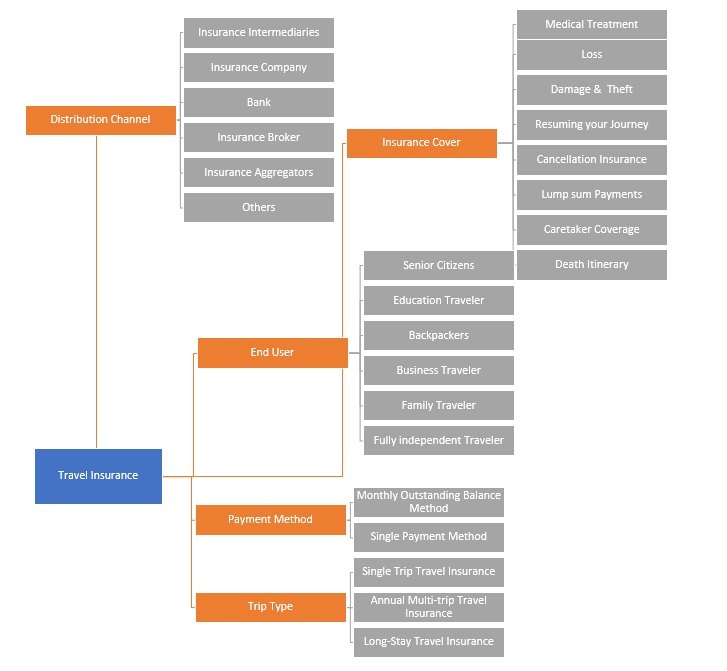

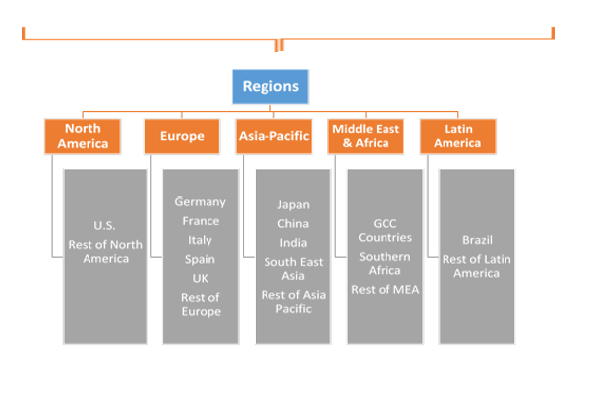

Travel Insurance Market by Insurance Cover (Medical Treatment, Loss, Damage and Theft, Resuming Your Journey, Cancellation Insurance, Lump Sum Payments, Caretaker Coverage and Death Itinerary); by Distribution Channel (Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Insurance Aggregator and Others); by End User (Senior Citizens, Education Traveler, Backpackers, Business Traveler, Family Traveler and Fully independent Traveler) by Payment Method (Monthly Outstanding Balance Method and Single Payment Method); by Trip Type (Single Trip Travel Insurance, Annual Multi-trip Travel Insurance and Long-Stay Travel Insurance); by Regional Outlook (U.S., Rest of North America, France, UK, Germany, Spain, Italy, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, GCC Countries, Southern Africa, Rest of MEA, Brazil, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2018-2026

Industry Trend

Travel insurance is intended to protect people against financial or medical losses while travelling. It also offers comprehensive coverage for exceptional events such as trip cancellation, loss of baggage, evacuation due to medical emergency or loss of travel documents. Travel insurance is increasing on international traveler’s checklist. The insurance may also include some benefits such as accidental health benefit, additional kennel or cattery fees, loss of income and permanent disability, alternative transport arrangement, etc. Factors such as increase in natural disasters, growth in tourism, rise in globalization and trade practices have made this industry attractive.

The travel insurance market valued US$ 18,868.4 Mn in 2017 is anticipated to reach US$ 29,086.0 Mn by 2022.

Travel Insurance Market, By Payment Method, 2018 - 2026 (USD Million)

Travel insurance can be paid by generally two methods which are monthly outstanding balance payments and single payment method. The single payment method holds the highest market share in payment segment for travel insurance. In case of single payment method, a lump sum amount is paid at once for any travel insurance being purchased. In this method, no interest is incurred on the payment amount. This has hereby, attracted consumers to adopt this payment method rapidly. However, various disadvantages of travel insurance, such as the twice payment after attaining the age of 66 years and no claims coverage for fragile items like glass, may hamper the industry. Moreover, travelers above the age of 65 years are not eligible for such insurance coverage, and hence may adversely impact the overall demand in the market. However, increase in number of business travelers across North America and Europe region is expected to fuel the growth of travel insurance industry.

Travel Insurance Market, By Trip Type

Annual multi-trip type holds the highest market share in trip type segment of travel insurance market. It allows the users coverage for a number of trips within a 12-month period. The annual multi-trip is suitable for solo travelers, as annual cover is the cheapest option, when it comes to travelling individually, for more than three times a year. This annual multi-trip type insurance is expected to be the most attractive travel insurance trip type amongst others. In 2017, Seven Corners initiated to offer annual and per trip protection plans designed specifically for consumers in the North America region. This again is owing to the large number of travelers in the region. Hence, such strategic initiatives undertaken by the companies is expected to boost the market growth.

Travel insurance Market, By Region

Asia Pacific holds the largest market share among other regions in the market. The region accounts for major travelers, mostly educational travelers, in the global market. The overall expenditure of middle-class income category of people towards travel and tourism has increased, specifically in the developing economies. Moreover, education and leisure travel has been identified to be the most preferred cause for travel. Moreover, the growth in the market is largely driven by increase in number of outbound travelers among senior citizens, who focus on secure travel and large travel in groups or with family. Moreover, the rise in number of family travelers and business travelers is expected to generate high demand for travel insurance market in this region.

Competitive Landscape

The report covers both, qualitative and quantitative research of the market, as well as include comprehensive insights and developments methods adopted by the key players. The report encompasses competitive detailed analysis of the key players which are driving the market. The key business strategies such as mergers & acquisitions, affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the travel insurance market report recognizes their manufacturing base, competitors, product type, application and specification, pricing, and gross margin.

Some of the primary market participants are Allianz, Generali Global Assistance, USI Affinity, Seven Corners Inc., Travel Safe Insurance, Trip Mate Inc. (Arthur J. Gallagher & Co.), Travel Insured International, AXA, Tata AIG General Insurance Company Limited, Insure & Go Insurance Services Limited, Travelex Insurance Services (TIS), Tokio Marine HCC Medical Insurance Services Group, First Allied Travel Insurance, Arch Insurance Company, Aviva Life Insurance Company India Ltd., American Express Company, BH Specialty Insurance, TravelInsurance.com (DigiVentures Holdings, LLC), amongst others.

