.4.3.2. Rest of MEA Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

10.4.3.2.1. Loss/Damage

10.4.3.2.2. Fire/Explosion

10.4.3.2.3. Natural Calamity

10.4.3.2.4. Others

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Type

10.5.3. By Insurance Coverage

11. Latin America Marine Insurance Market Analysis and Forecasts, 2018 – 2026

11.1. Overview

11.1.1. Latin America Marine Insurance

Market Revenue (US$ Mn)

11.2. Latin America Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

11.2.1. Transport/Cargo

11.2.2. Hull

11.2.3. Offshore/Energy

11.2.4. Marine Liability

11.3. Latin America Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

11.3.1. Loss/Damage

11.3.2. Fire/Explosion

11.3.3. Natural Calamity

11.3.4. Others

11.4. Latin America Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Country

11.4.1. Brazil

11.4.1.1. Brazil Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Type

11.4.1.1.1. Transport/Cargo

11.4.1.1.2. Hull

11.4.1.1.3. Offshore/Energy

11.4.1.1.4. Marine Liability

11.4.1.2. Brazil Marine Insurance

Market Revenue (US$ Mn) and Forecasts, By Insurance Coverage

11.4.1.2.1. Loss/Damage

11.4.1.2.2. Fire/Explosion

11.4.1.2.3. Natural Calamity

11.4.1.2.4. Others

11.4.2. Rest of Latin America

11.4.2.1. Rest of Latin America Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Type

11.4.2.1.1. Transport/Cargo

11.4.2.1.2. Hull

11.4.2.1.3. Offshore/Energy

11.4.2.1.4. Marine Liability

11.4.2.2. Rest of Latin America Marine Insurance Market Revenue (US$ Mn) and Forecasts, By

Insurance Coverage

11.4.2.2.1. Loss/Damage

11.4.2.2.2. Fire/Explosion

11.4.2.2.3. Natural Calamity

11.4.2.2.4. Others

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Type

11.5.3. By Insurance Coverage

12. Competitive Benchmarking

12.1. Player Positioning Analysis

12.2. Global Presence and Growth Strategies

13. Player Profiles

13.1. Allianz Global Corporate

Specialty SE

13.1.1. Company Details

13.1.2. Company Overview

13.1.3. Product Offerings

13.1.4. Key Developments

13.1.5. Financial Analysis

13.1.6. SWOT Analysis

13.1.7. Business Strategies

13.2. American International Group, Inc.

13.2.1. Company Details

13.2.2. Company Overview

13.2.3. Product Offerings

13.2.4. Key Developments

13.2.5. Financial Analysis

13.2.6. SWOT Analysis

13.2.7. Business Strategies

13.3. Anderson Insurance Agency

13.3.1. Company Details

13.3.2. Company Overview

13.3.3. Product Offerings

13.3.4. Key Developments

13.3.5. Financial Analysis

13.3.6. SWOT Analysis

13.3.7. Business Strategies

13.4. Aon plc

13.4.1. Company Details

13.4.2. Company Overview

13.4.3. Product Offerings

13.4.4. Key Developments

13.4.5. Financial Analysis

13.4.6. SWOT Analysis

13.4.7. Business Strategies

13.5. ARIES MARINE INSURANCE BROKERS LTD

13.5.1. Company Details

13.5.2. Company Overview

13.5.3. Product Offerings

13.5.4. Key Developments

13.5.5. Financial Analysis

13.5.6. SWOT Analysis

13.5.7. Business Strategies

13.6. Ascot

13.6.1. Company Details

13.6.2. Company Overview

13.6.3. Product Offerings

13.6.4. Key Developments

13.6.5. Financial Analysis

13.6.6. SWOT Analysis

13.6.7. Business Strategies

13.7. Atrium

13.7.1. Company Details

13.7.2. Company Overview

13.7.3. Product Offerings

13.7.4. Key Developments

13.7.5. Financial Analysis

13.7.6. SWOT Analysis

13.7.7. Business Strategies

13.8. AXA Insurance Company

13.8.1. Company Details

13.8.2. Company Overview

13.8.3. Product Offerings

13.8.4. Key Developments

13.8.5. Financial Analysis

13.8.6. SWOT Analysis

13.8.7. Business Strategies

13.9. AXA XL

13.9.1. Company Details

13.9.2. Company Overview

13.9.3. Product Offerings

13.9.4. Key Developments

13.9.5. Financial Analysis

13.9.6. SWOT Analysis

13.9.7. Business Strategies

13.10. Beazley

13.10.1.Company

Details

13.10.2.Company

Overview

13.10.3.Product

Offerings

13.10.4.Key

Developments

13.10.5.Financial

Analysis

13.10.6.SWOT

Analysis

13.10.7.Business

Strategies

13.11. Berkshire Hathaway Inc. (Berkshire Hathaway Specialty

Insurance)