Travel Insurance Market

1. Introduction

1.1. Market Scope

1.2. Market Segmentation

1.3. Methodology

1.4. Assumptions

2. Travel Insurance Market Snapshot

3. Executive Summary: Travel Insurance Market

4. Qualitative Analysis: Travel Insurance Market

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Development

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Trends in Market

5. Global Travel Insurance Market Analysis and Forecasts, 2018 –

2026

5.1. Overview

5.1.1. Global Market Revenue (US$ Mn) and Forecasts

5.2. Global Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

5.2.1. Medical Treatment

5.2.1.1. Definition

5.2.1.2. Market Penetration

5.2.1.3. Market Revenue Expected to Increase by 2026

5.2.1.4. Compound Annual Growth Rate (CAGR)

5.2.2. Loss

5.2.2.1. Definition

5.2.2.2. Market Penetration

5.2.2.3. Market Revenue Expected to Increase by 2026

5.2.2.4. Compound Annual Growth Rate (CAGR)

5.2.3. Damage and Theft

5.2.3.1. Definition

5.2.3.2. Market Penetration

5.2.3.3. Market Revenue Expected to Increase by 2026

5.2.3.4. Compound Annual Growth Rate (CAGR)

5.2.4. Resuming Your Journey

5.2.4.1. Definition

5.2.4.2. Market Penetration

5.2.4.3. Market Revenue Expected to Increase by 2026

5.2.4.4. Compound Annual Growth Rate (CAGR)

5.2.5. Cancellation Insurance

5.2.5.1. Definition

5.2.5.2. Market Penetration

5.2.5.3. Market Revenue Expected to Increase by 2026

5.2.5.4. Compound Annual Growth Rate (CAGR)

5.2.6. Lump Sum Payments

5.2.6.1. Definition

5.2.6.2. Market Penetration

5.2.6.3. Market Revenue Expected to Increase by 2026

5.2.6.4. Compound Annual Growth Rate (CAGR)

5.2.7. Caretaker Coverage

5.2.7.1. Definition

5.2.7.2. Market Penetration

5.2.7.3. Market Revenue Expected to Increase by 2026

5.2.7.4. Compound Annual Growth Rate (CAGR)

5.2.8. Death Itinerary

5.2.8.1. Definition

5.2.8.2. Market Penetration

5.2.8.3. Market Revenue Expected to Increase by 2026

5.2.8.4. Compound Annual Growth Rate (CAGR)

5.3. Key Segment for Channeling Investments

5.3.1. By Insurance Cover

6. Global Travel Insurance Market Analysis and Forecasts, 2018 –

2026

6.1. Overview

6.2. Global Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

6.2.1. Insurance Intermediaries

6.2.1.1. Definition

6.2.1.2. Market Penetration

6.2.1.3. Market Revenue Expected to Increase by 2026

6.2.1.4. Compound Annual Growth Rate (CAGR)

6.2.2. Insurance Company

6.2.2.1. Definition

6.2.2.2. Market Penetration

6.2.2.3. Market Revenue Expected to Increase by 2026

6.2.2.4. Compound Annual Growth Rate (CAGR)

6.2.3. Bank

6.2.3.1. Definition

6.2.3.2. Market Penetration

6.2.3.3. Market Revenue Expected to Increase by 2026

6.2.3.4. Compound Annual Growth Rate (CAGR)

6.2.4. Insurance Broker

6.2.4.1. Definition

6.2.4.2. Market Penetration

6.2.4.3. Market Revenue Expected to Increase by 2026

6.2.4.4. Compound Annual Growth Rate (CAGR)

6.2.5. Insurance Aggregator

6.2.5.1. Definition

6.2.5.2. Market Penetration

6.2.5.3. Market Revenue Expected to Increase by 2026

6.2.5.4. Compound Annual Growth Rate (CAGR)

6.2.6. Others

6.2.6.1. Definition

6.2.6.2. Market Penetration

6.2.6.3. Market Revenue Expected to Increase by 2026

6.2.6.4. Compound Annual Growth Rate (CAGR)

6.3. Key Segment for Channeling Investments

6.3.1. By Distribution Channel

7. Global Travel Insurance Market Analysis and Forecasts, 2018 –

2026

7.1. Overview

7.2. Global Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

7.2.1. Senior Citizens

7.2.1.1. Definition

7.2.1.2. Market Penetration

7.2.1.3. Market Revenue Expected to Increase by 2026

7.2.1.4. Compound Annual Growth Rate (CAGR)

7.2.2. Education Traveler

7.2.2.1. Definition

7.2.2.2. Market Penetration

7.2.2.3. Market Revenue Expected to Increase by 2026

7.2.2.4. Compound Annual Growth Rate (CAGR)

7.2.3. Backpackers

7.2.3.1. Definition

7.2.3.2. Market Penetration

7.2.3.3. Market Revenue Expected to Increase by 2026

7.2.3.4. Compound Annual Growth Rate (CAGR)

7.2.4. Business Traveler

7.2.4.1. Definition

7.2.4.2. Market Penetration

7.2.4.3. Market Revenue Expected to Increase by 2026

7.2.4.4. Compound Annual Growth Rate (CAGR)

7.2.5. Family Traveler

7.2.5.1. Definition

7.2.5.2. Market Penetration

7.2.5.3. Market Revenue Expected to Increase by 2026

7.2.5.4. Compound Annual Growth Rate (CAGR)

7.2.6. Fully independent Traveler

7.2.6.1. Definition

7.2.6.2. Market Penetration

7.2.6.3. Market Revenue Expected to Increase by 2026

7.2.6.4. Compound Annual Growth Rate (CAGR)

7.3. Key Segment for Channeling Investments

7.3.1. By End User

8. Global Travel Insurance Market Analysis and Forecasts, 2018 –

2026

8.1. Overview

8.2. Global Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Payment Method

8.2.1. Monthly Outstanding Balance Method

8.2.1.1. Definition

8.2.1.2. Market Penetration

8.2.1.3. Market Revenue Expected to Increase by 2026

8.2.1.4. Compound Annual Growth Rate (CAGR)

8.2.2. Single Payment Method

8.2.2.1. Definition

8.2.2.2. Market Penetration

8.2.2.3. Market Revenue Expected to Increase by 2026

8.2.2.4. Compound Annual Growth Rate (CAGR)

8.3. Key Segment for Channeling Investments

8.3.1. By Payment Method

9. Global Travel Insurance Market Analysis and Forecasts, 2018 –

2026

9.1. Overview

9.2. Global Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

9.2.1. Single Trip Travel Insurance

9.2.1.1. Definition

9.2.1.2. Market Penetration

9.2.1.3. Market Revenue Expected to Increase by 2026

9.2.1.4. Compound Annual Growth Rate (CAGR)

9.2.2. Annual Multi-trip Travel Insurance

9.2.2.1. Definition

9.2.2.2. Market Penetration

9.2.2.3. Market Revenue Expected to Increase by 2026

9.2.2.4. Compound Annual Growth Rate (CAGR)

9.2.3. Long-Stay Travel Insurance

9.2.3.1. Definition

9.2.3.2. Market Penetration

9.2.3.3. Market Revenue Expected to Increase by 2026

9.2.3.4. Compound Annual Growth Rate (CAGR)

9.3. Key Segment for Channeling Investments

9.3.1. By Trip Type

10. North America Travel Insurance Market Analysis and Forecasts,

2018 – 2026

10.1. Overview

10.1.1. North America Market Revenue (US$ Mn)

10.2. North America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

10.2.1. Medical Treatment

10.2.2. Loss

10.2.3. Damage and Theft

10.2.4. Resuming Your Journey

10.2.5. Cancellation Insurance

10.2.6. Lump Sum Payments

10.2.7. Caretaker Coverage

10.2.8. Death Itinerary

10.3. North America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Distribution Channel

10.3.1. Insurance Intermediaries

10.3.2. Insurance Company

10.3.3. Bank

10.3.4. Insurance Broker

10.3.5. Insurance Aggregator

10.3.6. Others

10.4. North America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

10.4.1. Senior Citizens

10.4.2. Education Traveler

10.4.3. Backpackers

10.4.4. Business Traveler

10.4.5. Family Traveler

10.4.6. Fully independent Traveler

10.5. North America Market Revenue (US$ Mn) and Forecasts, By Payment

Method

10.5.1. Monthly Outstanding Balance Method

10.5.2. Single Payment Method

10.6. North America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

10.6.1. Single Trip Travel Insurance

10.6.2. Annual Multi-trip Travel Insurance

10.6.3. Long-Stay Travel Insurance

10.7. North America Market Revenue (US$ Mn) and Forecasts, By

Country

10.7.1. U.S.

10.7.1.1. U.S. Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

10.7.1.1.1. Medical Treatment

10.7.1.1.2. Loss

10.7.1.1.3. Damage and Theft

10.7.1.1.4. Resuming Your Journey

10.7.1.1.5. Cancellation Insurance

10.7.1.1.6. Lump Sum Payments

10.7.1.1.7. Caretaker Coverage

10.7.1.1.8. Death Itinerary

10.7.1.2. U.S. Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

10.7.1.2.1. Insurance Intermediaries

10.7.1.2.2. Insurance Company

10.7.1.2.3. Bank

10.7.1.2.4. Insurance Broker

10.7.1.2.5. Insurance Aggregator

10.7.1.2.6. Others

10.7.1.3. U.S. Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

10.7.1.3.1. Senior Citizens

10.7.1.3.2. Education Traveler

10.7.1.3.3. Backpackers

10.7.1.3.4. Business Traveler

10.7.1.3.5. Family Traveler

10.7.1.3.6. Fully independent Traveler

10.7.1.4. U.S. Market Revenue (US$ Mn) and Forecasts, By Payment Method

10.7.1.4.1. Monthly Outstanding Balance Method

10.7.1.4.2. Single Payment Method

10.7.1.5. U.S. Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

10.7.1.5.1. Single Trip Travel Insurance

10.7.1.5.2. Annual Multi-trip Travel Insurance

10.7.1.5.3. Long-Stay Travel Insurance

10.7.2. Rest of North America

10.7.2.1. Rest of North America Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Insurance Cover

10.7.2.1.1. Medical Treatment

10.7.2.1.2. Loss

10.7.2.1.3. Damage and Theft

10.7.2.1.4. Resuming Your Journey

10.7.2.1.5. Cancellation Insurance

10.7.2.1.6. Lump Sum Payments

10.7.2.1.7. Caretaker Coverage

10.7.2.1.8. Death Itinerary

10.7.2.2. Rest of North America Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

10.7.2.2.1. Insurance Intermediaries

10.7.2.2.2. Insurance Company

10.7.2.2.3. Bank

10.7.2.2.4. Insurance Broker

10.7.2.2.5. Insurance Aggregator

10.7.2.2.6. Others

10.7.2.3. Rest of North America Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By End User

10.7.2.3.1. Senior Citizens

10.7.2.3.2. Education Traveler

10.7.2.3.3. Backpackers

10.7.2.3.4. Business Traveler

10.7.2.3.5. Family Traveler

10.7.2.3.6. Fully independent Traveler

10.7.2.4. Rest of North America Market Revenue (US$ Mn) and Forecasts,

By Payment Method

10.7.2.4.1. Monthly Outstanding Balance Method

10.7.2.4.2. Single Payment Method

10.7.2.5. Rest of North America Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Trip Type

10.7.2.5.1. Single Trip Travel Insurance

10.7.2.5.2. Annual Multi-trip Travel Insurance

10.7.2.5.3. Long-Stay Travel Insurance

10.8. Key Segment for Channeling Investments

10.8.1. By Country

10.8.2. By Insurance Cover

10.8.3. By Distribution Channel

10.8.4. By End User

10.8.5. By Payment Method

10.8.6. By Trip Type

11. Europe Travel Insurance Market Analysis and Forecasts, 2018 –

2026

11.1. Overview

11.1.1. Europe Market Revenue (US$ Mn)

11.2. Europe Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

11.2.1. Medical Treatment

11.2.2. Loss

11.2.3. Damage and Theft

11.2.4. Resuming Your Journey

11.2.5. Cancellation Insurance

11.2.6. Lump Sum Payments

11.2.7. Caretaker Coverage

11.2.8. Death Itinerary

11.3. Europe Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

11.3.1. Insurance Intermediaries

11.3.2. Insurance Company

11.3.3. Bank

11.3.4. Insurance Broker

11.3.5. Insurance Aggregator

11.3.6. Others

11.4. Europe Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

11.4.1. Senior Citizens

11.4.2. Education Traveler

11.4.3. Backpackers

11.4.4. Business Traveler

11.4.5. Family Traveler

11.4.6. Fully independent Traveler

11.5. Europe Market Revenue (US$ Mn) and Forecasts, By Payment

Method

11.5.1. Monthly Outstanding Balance Method

11.5.2. Single Payment Method

11.6. Europe Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

11.6.1. Single Trip Travel Insurance

11.6.2. Annual Multi-trip Travel Insurance

11.6.3. Long-Stay Travel Insurance

11.7. Europe Market Revenue (US$ Mn) and Forecasts, By Country

11.7.1. France

11.7.1.1. France Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

11.7.1.1.1. Medical Treatment

11.7.1.1.2. Loss

11.7.1.1.3. Damage and Theft

11.7.1.1.4. Resuming Your Journey

11.7.1.1.5. Cancellation Insurance

11.7.1.1.6. Lump Sum Payments