13.11.1.Company Details

13.11.2.Company Overview

13.11.3.Product Offerings

13.11.4.Key Developments

13.11.5.Financial Analysis

13.11.6.SWOT Analysis

13.11.7.Business Strategies

13.12. Brown Brown Insurance

13.12.1.Company Details

13.12.2.Company Overview

13.12.3.Product Offerings

13.12.4.Key Developments

13.12.5.Financial Analysis

13.12.6.SWOT Analysis

13.12.7.Business Strategies

13.13. Eidgenössische Technische Hochschule Zürich

13.13.1.Company Details

13.13.2.Company Overview

13.13.3.Product Offerings

13.13.4.Key Developments

13.13.5.Financial Analysis

13.13.6.SWOT Analysis

13.13.7.Business Strategies

13.14. Gallagher

13.14.1.Company Details

13.14.2.Company Overview

13.14.3.Product Offerings

13.14.4.Key Developments

13.14.5.Financial Analysis

13.14.6.SWOT Analysis

13.14.7.Business Strategies

13.15. Gard

13.15.1.Company Details

13.15.2.Company Overview

13.15.3.Product Offerings

13.15.4.Key Developments

13.15.5.Financial Analysis

13.15.6.SWOT Analysis

13.15.7.Business Strategies

13.16. Hannover Re

13.16.1.Company Details

13.16.2.Company Overview

13.16.3.Product Offerings

13.16.4.Key Developments

13.16.5.Financial Analysis

13.16.6.SWOT Analysis

13.16.7.Business Strategies

13.17. HDFC ERGO General Insurance Company Limited

13.17.1.Company Details

13.17.2.Company Overview

13.17.3.Product Offerings

13.17.4.Key Developments

13.17.5.Financial Analysis

13.17.6.SWOT Analysis

13.17.7.Business Strategies

13.18. Jardine Lloyd Thompson Group plc

13.18.1.Company Details

13.18.2.Company Overview

13.18.3.Product Offerings

13.18.4.Key Developments

13.18.5.Financial Analysis

13.18.6.SWOT Analysis

13.18.7.Business Strategies

13.19. Lampe Schwartze KG

13.19.1.Company Details

13.19.2.Company Overview

13.19.3.Product Offerings

13.19.4.Key Developments

13.19.5.Financial Analysis

13.19.6.SWOT Analysis

13.19.7.Business Strategies

13.20. Lockton Companies

13.20.1.Company Details

13.20.2.Company Overview

13.20.3.Product Offerings

13.20.4.Key Developments

13.20.5.Financial Analysis

13.20.6.SWOT Analysis

13.20.7.Business Strategies

13.21. Marsh LLC

13.21.1.Company Details

13.21.2.Company Overview

13.21.3.Product Offerings

13.21.4.Key Developments

13.21.5.Financial Analysis

13.21.6.SWOT Analysis

13.21.7.Business Strategies

13.22. MS AD Insurance Group Holdings, Inc.

13.22.1.Company Details

13.22.2.Company Overview

13.22.3.Product Offerings

13.22.4.Key Developments

13.22.5.Financial Analysis

13.22.6.SWOT Analysis

13.22.7.Business Strategies

13.23. Munich Re Group

13.23.1.Company Details

13.23.2.Company Overview

13.23.3.Product Offerings

13.23.4.Key Developments

13.23.5.Financial Analysis

13.23.6.SWOT Analysis

13.23.7.Business Strategies

13.24. Sirius International Insurance Corporation

13.24.1.Company Details

13.24.2.Company Overview

13.24.3.Product Offerings

13.24.4.Key Developments

13.24.5.Financial Analysis

13.24.6.SWOT Analysis

13.24.7.Business Strategies

13.25. SOMPO Taiwan Brokers Co., Ltd

13.25.1.Company Details

13.25.2.Company Overview

13.25.3.Product Offerings

13.25.4.Key Developments

13.25.5.Financial Analysis

13.25.6.SWOT Analysis

13.25.7.Business Strategies

13.26. Swiss Re

13.26.1.Company Details

13.26.2.Company Overview

13.26.3.Product Offerings

13.26.4.Key Developments

13.26.5.Financial Analysis

13.26.6.SWOT Analysis

13.26.7.Business Strategies

13.27. The Chubb Corporation.

13.27.1.Company Details

13.27.2.Company Overview

13.27.3.Product Offerings

13.27.4.Key Developments

13.27.5.Financial Analysis

13.27.6.SWOT Analysis

13.27.7.Business Strategies

13.28. Thomas Miller

13.28.1.Company Details

13.28.2.Company Overview

13.28.3.Product Offerings

13.28.4.Key Developments

13.28.5.Financial Analysis

13.28.6.SWOT Analysis

13.28.7.Business Strategies

13.29. Tokio Marine Holdings, Inc.

13.29.1.Company Details

13.29.2.Company Overview

13.29.3.Product Offerings

13.29.4.Key Developments

13.29.5.Financial Analysis

13.29.6.SWOT Analysis

13.29.7.Business Strategies

13.30. United India Insurance Co. Ltd.

13.30.1.Company Details

13.30.2.Company Overview

13.30.3.Product Offerings

13.30.4.Key Developments

13.30.5.Financial Analysis

13.30.6.SWOT Analysis

13.30.7.Business Strategies

13.31. Willis Towers Watson

13.31.1.Company Details

13.31.2.Company Overview

13.31.3.Product Offerings

13.31.4.Key Developments

13.31.5.Financial Analysis

13.31.6.SWOT Analysis

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.