11.7.1.1.7. Caretaker Coverage

11.7.1.1.8. Death Itinerary

11.7.1.2. France Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

11.7.1.2.1. Insurance Intermediaries

11.7.1.2.2. Insurance Company

11.7.1.2.3. Bank

11.7.1.2.4. Insurance Broker

11.7.1.2.5. Insurance Aggregator

11.7.1.2.6. Others

11.7.1.3. France Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

11.7.1.3.1. Senior Citizens

11.7.1.3.2. Education Traveler

11.7.1.3.3. Backpackers

11.7.1.3.4. Business Traveler

11.7.1.3.5. Family Traveler

11.7.1.3.6. Fully independent Traveler

11.7.1.4. France Market Revenue (US$ Mn) and Forecasts, By Payment

Method

11.7.1.4.1. Monthly Outstanding Balance Method

11.7.1.4.2. Single Payment Method

11.7.1.5. France Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

11.7.1.5.1. Single Trip Travel Insurance

11.7.1.5.2. Annual Multi-trip Travel Insurance

11.7.1.5.3. Long-Stay Travel Insurance

11.7.2. The UK

11.7.2.1. The UK Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

11.7.2.1.1. Medical Treatment

11.7.2.1.2. Loss

11.7.2.1.3. Damage and Theft

11.7.2.1.4. Resuming Your Journey

11.7.2.1.5. Cancellation Insurance

11.7.2.1.6. Lump Sum Payments

11.7.2.1.7. Caretaker Coverage

11.7.2.1.8. Death Itinerary

11.7.2.2. The UK Market Revenue (US$ Mn) and Forecasts, By Distribution

Channel

11.7.2.2.1. Insurance Intermediaries

11.7.2.2.2. Insurance Company

11.7.2.2.3. Bank

11.7.2.2.4. Insurance Broker

11.7.2.2.5. Insurance Aggregator

11.7.2.2.6. Others

11.7.2.3. The UK Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

11.7.2.3.1. Senior Citizens

11.7.2.3.2. Education Traveler

11.7.2.3.3. Backpackers

11.7.2.3.4. Business Traveler

11.7.2.3.5. Family Traveler

11.7.2.3.6. Fully independent Traveler

11.7.2.4. The UK Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Payment Method

11.7.2.4.1. Monthly Outstanding Balance Method

11.7.2.4.2. Single Payment Method

11.7.2.5. The UK Market Revenue (US$ Mn) and Forecasts, By Trip Type

11.7.2.5.1. Single Trip Travel Insurance

11.7.2.5.2. Annual Multi-trip Travel Insurance

11.7.2.5.3. Long-Stay Travel Insurance

11.7.3. Spain

11.7.3.1. Spain Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

11.7.3.1.1. Medical Treatment

11.7.3.1.2. Loss

11.7.3.1.3. Damage and Theft

11.7.3.1.4. Resuming Your Journey

11.7.3.1.5. Cancellation Insurance

11.7.3.1.6. Lump Sum Payments

11.7.3.1.7. Caretaker Coverage

11.7.3.1.8. Death Itinerary

11.7.3.2. Spain Market Revenue (US$ Mn) and Forecasts, By Distribution

Channel

11.7.3.2.1. Insurance Intermediaries

11.7.3.2.2. Insurance Company

11.7.3.2.3. Bank

11.7.3.2.4. Insurance Broker

11.7.3.2.5. Insurance Aggregator

11.7.3.2.6. Others

11.7.3.3. Spain Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

11.7.3.3.1. Senior Citizens

11.7.3.3.2. Education Traveler

11.7.3.3.3. Backpackers

11.7.3.3.4. Business Traveler

11.7.3.3.5. Family Traveler

11.7.3.3.6. Fully independent Traveler

11.7.3.4. Spain Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Payment Method

11.7.3.4.1. Monthly Outstanding Balance Method

11.7.3.4.2. Single Payment Method

11.7.3.5. Spain Market Revenue (US$ Mn) and Forecasts, By Trip Type

11.7.3.5.1. Single Trip Travel Insurance

11.7.3.5.2. Annual Multi-trip Travel Insurance

11.7.3.5.3. Long-Stay Travel Insurance

11.7.4. Germany

11.7.4.1. Germany Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

11.7.4.1.1. Medical Treatment

11.7.4.1.2. Loss

11.7.4.1.3. Damage and Theft

11.7.4.1.4. Resuming Your Journey

11.7.4.1.5. Cancellation Insurance

11.7.4.1.6. Lump Sum Payments

11.7.4.1.7. Caretaker Coverage

11.7.4.1.8. Death Itinerary

11.7.4.2. Germany Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Distribution Channel

11.7.4.2.1. Insurance Intermediaries

11.7.4.2.2. Insurance Company

11.7.4.2.3. Bank

11.7.4.2.4. Insurance Broker

11.7.4.2.5. Insurance Aggregator

11.7.4.2.6. Others

11.7.4.3. Germany Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

11.7.4.3.1. Senior Citizens

11.7.4.3.2. Education Traveler

11.7.4.3.3. Backpackers

11.7.4.3.4. Business Traveler

11.7.4.3.5. Family Traveler

11.7.4.3.6. Fully independent Traveler

11.7.4.4. Germany Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Payment Method

11.7.4.4.1. Monthly Outstanding Balance Method

11.7.4.4.2. Single Payment Method

11.7.4.5. Germany Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

11.7.4.5.1. Single Trip Travel Insurance

11.7.4.5.2. Annual Multi-trip Travel Insurance

11.7.4.5.3. Long-Stay Travel Insurance

11.7.5. Italy

11.7.5.1. Italy Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

11.7.5.1.1. Medical Treatment

11.7.5.1.2. Loss

11.7.5.1.3. Damage and Theft

11.7.5.1.4. Resuming Your Journey

11.7.5.1.5. Cancellation Insurance

11.7.5.1.6. Lump Sum Payments

11.7.5.1.7. Caretaker Coverage

11.7.5.1.8. Death Itinerary

11.7.5.2. Italy Market Revenue (US$ Mn) and Forecasts, By Distribution

Channel

11.7.5.2.1. Insurance Intermediaries

11.7.5.2.2. Insurance Company

11.7.5.2.3. Bank

11.7.5.2.4. Insurance Broker

11.7.5.2.5. Insurance Aggregator

11.7.5.2.6. Others

11.7.5.3. Italy Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

11.7.5.3.1. Senior Citizens

11.7.5.3.2. Education Traveler

11.7.5.3.3. Backpackers

11.7.5.3.4. Business Traveler

11.7.5.3.5. Family Traveler

11.7.5.3.6. Fully independent Traveler

11.7.5.4. Italy Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Payment Method

11.7.5.4.1. Monthly Outstanding Balance Method

11.7.5.4.2. Single Payment Method

11.7.5.5. Italy Market Revenue (US$ Mn) and Forecasts, By Trip Type

11.7.5.5.1. Single Trip Travel Insurance

11.7.5.5.2. Annual Multi-trip Travel Insurance

11.7.5.5.3. Long-Stay Travel Insurance

11.7.6. Rest of Europe

11.7.6.1. Rest of Europe Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

11.7.6.1.1. Medical Treatment

11.7.6.1.2. Loss

11.7.6.1.3. Damage and Theft

11.7.6.1.4. Resuming Your Journey

11.7.6.1.5. Cancellation Insurance

11.7.6.1.6. Lump Sum Payments

11.7.6.1.7. Caretaker Coverage

11.7.6.1.8. Death Itinerary

11.7.6.2. Rest of Europe Market Revenue (US$ Mn) and Forecasts, By

Distribution Channel

11.7.6.2.1. Insurance Intermediaries

11.7.6.2.2. Insurance Company

11.7.6.2.3. Bank

11.7.6.2.4. Insurance Broker

11.7.6.2.5. Insurance Aggregator

11.7.6.2.6. Others

11.7.6.3. Rest of Europe Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

11.7.6.3.1. Senior Citizens

11.7.6.3.2. Education Traveler

11.7.6.3.3. Backpackers

11.7.6.3.4. Business Traveler

11.7.6.3.5. Family Traveler

11.7.6.3.6. Fully independent Traveler

11.7.6.4. Rest of Europe Market Revenue (US$ Mn) and Forecasts, By

Payment Method

11.7.6.4.1. Monthly Outstanding Balance Method

11.7.6.4.2. Single Payment Method

11.7.6.5. Rest of Europe Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

11.7.6.5.1. Single Trip Travel Insurance

11.7.6.5.2. Annual Multi-trip Travel Insurance

11.7.6.5.3. Long-Stay Travel Insurance

11.8. Key Segment for Channeling Investments

11.8.1. By Country

11.8.2. By Insurance Cover

11.8.3. By Distribution Channel

11.8.4. By End User

11.8.5. By Payment Method

11.8.6. By Trip Type

12. Asia Pacific Travel

Insurance Market Analysis and Forecasts, 2018 – 2026

12.1. Overview

12.1.1. Asia Pacific Market Revenue (US$ Mn)

12.2. Asia Pacific Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

12.2.1. Medical Treatment

12.2.2. Loss

12.2.3. Damage and Theft

12.2.4. Resuming Your Journey

12.2.5. Cancellation Insurance

12.2.6. Lump Sum Payments

12.2.7. Caretaker Coverage

12.2.8. Death Itinerary

12.3. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By

Distribution Channel

12.3.1. Insurance Intermediaries

12.3.2. Insurance Company

12.3.3. Bank

12.3.4. Insurance Broker

12.3.5. Insurance Aggregator

12.3.6. Others

12.4. Asia Pacific Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

12.4.1. Senior Citizens

12.4.2. Education Traveler

12.4.3. Backpackers

12.4.4. Business Traveler

12.4.5. Family Traveler

12.4.6. Fully independent Traveler

12.5. Asia Pacific Market Revenue (US$ Mn) and Forecasts, By Payment

Method

12.5.1. Monthly Outstanding Balance Method

12.5.2. Single Payment Method

12.6. Asia Pacific Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

12.6.1. Single Trip Travel Insurance

12.6.2. Annual Multi-trip Travel Insurance

12.6.3. Long-Stay Travel Insurance

12.7. Asia Pacific Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Country

12.7.1. China

12.7.1.1. China Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

12.7.1.1.1. Medical Treatment

12.7.1.1.2. Loss

12.7.1.1.3. Damage and Theft

12.7.1.1.4. Resuming Your Journey

12.7.1.1.5. Cancellation Insurance

12.7.1.1.6. Lump Sum Payments

12.7.1.1.7. Caretaker Coverage

12.7.1.1.8. Death Itinerary

12.7.1.2. China Market Revenue (US$ Mn) and Forecasts, By Distribution

Channel

12.7.1.2.1. Insurance Intermediaries

12.7.1.2.2. Insurance Company

12.7.1.2.3. Bank

12.7.1.2.4. Insurance Broker

12.7.1.2.5. Insurance Aggregator

12.7.1.2.6. Others

12.7.1.3. China Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

12.7.1.3.1. Senior Citizens

12.7.1.3.2. Education Traveler

12.7.1.3.3. Backpackers

12.7.1.3.4. Business Traveler

12.7.1.3.5. Family Traveler

12.7.1.3.6. Fully independent Traveler

12.7.1.4. China Market Revenue (US$ Mn) and Forecasts, By Payment Method

12.7.1.4.1. Monthly Outstanding Balance Method

12.7.1.4.2. Single Payment Method

12.7.1.5. China Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

12.7.1.5.1. Single Trip Travel Insurance

12.7.1.5.2. Annual Multi-trip Travel Insurance

12.7.1.5.3. Long-Stay Travel Insurance

12.7.2. Japan

12.7.2.1. Japan Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

12.7.2.1.1. Medical Treatment

12.7.2.1.2. Loss

12.7.2.1.3. Damage and Theft

12.7.2.1.4. Resuming Your Journey

12.7.2.1.5. Cancellation Insurance

12.7.2.1.6. Lump Sum Payments

12.7.2.1.7. Caretaker Coverage

12.7.2.1.8. Death Itinerary

12.7.2.2. Japan Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

12.7.2.2.1. Insurance Intermediaries

12.7.2.2.2. Insurance Company

12.7.2.2.3. Bank

12.7.2.2.4. Insurance Broker

12.7.2.2.5. Insurance Aggregator

12.7.2.2.6. Others

12.7.2.3. Japan Market Revenue (US$ Mn) and Forecasts, By End User

12.7.2.3.1. Senior Citizens

12.7.2.3.2. Education Traveler

12.7.2.3.3. Backpackers

12.7.2.3.4. Business Traveler

12.7.2.3.5. Family Traveler

12.7.2.3.6. Fully independent Traveler

12.7.2.4. Japan Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Payment Method

12.7.2.4.1. Monthly Outstanding Balance Method

12.7.2.4.2. Single Payment Method

12.7.2.5. Japan Market Revenue (US$ Mn) and Forecasts, By Trip Type

12.7.2.5.1. Single Trip Travel Insurance

12.7.2.5.2. Annual Multi-trip Travel Insurance

12.7.2.5.3. Long-Stay Travel Insurance

12.7.3. India

12.7.3.1. India Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

12.7.3.1.1. Medical Treatment

12.7.3.1.2. Loss

12.7.3.1.3. Damage and Theft

12.7.3.1.4. Resuming Your Journey

12.7.3.1.5. Cancellation Insurance

12.7.3.1.6. Lump Sum Payments

12.7.3.1.7. Caretaker Coverage

12.7.3.1.8. Death Itinerary

12.7.3.2. India Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

12.7.3.2.1. Insurance Intermediaries

12.7.3.2.2. Insurance Company

12.7.3.2.3. Bank

12.7.3.2.4. Insurance Broker

12.7.3.2.5. Insurance Aggregator

12.7.3.2.6. Others

12.7.3.3. India Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

12.7.3.3.1. Senior Citizens

12.7.3.3.2. Education Traveler

12.7.3.3.3. Backpackers

12.7.3.3.4. Business Traveler

12.7.3.3.5. Family Traveler

12.7.3.3.6. Fully independent Traveler

12.7.3.4. India Market Revenue (US$ Mn) and Forecasts, By Payment Method

12.7.3.4.1. Monthly Outstanding Balance Method

12.7.3.4.2. Single Payment Method

12.7.3.5. India Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

12.7.3.5.1. Single Trip Travel Insurance

12.7.3.5.2. Annual Multi-trip Travel Insurance

12.7.3.5.3. Long-Stay Travel Insurance

12.7.4. Southeast Asia

12.7.4.1. Southeast Asia Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

12.7.4.1.1. Medical Treatment

12.7.4.1.2. Loss

12.7.4.1.3. Damage and Theft

12.7.4.1.4. Resuming Your Journey

12.7.4.1.5. Cancellation Insurance

12.7.4.1.6. Lump Sum Payments

12.7.4.1.7. Caretaker Coverage

12.7.4.1.8. Death Itinerary

12.7.4.2. Southeast Asia Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Distribution Channel

12.7.4.2.1. Insurance Intermediaries

12.7.4.2.2. Insurance Company

12.7.4.2.3. Bank

12.7.4.2.4. Insurance Broker

12.7.4.2.5. Insurance Aggregator

12.7.4.2.6. Others

12.7.4.3. Southeast Asia Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

12.7.4.3.1. Senior Citizens

12.7.4.3.2. Education Traveler

12.7.4.3.3. Backpackers

12.7.4.3.4. Business Traveler

12.7.4.3.5. Family Traveler

12.7.4.3.6. Fully independent Traveler

12.7.4.4. Southeast Asia Market Revenue (US$ Mn) and Forecasts, By

Payment Method

12.7.4.4.1. Monthly Outstanding Balance Method

12.7.4.4.2. Single Payment Method

12.7.4.5. Southeast Asia Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

12.7.4.5.1. Single Trip Travel Insurance

12.7.4.5.2. Annual Multi-trip Travel Insurance

12.7.4.5.3. Long-Stay Travel Insurance

12.7.5. Rest of Asia Pacific

12.7.5.1. Rest of Asia Pacific Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Insurance Cover

12.7.5.1.1. Medical Treatment

12.7.5.1.2. Loss

12.7.5.1.3. Damage and Theft

12.7.5.1.4. Resuming Your Journey

12.7.5.1.5. Cancellation Insurance

12.7.5.1.6. Lump Sum Payments

12.7.5.1.7. Caretaker Coverage

12.7.5.1.8. Death Itinerary

12.7.5.2. Rest of Asia Pacific Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Distribution Channel

12.7.5.2.1. Insurance Intermediaries

12.7.5.2.2. Insurance Company

12.7.5.2.3. Bank

12.7.5.2.4. Insurance Broker

12.7.5.2.5. Insurance Aggregator

12.7.5.2.6. Others

12.7.5.3. Rest of Asia Pacific Market Revenue (US$ Mn) and Forecasts, By

End User

12.7.5.3.1. Senior Citizens

12.7.5.3.2. Education Traveler

12.7.5.3.3. Backpackers

12.7.5.3.4. Business Traveler

12.7.5.3.5. Family Traveler

12.7.5.3.6. Fully independent Traveler

12.7.5.4. Rest of Asia Pacific Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Payment Method

12.7.5.4.1. Monthly Outstanding Balance Method

12.7.5.4.2. Single Payment Method

12.7.5.5. Rest of Asia Pacific Market Revenue (US$ Mn) and Forecasts, By

Trip Type

12.7.5.5.1. Single Trip Travel Insurance

12.7.5.5.2. Annual Multi-trip Travel Insurance

12.7.5.5.3. Long-Stay Travel Insurance

12.8. Key Segment for Channeling Investments

12.8.1. By Country

12.8.2. By Insurance Cover

12.8.3. By Distribution Channel

12.8.4. By End User

12.8.5. By Payment Method

12.8.6. By Trip Type

13. Middle East and Africa

Travel Insurance Market Analysis and Forecasts, 2018 – 2026

13.1. Overview

13.1.1. Middle East and Africa Market Revenue (US$ Mn)

13.2. Middle East and Africa Travel Insurance Market Revenue (US$

Mn) and Forecasts, By Insurance Cover

13.2.1. Medical Treatment

13.2.2. Loss

13.2.3. Damage and Theft

13.2.4. Resuming Your Journey

13.2.5. Cancellation Insurance

13.2.6. Lump Sum Payments

13.2.7. Caretaker Coverage

13.2.8. Death Itinerary

13.3. Middle East and Africa Travel Insurance Market Revenue (US$

Mn) and Forecasts, By Distribution Channel

13.3.1. Insurance Intermediaries

13.3.2. Insurance Company

13.3.3. Bank

13.3.4. Insurance Broker

13.3.5. Insurance Aggregator

13.3.6. Others

13.4. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By End User

13.4.1. Senior Citizens

13.4.2. Education Traveler

13.4.3. Backpackers

13.4.4. Business Traveler

13.4.5. Family Traveler

13.4.6. Fully independent Traveler

13.5. Middle East and Africa Travel Insurance Market Revenue (US$

Mn) and Forecasts, By Payment Method

13.5.1. Monthly Outstanding Balance Method

13.5.2. Single Payment Method

13.6. Middle East and Africa Market Revenue (US$ Mn) and Forecasts,

By Trip Type

13.6.1. Single Trip Travel Insurance

13.6.2. Annual Multi-trip Travel Insurance

13.6.3. Long-Stay Travel Insurance

13.7. Middle East and Africa Travel Insurance Market Revenue (US$

Mn) and Forecasts, By Country

13.7.1. GCC Countries

13.7.1.1. GCC Countries Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

13.7.1.1.1. Medical Treatment

13.7.1.1.2. Loss

13.7.1.1.3. Damage and Theft

13.7.1.1.4. Resuming Your Journey

13.7.1.1.5. Cancellation Insurance

13.7.1.1.6. Lump Sum Payments

13.7.1.1.7. Caretaker Coverage

13.7.1.1.8. Death Itinerary

13.7.1.2. GCC Countries Market Revenue (US$ Mn) and Forecasts, By

Distribution Channel

13.7.1.2.1. Insurance Intermediaries

13.7.1.2.2. Insurance Company

13.7.1.2.3. Bank

13.7.1.2.4. Insurance Broker

13.7.1.2.5. Insurance Aggregator

13.7.1.2.6. Others

13.7.1.3. GCC Countries Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

13.7.1.3.1. Senior Citizens

13.7.1.3.2. Education Traveler

13.7.1.3.3. Backpackers

13.7.1.3.4. Business Traveler

13.7.1.3.5. Family Traveler

13.7.1.3.6. Fully independent Traveler

13.7.1.4. GCC Countries Market Revenue (US$ Mn) and Forecasts, By

Payment Method

13.7.1.4.1. Monthly Outstanding Balance Method

13.7.1.4.2. Single Payment Method

13.7.1.5. GCC Countries Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

13.7.1.5.1. Single Trip Travel Insurance

13.7.1.5.2. Annual Multi-trip Travel Insurance

13.7.1.5.3. Long-Stay Travel Insurance

13.7.2. Southern Africa

13.7.2.1. Southern Africa Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

13.7.2.1.1. Medical Treatment

13.7.2.1.2. Loss

13.7.2.1.3. Damage and Theft

13.7.2.1.4. Resuming Your Journey

13.7.2.1.5. Cancellation Insurance

13.7.2.1.6. Lump Sum Payments

13.7.2.1.7. Caretaker Coverage

13.7.2.1.8. Death Itinerary

13.7.2.2. Southern Africa Market Revenue (US$ Mn) and Forecasts, By

Distribution Channel

13.7.2.2.1. Insurance Intermediaries

13.7.2.2.2. Insurance Company

13.7.2.2.3. Bank

13.7.2.2.4. Insurance Broker

13.7.2.2.5. Insurance Aggregator

13.7.2.2.6. Others

13.7.2.3. Southern Africa Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

13.7.2.3.1. Senior Citizens

13.7.2.3.2. Education Traveler

13.7.2.3.3. Backpackers

13.7.2.3.4. Business Traveler

13.7.2.3.5. Family Traveler

13.7.2.3.6. Fully independent Traveler

13.7.2.4. Southern Africa Market Revenue (US$ Mn) and Forecasts, By

Payment Method

13.7.2.4.1. Monthly Outstanding Balance Method

13.7.2.4.2. Single Payment Method

13.7.2.5. Southern Africa Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

13.7.2.5.1. Single Trip Travel Insurance

13.7.2.5.2. Annual Multi-trip Travel Insurance

13.7.2.5.3. Long-Stay Travel Insurance

13.7.3. Rest of MEA

13.7.3.1. Rest of MEA Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

13.7.3.1.1. Medical Treatment

13.7.3.1.2. Loss

13.7.3.1.3. Damage and Theft

13.7.3.1.4. Resuming Your Journey

13.7.3.1.5. Cancellation Insurance

13.7.3.1.6. Lump Sum Payments

13.7.3.1.7. Caretaker Coverage

13.7.3.1.8. Death Itinerary

13.7.3.2. Rest of MEA Market Revenue (US$ Mn) and Forecasts, By

Distribution Channel

13.7.3.2.1. Insurance Intermediaries

13.7.3.2.2. Insurance Company

13.7.3.2.3. Bank

13.7.3.2.4. Insurance Broker

13.7.3.2.5. Insurance Aggregator

13.7.3.2.6. Others

13.7.3.3. Rest of MEA Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

13.7.3.3.1. Senior Citizens

13.7.3.3.2. Education Traveler

13.7.3.3.3. Backpackers

13.7.3.3.4. Business Traveler

13.7.3.3.5. Family Traveler

13.7.3.3.6. Fully independent Traveler

13.7.3.4. Rest of MEA Market Revenue (US$ Mn) and Forecasts, By Payment

Method

13.7.3.4.1. Monthly Outstanding Balance Method

13.7.3.4.2. Single Payment Method

13.7.3.5. Rest of MEA Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

13.7.3.5.1. Single Trip Travel Insurance

13.7.3.5.2. Annual Multi-trip Travel Insurance

13.7.3.5.3. Long-Stay Travel Insurance

13.8. Key Segment for Channeling Investments

13.8.1. By Country

13.8.2. By Insurance Cover

13.8.3. By Distribution Channel

13.8.4. By End User

13.8.5. By Payment Method

13.8.6. By Trip Type

14. Latin America Travel Insurance Market Analysis and Forecasts,

2018 – 2026

14.1. Overview

14.1.1. Latin America Market Revenue (US$ Mn)

14.2. Latin America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Insurance Cover

14.2.1. Medical Treatment

14.2.2. Loss

14.2.3. Damage and Theft

14.2.4. Resuming Your Journey

14.2.5. Cancellation Insurance

14.2.6. Lump Sum Payments

14.2.7. Caretaker Coverage

14.2.8. Death Itinerary

14.3. Latin America Market Revenue (US$ Mn) and Forecasts, By

Distribution Channel

14.3.1. Insurance Intermediaries

14.3.2. Insurance Company

14.3.3. Bank

14.3.4. Insurance Broker

14.3.5. Insurance Aggregator

14.3.6. Others

14.4. Latin America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By End User

14.4.1. Senior Citizens

14.4.2. Education Traveler

14.4.3. Backpackers

14.4.4. Business Traveler

14.4.5. Family Traveler

14.4.6. Fully independent Traveler

14.5. Latin America Market Revenue (US$ Mn) and Forecasts, By

Payment Method

14.5.1. Monthly Outstanding Balance Method

14.5.2. Single Payment Method

14.6. Latin America Travel Insurance Market Revenue (US$ Mn) and

Forecasts, By Trip Type

14.6.1. Single Trip Travel Insurance

14.6.2. Annual Multi-trip Travel Insurance

14.6.3. Long-Stay Travel Insurance

14.7. Latin America Market Revenue (US$ Mn) and Forecasts, By

Country

14.7.1. Brazil

14.7.1.1. Brazil Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Insurance Cover

14.7.1.1.1. Medical Treatment

14.7.1.1.2. Loss

14.7.1.1.3. Damage and Theft

14.7.1.1.4. Resuming Your Journey

14.7.1.1.5. Cancellation Insurance

14.7.1.1.6. Lump Sum Payments

14.7.1.1.7. Caretaker Coverage

14.7.1.1.8. Death Itinerary

14.7.1.2. Brazil Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

14.7.1.2.1. Insurance Intermediaries

14.7.1.2.2. Insurance Company

14.7.1.2.3. Bank

14.7.1.2.4. Insurance Broker

14.7.1.2.5. Insurance Aggregator

14.7.1.2.6. Others

14.7.1.3. Brazil Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By End User

14.7.1.3.1. Senior Citizens

14.7.1.3.2. Education Traveler

14.7.1.3.3. Backpackers

14.7.1.3.4. Business Traveler

14.7.1.3.5. Family Traveler

14.7.1.3.6. Fully independent Traveler

14.7.1.4. Brazil Market Revenue (US$ Mn) and Forecasts, By Payment

Method

14.7.1.4.1. Monthly Outstanding Balance Method

14.7.1.4.2. Single Payment Method

14.7.1.5. Brazil Travel Insurance Market Revenue (US$ Mn) and Forecasts,

By Trip Type

14.7.1.5.1. Single Trip Travel Insurance

14.7.1.5.2. Annual Multi-trip Travel Insurance

14.7.1.5.3. Long-Stay Travel Insurance

14.7.2. Rest of Latin America

14.7.2.1. Rest of Latin America Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Insurance Cover

14.7.2.1.1. Medical Treatment

14.7.2.1.2. Loss

14.7.2.1.3. Damage and Theft

14.7.2.1.4. Resuming Your Journey

14.7.2.1.5. Cancellation Insurance

14.7.2.1.6. Lump Sum Payments

14.7.2.1.7. Caretaker Coverage

14.7.2.1.8. Death Itinerary

14.7.2.2. Rest of Latin America Market Revenue (US$ Mn) and Forecasts,

By Distribution Channel

14.7.2.2.1. Insurance Intermediaries

14.7.2.2.2. Insurance Company

14.7.2.2.3. Bank

14.7.2.2.4. Insurance Broker

14.7.2.2.5. Insurance Aggregator

14.7.2.2.6. Others

14.7.2.3. Rest of Latin America Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By End User

14.7.2.3.1. Senior Citizens

14.7.2.3.2. Education Traveler

14.7.2.3.3. Backpackers

14.7.2.3.4. Business Traveler

14.7.2.3.5. Family Traveler

14.7.2.3.6. Fully independent Traveler

14.7.2.4. Rest of Latin America Market Revenue (US$ Mn) and Forecasts,

By Payment Method

14.7.2.4.1. Monthly Outstanding Balance Method

14.7.2.4.2. Single Payment Method

14.7.2.5. Rest of Latin America Travel Insurance Market Revenue (US$ Mn)

and Forecasts, By Trip Type

14.7.2.5.1. Single Trip Travel Insurance

14.7.2.5.2. Annual Multi-trip Travel Insurance

14.7.2.5.3. Long-Stay Travel Insurance

14.8. Key Segment for Channeling Investments

14.8.1. By Country

14.8.2. By Insurance Cover

14.8.3. By Distribution Channel

14.8.4. By End User

14.8.5. By Payment Method

14.8.6. By Trip Type

15. Competitive Benchmarking

15.1. Player Positioning Analysis

15.2. Global Presence and Growth Strategies

16. Player Profiles

16.1. Allianz

16.1.1. Company Details

16.1.2. Company Overview

16.1.3. Product Offerings

16.1.4. Key Developments

16.1.5. Financial Analysis

16.1.6. SWOT Analysis

16.1.7. Business Strategies

16.2. American Express Company

16.2.1. Company Details

16.2.2. Company Overview

16.2.3. Product Offerings

16.2.4. Key Developments

16.2.5. Financial Analysis

16.2.6. SWOT Analysis

16.2.7. Business Strategies

16.3. Arch Insurance Company

16.3.1. Company Details

16.3.2. Company Overview

16.3.3. Product Offerings

16.3.4. Key Developments

16.3.5. Financial Analysis

16.3.6. SWOT Analysis

16.3.7. Business Strategies

16.4. Aviva Life Insurance Company India Ltd.

16.4.1. Company Details

16.4.2. Company Overview

16.4.3. Product Offerings

16.4.4. Key Developments

16.4.5. Financial Analysis

16.4.6. SWOT Analysis

16.4.7. Business Strategies

16.5. AXA

16.5.1. Company Details

16.5.2. Company Overview

16.5.3. Product Offerings

16.5.4. Key Developments

16.5.5. Financial Analysis

16.5.6. SWOT Analysis

16.5.7. Business Strategies

16.6. BH Specialty Insurance

16.6.1. Company Details

16.6.2. Company Overview

16.6.3. Product Offerings

16.6.4. Key Developments

16.6.5. Financial Analysis

16.6.6. SWOT Analysis

16.6.7. Business Strategies

16.7. First Allied Travel Insurance

16.7.1. Company Details

16.7.2. Company Overview

16.7.3. Product Offerings

16.7.4. Key Developments

16.7.5. Financial Analysis

16.7.6. SWOT Analysis

16.7.7. Business Strategies

16.8. Generali Global Assistance

16.8.1. Company Details

16.8.2. Company Overview

16.8.3. Product Offerings

16.8.4. Key Developments

16.8.5. Financial Analysis

16.8.6. SWOT Analysis

16.8.7. Business Strategies

16.9. Insure & Go Insurance Services Limited

16.9.1. Company Details

16.9.2. Company Overview

16.9.3. Product Offerings

16.9.4. Key Developments

16.9.5. Financial Analysis

16.9.6. SWOT Analysis

16.9.7. Business Strategies

16.10. Tata AIG General Insurance Company Limited

16.10.1. Company Details

16.10.2. Company Overview

16.10.3. Product Offerings

16.10.4. Key Developments

16.10.5. Financial Analysis

16.10.6. SWOT Analysis

16.10.7. Business Strategies

16.11. Tokio Marine HCC Medical Insurance Services Group

16.11.1.

Company Details

16.11.2.

Company Overview

16.11.3.

Product Offerings

16.11.4.

Key Developments

16.11.5.

Financial Analysis

16.11.6.

SWOT Analysis

16.11.7.

Business Strategies

16.12. Travel Insured International

16.12.1.

Company Details

16.12.2.

Company Overview

16.12.3.

Product Offerings

16.12.4.

Key Developments

16.12.5.

Financial Analysis

16.12.6.

SWOT Analysis

16.12.7.

Business Strategies

16.13. Travel Safe Insurance

16.13.1.

Company Details

16.13.2.

Company Overview

16.13.3.

Product Offerings

16.13.4.

Key Developments

16.13.5.

Financial Analysis

16.13.6.

SWOT Analysis

16.13.7.

Business Strategies

16.14. Travelex Insurance Services (TIS)

16.14.1.

Company Details

16.14.2.

Company Overview

16.14.3.

Product Offerings

16.14.4.

Key Developments

16.14.5.

Financial Analysis

16.14.6.

SWOT Analysis

16.14.7.

Business Strategies

16.15. TravelInsurance.com (DigiVentures Holdings, LLC)

16.15.1.

Company Details

16.15.2.

Company Overview

16.15.3.

Product Offerings

16.15.4.

Key Developments

16.15.5.

Financial Analysis

16.15.6.

SWOT Analysis

16.15.7.

Business Strategies

16.16. Trip Mate Inc. (Arthur J. Gallagher & Co.)

16.16.1.

Company Details

16.16.2.

Company Overview

16.16.3.

Product Offerings

16.16.4.

Key Developments

16.16.5.

Financial Analysis

16.16.6.

SWOT Analysis

16.16.7.

Business Strategies

16.17. USI Affinity, Seven Corners Inc.

16.17.1.

Company Details

16.17.2.

Company Overview

16.17.3.

Product Offerings

16.17.4.

Key Developments

16.17.5.

Financial Analysis

16.17.6.

SWOT Analysis

16.17.7.

Business Strategies

Note: This ToC is

tentative and can be changed according to the research study conducted during

the course of report completion.

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

- Reuters

- Factiva

- Bloomberg

- One Source

- Hoovers

Research Methodology

Key Inclusions

Reach to us

Call us on

+91-74002-42424

Drop us an email at

sales@absolutemarketsinsights.com

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.